Return to Projected Balance Projection Configuration

This report displays mapping of the Profit and Loss (PnL) statements to the Balance Sheet (BS) statements and how projections are allocated to these accounts.

The heading area of the report displays the following fields:

| Field | Description | Implementation |

|

Title |

Name of the report. |

Name of the report in Report Designer |

|

Subtitle |

Current Parameters selection. |

Localized subtitle will update as Parameters selections are made |

|

Link |

Link to the Projected Balance Sheet Projection Configuration report. |

Report Columns

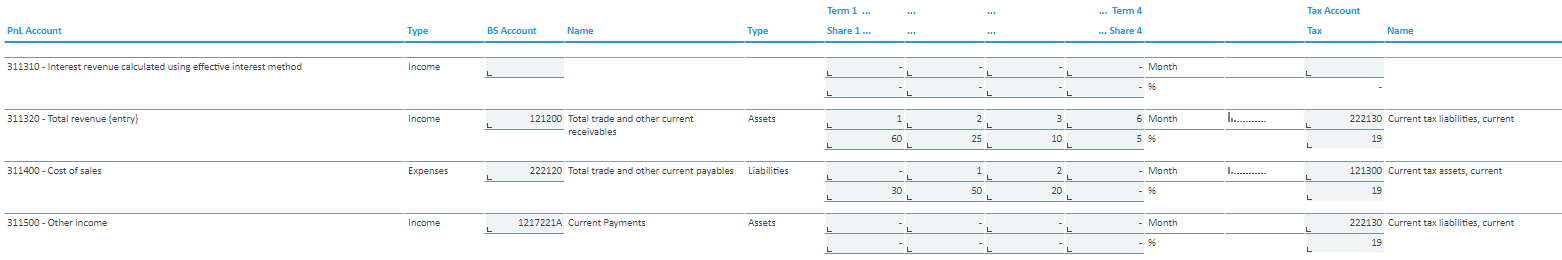

The screenshot below shows a report displaying several PnL Accounts mapped to BS Accounts with the corresponding projection term and tax allocation.

|

Field |

Description |

Implementation |

| PnL Account | Displays the account number and name of the profit and loss account that the projection was caused from. | ID_Name attribute of PnL Account dimension |

| Type | Indicates whether the account is for Income or Expenses. |

Type attribute of PnL Account dimension |

| BS Account | Displays the account number of the balance sheet account that the profit and loss account is mapped to. Used for instant mapping of income or expenses without tax and instant mapping of income or expenses with tax. | ID_Name attribute of BS Account dimension |

| Name | Displays the name of the balance sheet account mapped to. | Name attribute of BS Account dimension |

| Type | Indicates whether the account is under the Assets or Liabilities side of the ledger. |

Type attribute of BS Account dimension |

| Term 1 - Term 4 | Time period of projection allocation.Valid values are integers (e.g. ... -2, -1, 0, 1, 2 ...) representing months of prepayment (negative values), immediate (zero) or delayed payment. Used for deferred proceeds and payments. | Elements of Projection Configuration_measure dimension |

| Share 1 - Share 4 | Share of allocation for each term. Valid values from 0 to 100. Used for deferred proceeds and payments. | Elements of Projection Configuration_measure dimension |

| Tax Account | Balance sheet account to map the tax to. Used for instant mapping of income or expenses with tax. | Tax Account element of Projection Configuration_measure dimension |

| Tax | Tax percentage. Valid values from 0 to 100. Used for instant mapping of income or expenses with tax. | Tax element of Projection Configuration_measure dimension |

| Name | Name of tax account. | Name attribute of BS Account dimension |

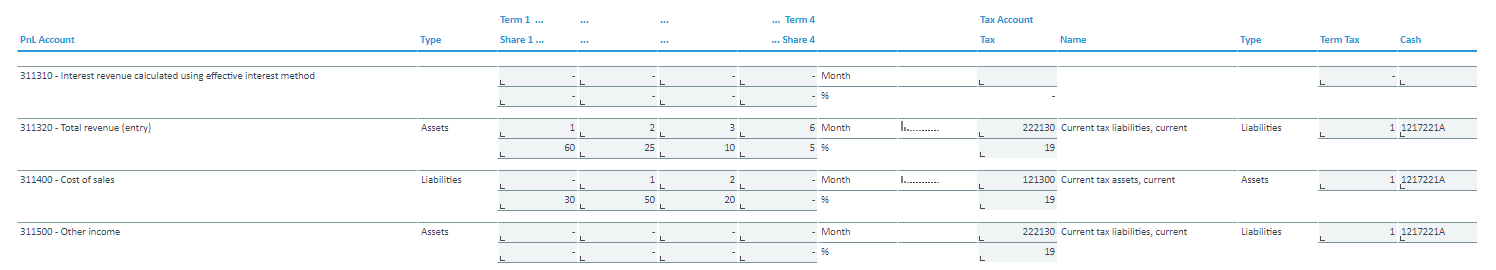

Additional columns are shown in the screenshot below.

|

Field |

Description |

Implementation |

| Type | Indicates whether the tax account is under the Assets or Liabilities side of the ledger. | Type attribute of BS Account dimension |

| Term Tax | Time period of tax allocation. Valid values are integers (e.g. ... -2, -1, 0, 1, 2 ...) representing months of prepayment (negative values) or delayed payment. Used for instant mapping of income or expenses with tax and deferred proceeds and payments from tax assets and tax liabilities. | Term Tax element of Projection Configuration_measure dimension |

| Cash | Indicates the account number that the amount is credited or debited from. Used for deferred proceeds and payments and deferred proceeds and payments from tax assets and tax liabilities. | Cash element of Projection Configuration_measure dimension |

Updated February 25, 2026