The Scope of Consolidation cube contains data concerning the total group and subgroups should they exist. This includes the ownership rates, consolidation method and tax rates. These are dynamic values that may change along with their Time and Version element. Other information remains static regardless of time and version. This information is contained in the Legal Entity, Partner Entity and Scope dimensions.

The dimensions of the Scope of Consolidation cube are described below:

| Dimension | Description | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Version | The Version dimension separates actual figures from planning figures. See full article. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Month_YTD | The Month_YTD dimension holds aggregated values from the beginning of the calendar or fiscal year to the end of a month. See full article. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Scope | The Scope dimension contains all target elements for financial consolidation in a flat list. See full article. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Legal Entity | Elements in the Legal Entity dimension represent the companies within a group, i.e. those companies for which you need a separate financial statement. See full article. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Partner Entity | Elements in the Partner Entity dimension represent business relationships with other companies in a group. See full article. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Scope of Consolidation_Measure dimension |

Data Validations, Data Validation Errors, and Data Validation Warnings hierarchies are configurable. See Balance Sheet_Measure Dimension article for more information.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

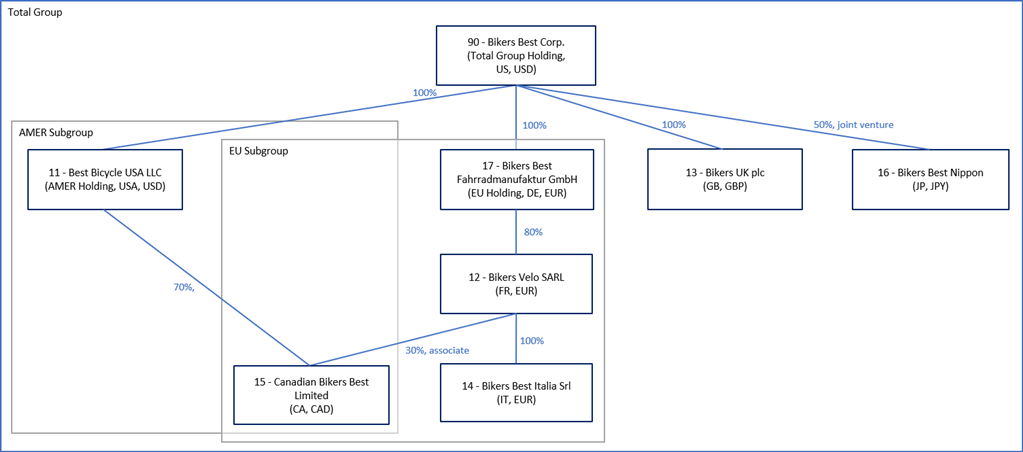

The diagram below shows the sample data for the Financial Consolidation model, depicting the various qualities and relations between the business entities falling within its scope:

The uppermost box represents the total group holding: a parent company that maintains control over multiple business entities and is in charge of creating the consolidated financial statement for the group. In this case, the legal entity 90 (Bikers Best Corp) is the holding of the Total Group. Business entities 11 and 17 are the respective holdings of the AMER and EU subgroups. The holding is stored in the Holding Entity attribute in the Legal Entity dimension on the total group or subgroup elements. The second row from the top (11, 17, 13, and 16) represents the business entities in direct ownership with the total group holding. These entities are stored in the Direct Ownership Rate measure. The ones below this (12, 15, and 14) are in indirect ownership, which means they are stored in the Indirect Ownership Rate measure. The diagram also shows the various relations the business entities have with one another:

- Subsidiary: investor has full control of the company (

90[Bikers Best Corp] →11[Best Bicycle USA]). - Associate: investor has minor, but significant control of the company (

12[Bikers Velo] →15[Canadian Bikes Best]). - Joint venture: two or more investors share equal control of a company (

90[Bikers Best Corp] →16[Bikers Best Nippon]—a 50% joint venture with two equal control rates).

Please note: Ownership rate does not always correspond with rate of control. Majority shareholders do not always have full control and minority shareholders may have more control than their ownership rate suggests.

Of course, this diagram is only an example and your financial consolidation hierarchy may look different.

Updated February 23, 2026