Return to Financial Consolidation Model Overview.

The Scope of Consolidation report shows business relations within the Scope of Consolidation Cube, allowing you to view and customize these relations, adapting them to your financial consolidation structure as it grows and develops. The upper two tables in the scope of consolidation report are scope-neutral (their content stay the same regardless of scope), while the tables below them are scope-specific (their content changes based on their specific scope).

Note that while the Scope of Consolidation Cube saves changes in the relationships between individual entities in your company, the Legal Entity dimension is not updated automatically. If necessary, the Legal Entity dimension must be manually adjusted in the Modeler.

Report Heading

The report heading updates dynamically as various reporting options are selected. Below it shows the scope for Actual, 2020-12_YTD.

The logo can be changed in Administration; see Configuring Design Elements for more on report design.

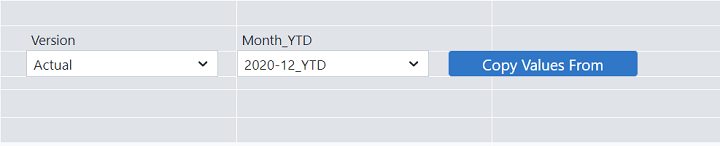

You can select your base elements in the Comboboxes below the report heading:

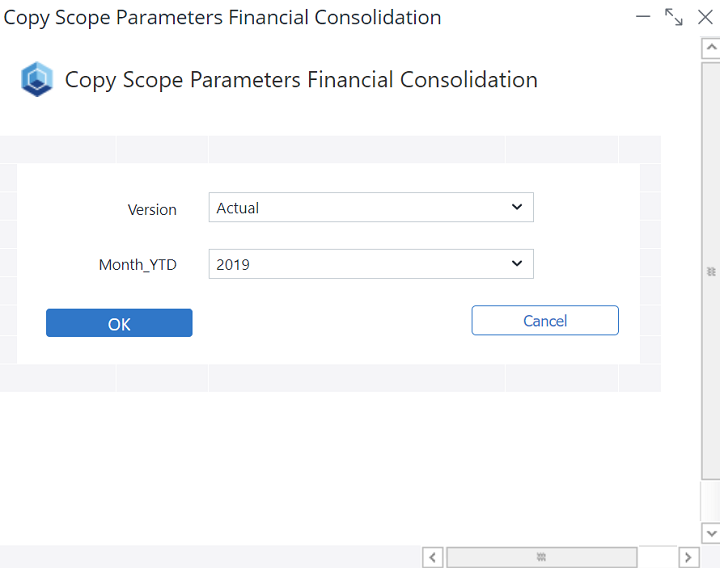

The Version dimension separates actual figures from planning figures, see full article. The Month_YTD dimension accumulates float values from the beginning of the calendar year to the current date, while respectively holding the final figure for stock values. The Copy From button gives you the possibility to copy the parameters from a previous Version and Month_YTD element, i.e. Actual, 2019.

