Return to Financial Consolidation Model Overview.

This article explains how to administrate cash flow calculations using the following steps:

- Update the

PnL and BS Accountdimension to the current chart of accounts defined by thePnL Accountas well as theBS Accountdimensions; - Edit the cash flow mapping records stored in the

Cash Flow Mappingcube; - Update an auxiliary dimension and the rules in the

Cash Flow Calculationand the Cash Flow Calculation (Segment)cube. This cube does not contain any physical values but is entirely populated by rules which actually perform the calculation of the cash flow statement.

Report Heading

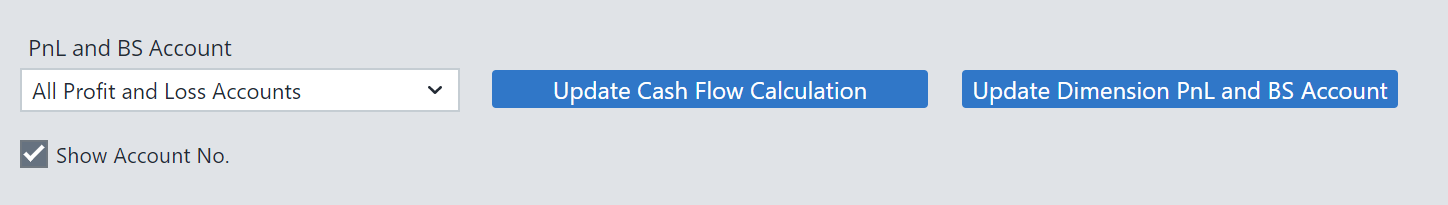

The screenshot below points out the heading area of the Financial Consolidation Cash Flow Mapping report. The report heading updates dynamically as various reporting options are selected.

The logo can be changed in Administration; see Configuring Design Elements for more on report design.

The heading area of the report displays the following fields and buttons:

|

Field/Button |

Description |

Implementation |

|

PnL and BS Account (Combobox) |

Selects a starting entry element to display accounts on rows. |

Selected consolidated elements of the |

|

Show Account No (checkbox) |

Displays the account number along with the account name in the row labels. |

Switch between |

| Update Cash Flow Calculation |

Updates the cash flow calculation from the mapping entered in this report. |

Update Cash Flow Calculation: |

| Update Dimension PnL and BS Account | Updates the accounts available as rows on this report for the mapping from the profit and loss and the balance sheet accounts. |

