Return to Profit Center Model Overview.

The allocation is a data processing procedure to move amounts between profit centers or cost objects (aka cost units) within the Profit Center Cube. The allocation attributes costs from profit centers providing internal services to the profit centers consuming the services. The same procedure applies to cost objects. The purpose of the allocation is to obtain fairly charged and thus comparable profit centers as well as cost objects.

The allocation procedure consists of multiple allocation steps, each working on the results of the previous step. Each step is configured in order to determine the amounts and destinations to be moved.

The configuration can be set up as well as executed using the Profit Center Allocation Configuration report. The allocation procedure creates Posting Journal entries in the Costing ledger and posts the totals to the Profit Center cube.

The allocations in the Profit Center model cover the following methods:

- Equal distribution to Profit Centers (Intracompany): Allocate an amount from a profit center to others, each receiving the equal share of the amount.

- Equal distribution to Cost Objects (Intracompany): Same as above but allocating between cost objects instead of profit centers.

- Allocation by Profit Center key (Intracompany): Allocate an amount from one profit center to a set of others using an allocation key to compute the share of each receiving profit center. The allocation key can consist of precomputed percentages, amounts or a figure in any other unit.

- Allocation by Cost Object key (Intracompany): Same as above but allocating between cost objects instead of profit centers.

- Internal activity allocation by Profit Center service relationships (Intracompany): Allocate an amount from one profit center to a set of others using a volume of the service relationship and a service rate to compute the amounts.

- Internal activity allocation by Cost Object service relationships (Intracompany): Same as above but allocating between cost objects instead of profit centers.

1./2. Equal distribution to Profit Centers/Cost Objects (Intracompany)

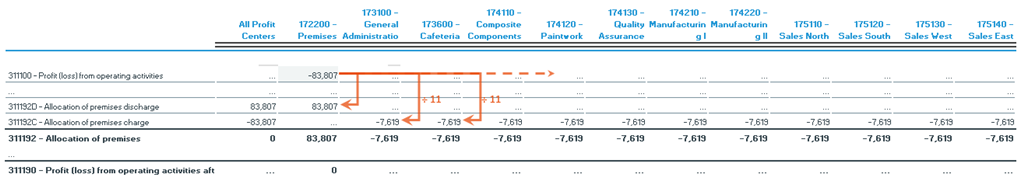

Profit center 172200 (Premises) has planned loss of $ 83,806.97 for Budget in January 2017. This loss should be taken from the non-productive profit center and be moved to eleven productive profit centers to allow for a fair analysis of their performance. The loss should be split into equal shares. The movement is shown on dedicated accounts - separated by discharge and charge.

The following diagram illustrates how the allocation is computed and added to the profit and loss statement in the PC Account dimension:

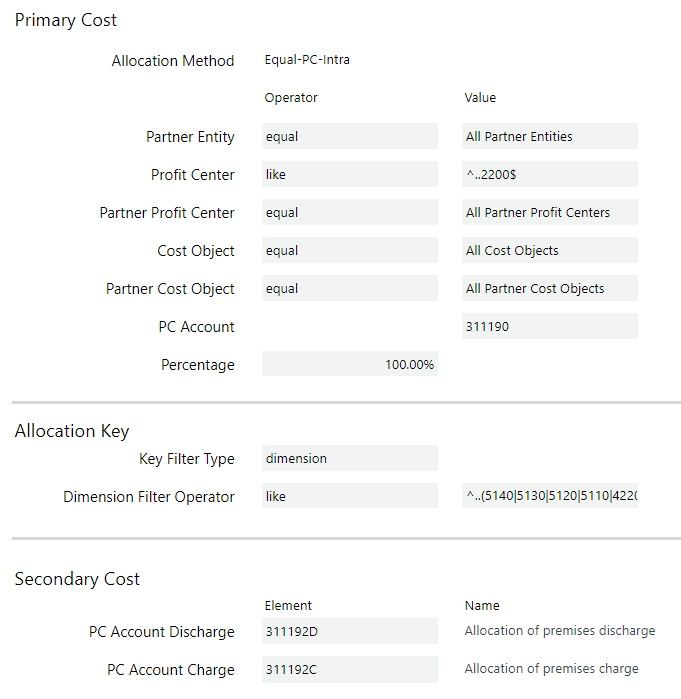

The configuration of this allocation step is defined in the allocation configuration, within it you can see 3 sections:

- The Primary Cost section where the non-productive profit center (172200, Premise) is selected using a regular expression.

- The Allocation Key section where the Key Filter Type (dimension) for the productive profit centers are selected (via a regular expression) to calculate the allocation.

- The Secondary Cost section where the PC Account Discharge and Charge sections are set.