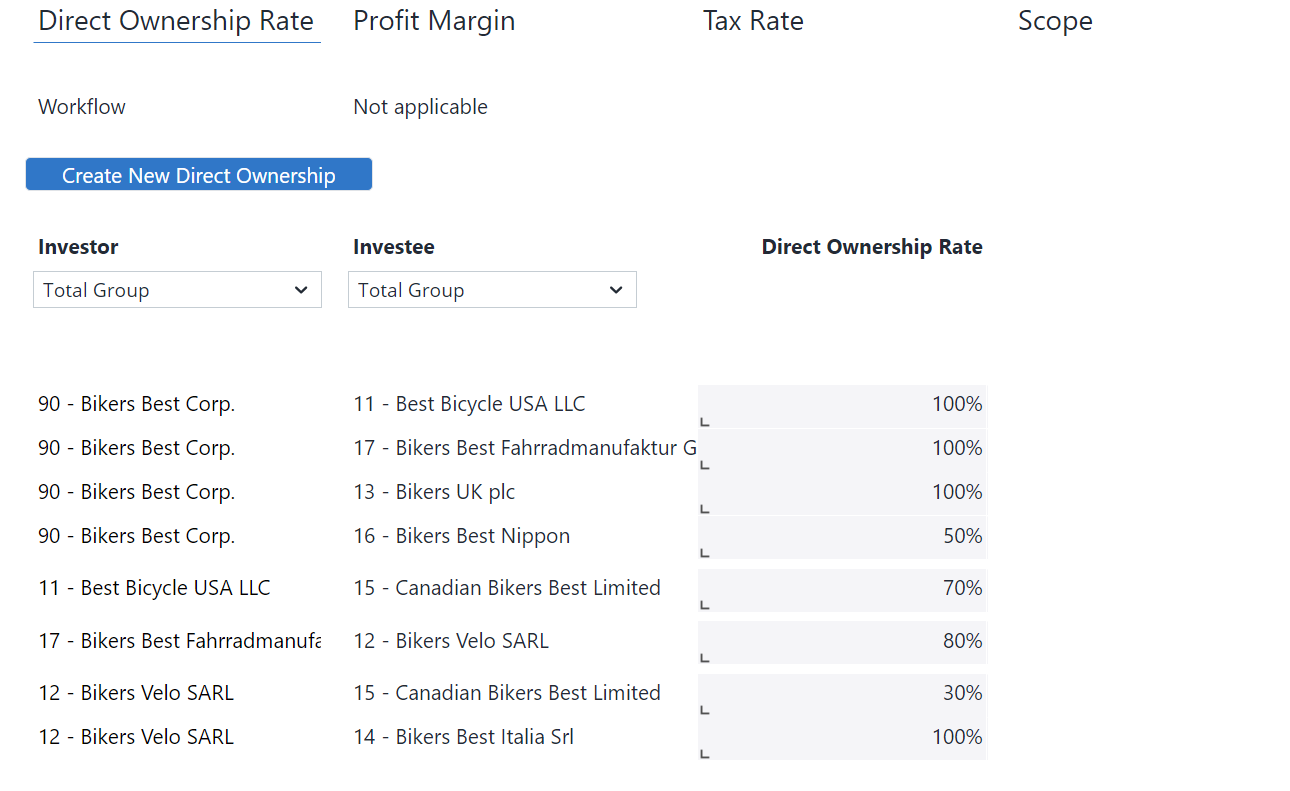

The Report is divided into four sections: Direct Ownership Rate, Profit Margin, Tax rate, and Scope.

Direct Ownership Rate

The rows display the same business entities. The rows in the first column show the entities in the role of investors; the second column show the entities in the role of investees. The third column cells show the relationship of the two business entities in terms of direct ownership.

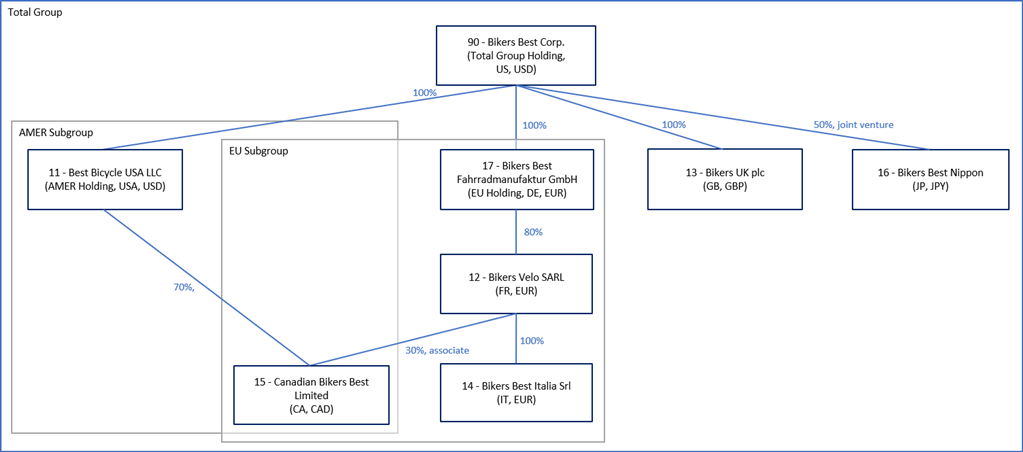

The following diagram uses the sample data to explain different parts of the report:

In terms of direct business ownership, we can see that 90 (Bikers Best) has 100% direct ownership over business entities 11, 17, and 13, and 50% direct Ownership of 16 (Bikers Best Nippon). Read more about different business relations here. Business entity 17, in turn, owns 80% of business entity 12. This means the holding company 90indirectly owns business entity 12 at a rate of 80%. You can read more about business relationships under the scope of consolidation here.

A new relation can be created by clicking the “Create New Direct Ownership” button.