Update Dimension PnL and BS Account: Run Integrator job |

Report Columns

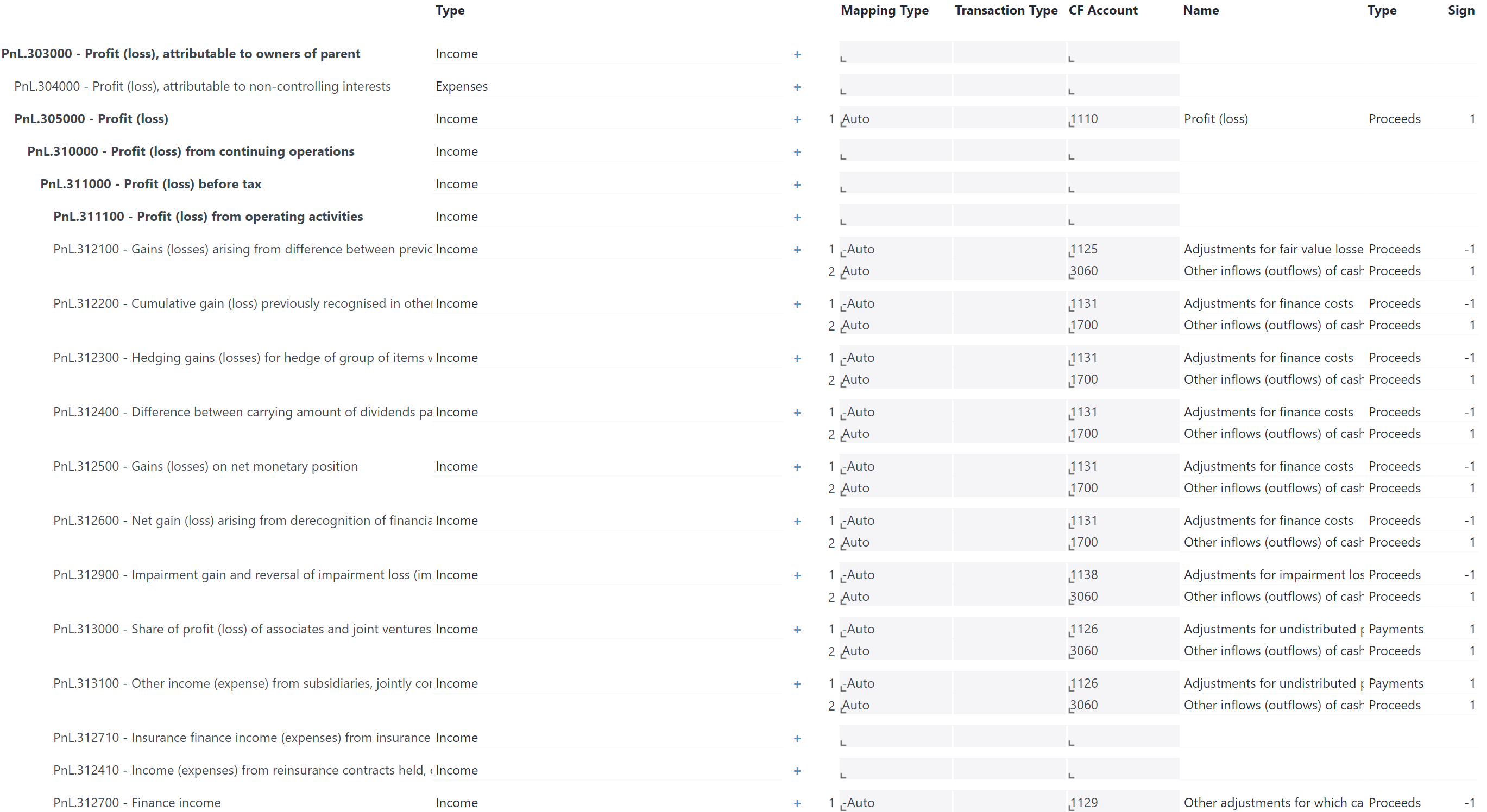

The columns displayed in the report depend on selection made in the Combobox for selecting hierarchy for PnL Account and BS Account. The screenshot below shows a report displaying hierarchy out of dimension BS Account.

Below are descriptions of the columns in the Cash Flow Mapping.

|

Field |

Description |

Implementation |

|

Row label |

Account shown as a localized name. |

Shows elements from the The elements named above can be changed in Administration - Cash Flow - Configuration with the keys |

|

Type |

Displays account type (Valid values are |

|

|

Mapping Type |

Defines how the sign of values from the source cubes

|

Changed value is stored in the |

|

Transaction Type |

Only valid for mappings from balance sheet accounts. |

Changed value is stored in the |

|

CF Account |

Target cash flow account of the mapping. |

Valid values are descendants of a Changed value is stored in the |

|

Name |

Cash flow account shown as a localized name. |

|

|

Type |

Displays type of cash flow account. |

|

|

Sign |

Effective sign of the mapping, depending on the mapping type. |

This value is computed by the Update Cash Flow Calculation procedure and stored in the |

Useful tips for the mapping

To set up a cash flow statement using the indirect method, make sure the changes to every balance sheet account with the exception of the cash accounts (in current assets) and the retained earnings (in equity) are mapped exactly once. The retained earnings account will be substituted with the profit and loss statement. You want to make sure every profit and loss account affecting cash is mapped exactly once. (Depreciation is an example of a profit and loss account not affecting cash.)

Try to set up the mapping with as few mapping records as possible - this will ease the future maintenance and keep the mapping robust against some simple changes in the chart of accounts.

When a consolidated profit and loss or balance sheet account with all descendants runs into the same cash flow account you can simply map the consolidated account instead of all individual accounts on the base level. When almost all descendants with only a few exceptions run into the same cash flow account you can simply map the consolidated account. You have to deduct the exception accounts with the reversed Mapping Type from the cash flow account and add another mapping for these onto another cash flow account, where the values of the exception accounts should be shown.

When all transaction types of a balance sheet account map to the same cash flow account you can simply map the T850 (Movements) transaction type instead of all individual transaction types on the base level. To split increases and decreases you can simply map the T820 (Total increase), T829 (Total increase (decrease)) and T830 (Total decrease) transaction types.

Take advantage of the Auto mapping type where possible. Make sure to setup the Type attributes in the PnL Account, BS Account and CF Account dimensions and the sign standard setting correct.

Updated February 23, 2026