Getting Started with the Financial Consolidation Model

Return to the Financial Consolidation Model Overview.

The Jedox Financial Consolidation Model is a prebuilt, configurable OLAP‑based application designed to streamline group-level reporting—covering preparatory tasks, automated eliminations, and final reporting for IFRS, US GAAP, and more. This guide walks first‑time users through the model’s configuration, deployment, and consolidation workflow.

The Financial Consolidation model can be set up with or without sample data. To familiarize yourself with the Financial Consolidation model, you can install it with a sample configuration that includes sample data. You can find instructions on configuring the model using sample data in Setting Up Financial Consolidation Model. To set up the Financial Consolidation Model with your own data, refer to the article Setting Up the Financial Consolidation Model with Custom Data.

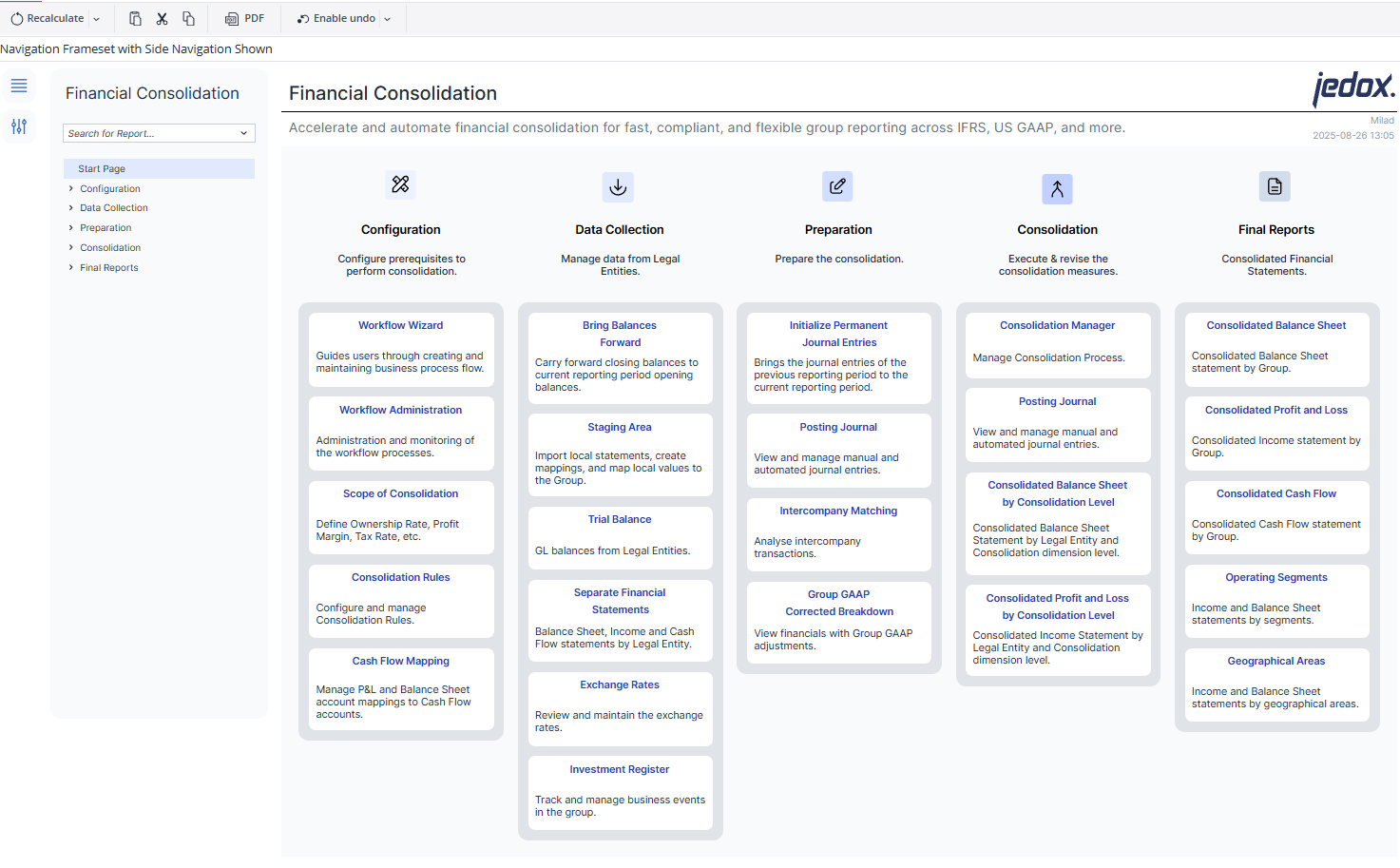

Financial Consolidation model's Start Page

The Financial Consolidation model provides a structured experience through its Start Page and Side Navigation, making it easier to access key processes and reports. The side navigation allows you to quickly move between different areas of the model, while framesets enable reports to open alongside the navigation panel for improved usability.

When you open the Start Page, you’ll see the main workflow organized into five phases:

1. Configuration

1. Configuration

Before performing consolidation, configure the model to match your group structure.

-

Workflow Wizard: Create and manage workflow tasks by defining business process flows. See the Workflow Wizard article for more information.

-

Workflow Administration: Manage and monitor workflow processes by controlling when and how users can enter or change planning data. Access is limited to specific workflow activities, ensuring timely input, better oversight, and data integrity. See the Workflow Administration Report (Financial Consolidation) article for more information.

-

Scope of Consolidation: Define ownership rates, profit margins, tax rates, and other parameters. The report displays business relationships in the Scope of Consolidation Cube, letting you view and adjust them as your consolidation structure evolves. While the top two tables are scope-neutral and remain unchanged, the lower tables are scope-specific and adapt to the selected scope. See the Financial Consolidation Scope of Consolidation article for more information.

-

Consolidation Rules: Create, configure, and manage consolidation rules with detailed data on each rule. See the Consolidation Rules Report article for more information.

-