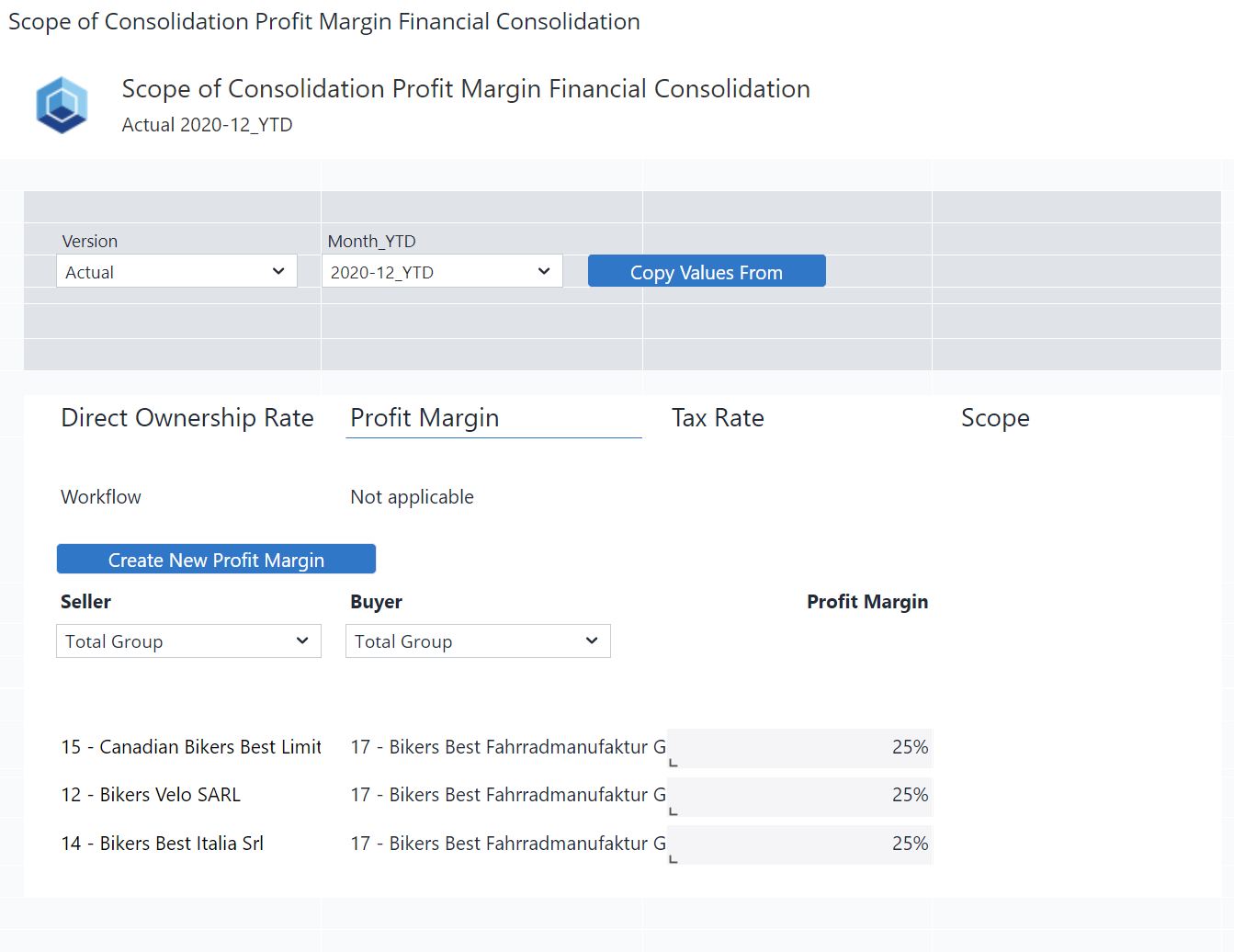

Profit Margin

The rows display the business entities. The rows in the first column show the entities in the role of sellers; the second column show the entities in the role of buyers. The third column cells show the relationship of the two business entities in terms of profit margin.

A new margin can be created by clicking on the “Create New Profit Margin” button.