The journal entry created for this allocation is:

|

PC Account (Profit Center) |

Debit |

Credit |

|

Allocation of premises charge (175140) |

7,618.82 |

|

|

Allocation of premises charge (175130) |

7,618.82 |

|

|

Allocation of premises charge (175120) |

7,618.82 |

|

|

Allocation of premises charge (175110) |

7,618.82 |

|

|

Allocation of premises charge (174220) |

7,618.82 |

|

|

Allocation of premises charge (174210) |

7,618.82 |

|

|

Allocation of premises charge (174130) |

7,618.82 |

|

|

Allocation of premises charge (174120) |

7,618.82 |

|

|

Allocation of premises charge (174110) |

7,618.82 |

|

|

Allocation of premises charge (173600) |

7,618.82 |

|

|

Allocation of premises charge (173100) |

7,618.82 |

|

|

Allocation of premises discharge (172200) |

83,806.97 |

3./4. Allocation by Profit Center/Cost Object key (Intracompany)

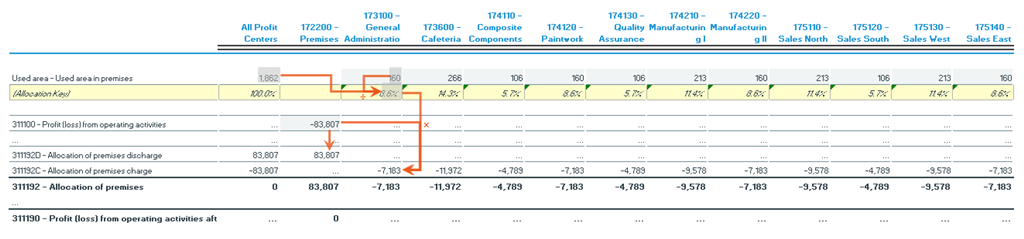

Profit center 172200 (Premises) has planned loss of $ 83,806.97 for Budget in January 2017. This loss should be taken from the non-productive profit center and be moved to eleven productive profit centers to allow for a fair analysis of their performance. The loss should be split in proportion to the floor space used by each profit center which is stored on the statistical account Used area (except for the original profit center 172200, of course). This account is used as an allocation key and indicates the percentage shares. The movement is shown on dedicated accounts - separated by discharge and charge.

The following diagram illustrates how the allocation is computed and added to the profit and loss statement in the PC Account dimension:

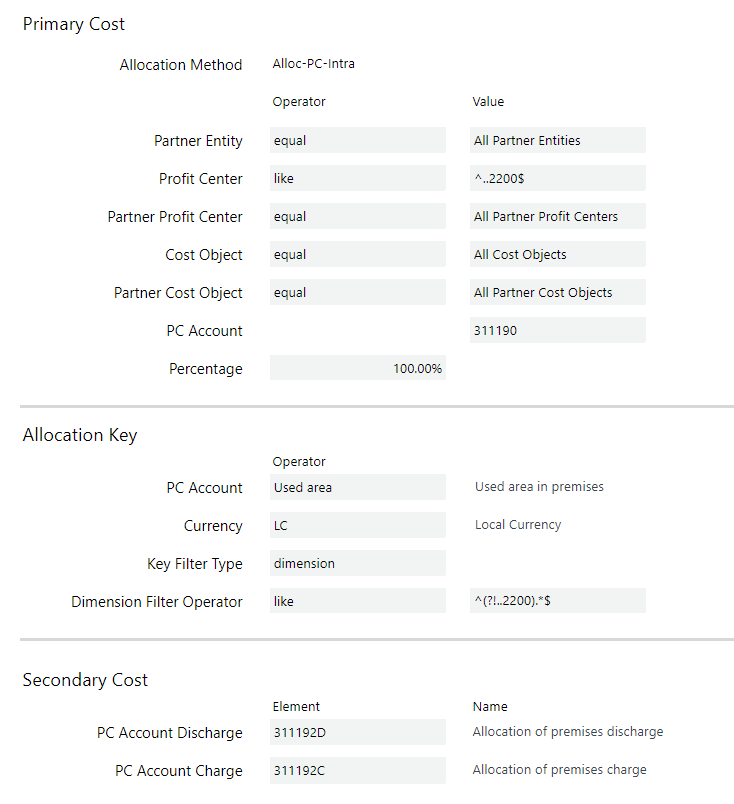

The configuration for this allocation step is defined in the allocation configuration, within it you can see 3 sections:

- The Primary Cost section where the non-productive profit center (172200, Premise) is selected using a regular expression.

- The Allocation Key section where the PC Account (used area) and the Key Filter Type (dimension) for the productive profit centers are selected (via a regular expression) to calculate the allocation.

- The Secondary Cost section where the PC Account Discharge and Charge sections are set.