Cash Flow Mapping: Manage cash flow calculations by mapping P&L and Balance Sheet accounts to Cash Flow accounts, editing mapping records in the Cash Flow Mapping cube, and updating auxiliary dimensions and calculation rules. See the Cash Flow Mapping Report (Financial Consolidation) article for more information.

2. Data Collection

2. Data Collection

Collect and manage data from legal entities.

-

Bring Balances Forward: Carry closing balances from the previous period into the opening balances of the current reporting period. See the Bring Balances Forward article for more information.

-

Staging Area: Import financial data from local entities into the consolidation model; upload trial balances or financial statements from each subsidiary, and prepare them for group reporting; define and maintain the necessary mappings, ensuring that local account structures align with the group’s chart of accounts; adjust and transform local values into standardized group values, applying rules such as reclassifications or corrections.

-

Trial Balance: Import the general ledger balances of all accounts from legal entities on a specific date. It ensures that total debits equal total credits, indicating that entries in the ledger are correct and complete. See the Trial Balance Report article for more information.

-

Separate Financial Statements: View and analyze the financial performance of each legal entity in your group before any consolidation takes place. Within this section, you can access the Balance Sheet, Income Statement, and Cash Flow Statement prepared at the entity level.

-

Exchange Rates: Review, maintain, and update these conversion rates. You can enter standard rates for each reporting period, define average and closing rates, and ensure they align with your group’s accounting policies (e.g., IFRS or US GAAP requirements). See the Exchange Rates Report (Financial Consolidation) article for more information.

-

Investment Register: Record, track, and manage all business events that affect investments within your group structure. From acquisitions and divestitures to ownership changes, the register ensures these events are consistently reflected in the Balance Sheet and consolidation process. See the Investment Register Report article for more information.

3. Preparation

3. Preparation

Prepare data for consolidation with validation and adjustments.

-

Initialize Permanent Journal Entries: ensures continuity across reporting cycles by automatically carrying forward relevant journal entries from the previous period into the current one. This allows users to maintain adjustments and entries that remain valid beyond a single reporting period, reducing manual effort and ensuring consistency. See the article for more information. See the Initialize Permanent Journal Entries article for more information.