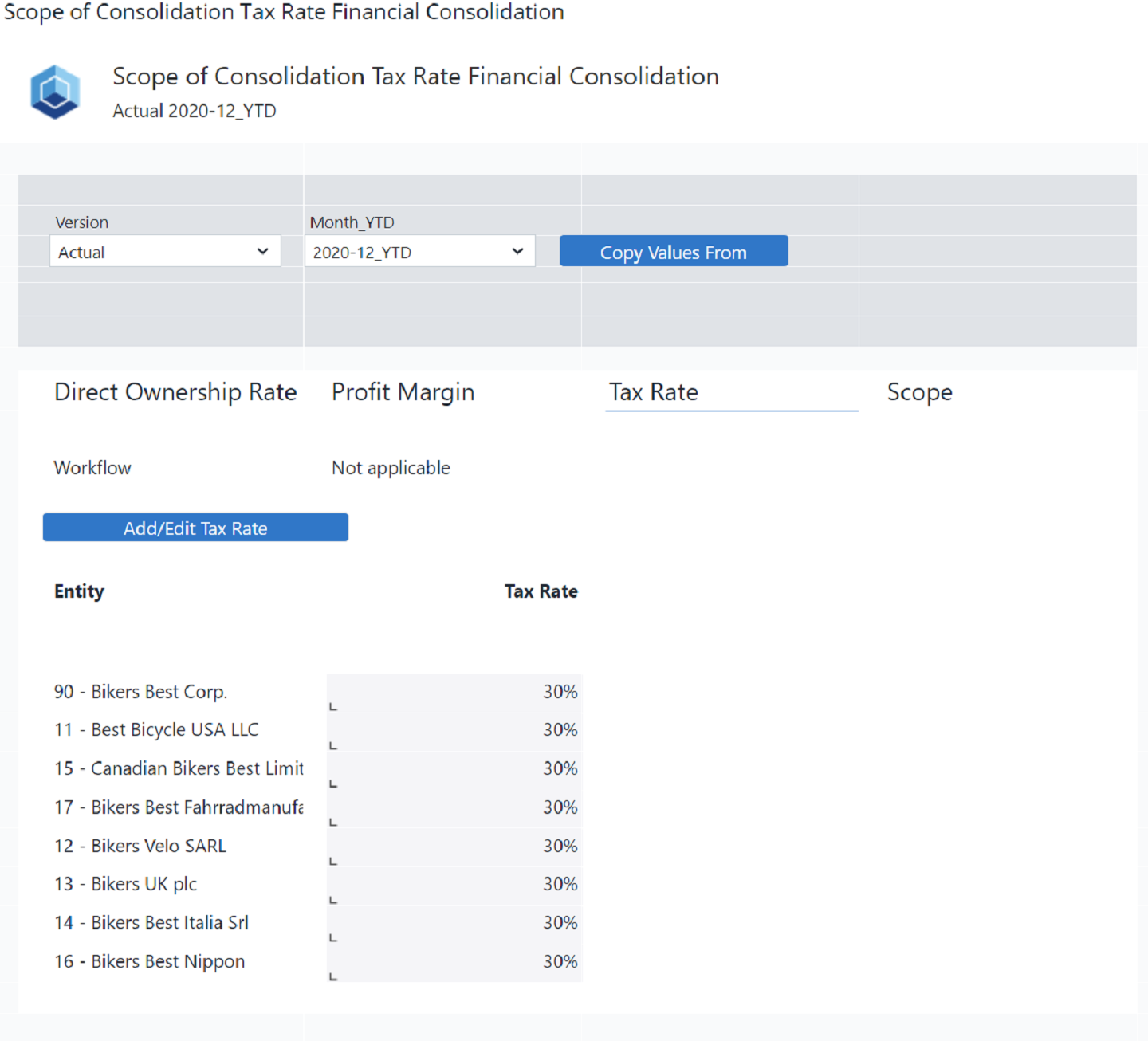

Tax Rate

The next table shows the tax rate for each business entity:

A 30% tax rate is given as an example for all entities above. It is important to note, however, that each cell containing a tax rate percentile is an independent input field. The key user inserts a figure estimating the tax withholdings for each business separately. These figures may vary from one business entity to the next and only serve as an approximation of the final taxes that will be withheld.