The journal entry created for this allocation is:

|

PC Account (Profit Center) |

Debit |

Credit |

|

Allocation of premises charge (175140) |

7,183.33 |

|

|

Allocation of premises charge (175130) |

9,578.07 |

|

|

Allocation of premises charge (175120) |

4,789.03 |

|

|

Allocation of premises charge (175110) |

9,578.07 |

|

|

Allocation of premises charge (174220) |

7,183.33 |

|

|

Allocation of premises charge (174210) |

9,578.07 |

|

|

Allocation of premises charge (174130) |

4,789.03 |

|

|

Allocation of premises charge (174120) |

7,183.33 |

|

|

Allocation of premises charge (174110) |

4,789.03 |

|

|

Allocation of premises charge (173600) |

11,972.36 |

|

|

Allocation of premises charge (173100) |

7,183.33 |

|

|

Allocation of premises discharge (172200) |

83,806.97 |

5./6. Internal activity allocation by Profit Center/Cost Object service relationships (Intracompany)

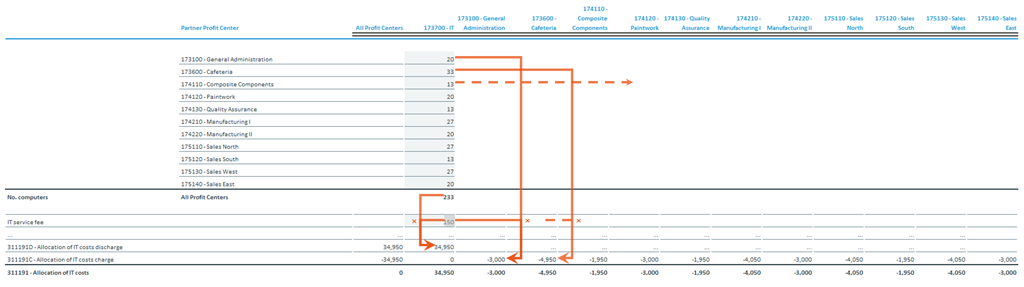

Profit center 173700 (IT) provides computers and related services to other profit centers. They charge an IT service fee of $150 per device a month. Profit center 173100 (General Administration) uses 20 computers. The number of devices is stored in the statistical account No. computers as a matrix between the provider (e.g. IT) and consumer (e.g. General Administration).

The calculated costs should be taken from the providing IT profit center and be moved to the consuming productive profit centers to allow for a fair analysis of their performance. Each charged amount is calculated by no. computers times the service fee. The movement is shown on dedicated account - separated by discharge and charge.

The following diagram illustrates how the internal activity allocation is computed and added to the profit and loss statement in the PC Account dimension:

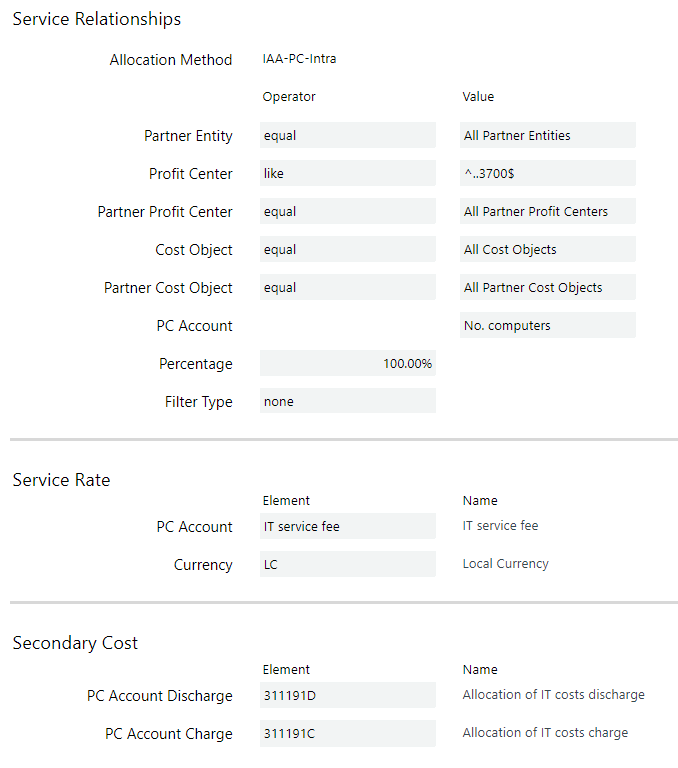

The configuration for this allocation step is defined in the allocation configuration, within it you can see 3 sections:

- The Service Relationships section where the Profit center (173700 (IT)) that provides the resource is selected using a regular expression.

- The Service Rate section where the PC Account (IT service fee) is set.

- The Secondary Cost section where the PC Account Discharge and Charge sections are set.

The journal entry created for this allocation is:

|

PC Account (Profit Center) |

Debit |

Credit |

|

Allocation of IT costs charge (173100) |

3,000.00 |

|

|

Allocation of IT costs discharge (173700) |

3,000.00 |

Updated February 25, 2026