-

Posting Journal: Provides a single place to view, create, and manage all journal entries used in consolidation. Entries are grouped in ledgers, which define the area of the cube affected once postings are made, ensuring clarity and control. See the Posting Journal Report (Financial Consolidation) article for more information.

-

Intercompany Matching: Allows you to identify, compare, and reconcile transactions between entities within the same group. By analyzing these intercompany flows, you can detect mismatches early, ensure accuracy, and maintain compliance before running the consolidation process.

-

Group GAAP Corrected Breakdown: Provides a detailed view of how local GAAP figures are transformed through adjustments, transactions, and corrections into the final Group GAAP-aligned results. See the Group GAAP Corrected Breakdown Report article for more information.

4. Consolidation

4. Consolidation

Execute the consolidation process and review outcomes.

-

Consolidation Manager: Provides a central workspace for running the consolidation process. It delivers a clear overview of validation results and workflow progress, organized at the scope level. See the Consolidation Manager Report article for more information.

-

Posting Journal: Provides a single place to view, create, and manage all journal entries used in consolidation. Entries are grouped in ledgers, which define the area of the cube affected once postings are made, ensuring clarity and control. See the Posting Journal Report (Financial Consolidation) article for more information.

-

Consolidated Balance Sheet by Consolidation Level: Provides a detailed view of the group’s financial position, broken down by each legal entity and the chosen consolidation dimension. This report allows users to analyze how individual entities contribute to the overall consolidated balance sheet while maintaining full transparency across consolidation levels.

-

Consolidated Profit and Loss by Consolidation Level: Provides a detailed view of the group’s income statement, broken down by individual legal entities as well as across different consolidation dimensions. This allows users to analyze performance not only at the overall group level but also within specific entities or consolidation layers.

5. Final Reports

5. Final Reports

Generate standard financial reports at group level.

-

Consolidated Balance Sheet: Presents a fully consolidated balance sheet for a chosen scope, reflecting the combined financial position of the group or subgroup after consolidation. See theConsolidated Balance Sheet Report article for more information.

-

Consolidated Profit and Loss: Delivers a complete income statement for a selected consolidation scope, reflecting financial positions after eliminations and group-level aggregation. See the Consolidated Profit and Loss Report article for more information.

-

Consolidated Cash Flow: Delivers a comprehensive cash flow statement for your group at a chosen consolidation scope, reflecting consolidated cash movements across operating, investing, and financing activities. See the Consolidated Cash Flow Report article for more information.

-

Operating Segments: Offers a detailed view of income statement and balance sheet data by business segment, giving clear insight into revenues, expenses, assets, and liabilities at the operational level. See the Operating Segments article for more information.

-

Geographical Areas: Offers a segmented view of your organization’s financial performance by region, leveraging the Balance Sheet (Segment) cube to break down key figures across different geographic areas. It displays both Income Statement metrics (like profit and loss lines) and Balance Sheet elements (such as assets and liabilities) across regions, allowing for clear insight into regional financial performance. See the Geographical Areas article for more information.

Several reports have been converted to Canvas, offering a clearer layout and interactive features. These include:

-

Group GAAP Corrected Breakdown Report

-

Scope of Consolidation Report

-

Intercompany Matrix Report

-

Intercompany Relation Summary Report

-

Intercompany Relation Report

-

Cash Flow Mapping Report

This setup ensures that frequently used reports and processes are easily accessible, while the canvas-based design provides a modern, user-friendly reporting environment.

Check out some of the Jedox Models Article

Models are predefined applications comprising files/reports, OLAP databases, Integrator jobs, scheduled tasks, and settings. Read this article for more information on Jedox Models.

Read this article for more information on the support lifecycle of each Model.

Installation of Premium Models

Besides free Models, Jedox also offers Premium Models, which require a specific license to be in place before they can be installed and used. The model will only be usable for as long as the license is present and valid. Read this article for more information.

Updated February 23, 2026