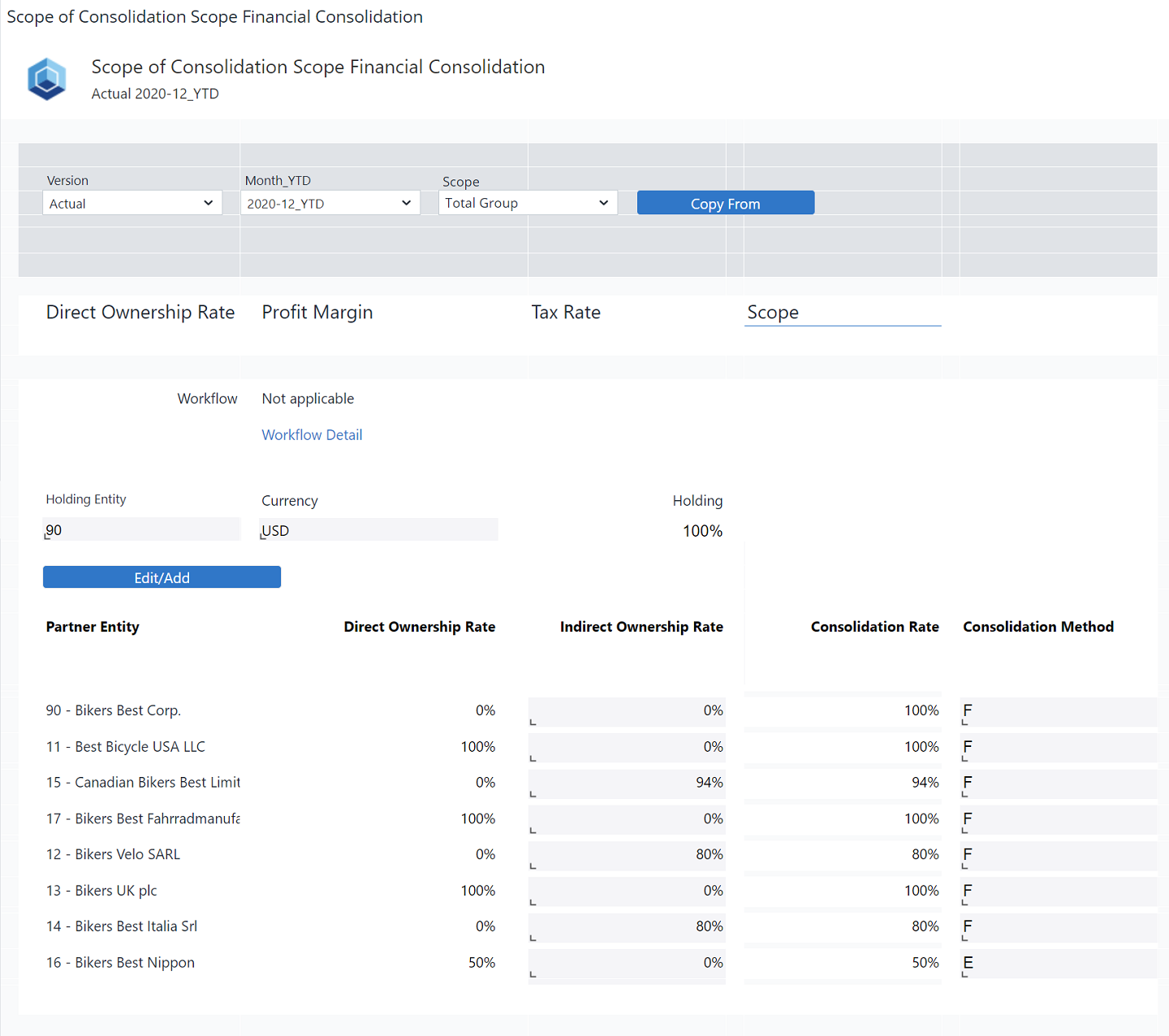

Scope

The Scope table depicts the full scope of consolidation. Click on the Holding cell to open the dropdown menu from which you can select the holding company.

The entities and the columns correspond to the five measures of the scope dimension (read the details about them here). They are described below:

| Measure | Description | Implementation |

| Direct Ownership Rate | Percentage of business owned directly by the holding (read only). | Any value stored in the Direct Ownership element of the Scope of Consolidation_measure dimension (numeric). |

| Indirect Ownership Rate | Percentage of business owned indirectly, through other business relations. | Any value stored in the Indirect Ownership element of the Scope of Consolidation_measure dimension (numeric). |

| Holding | Only applies to the total holding company and is always 100% (read only). | Value stored in the Holding Entity attribute of the Legal Entity dimension (string). If there is any change in the holding entity attribute of Legal Entity Dimension, the rule template in the scope of consolidation cube needs to be updated. |

| Consolidation Method |

Signifies how a specific entity is included in the scope (read/write). Clicking the cell reveals a dropdown menu with four options:

|

Value stored in the Consolidation Method element of the Scope of Consolidation_measure dimension (string). |

Updated February 23, 2026