Return to Financial Consolidation Model Overview.

Starting from Financial Consolidation version 2.6.5166, Business Transaction Type Total Divestment is available on the Investment Register report.

This business transaction type is applied if one of the subsidiaries leaves the group entirely. In this case, all amounts concerning the subsidiary leaving the group must be eliminated from the group reporting.

The following positions are considered for all internal owners:

(1) The investment is removed from the closing balance

(2) The gains (losses) from divestment from the group perspective are computed. The gains (losses) reported on the separate financial statements from the owner's perspective must be adjusted to the group perspective.

The following positions are considered for the subsidiary:

(1) The goodwill is removed from the closing balance

(2) Any total equity attributable to owners of the parent must be 0

(3) All non-controlling interests are removed from the closing balance

(4) All other assets, liabilities, and equity are removed from the closing balance

Divestment Consolidation Rules

The sample configuration of the Financial Consolidation model contains two consolidation rules for divestment, C6 (Direct Owners), and C7 (Divestment of non-controlling interests).

Any changes in the current reporting period (e.g., adjustments of FXDiff on Goodwill, amortization or impairment of goodwill, step acquisition, step divestment, etc.) must be posted before executing the divestment consolidation rule. This introduces dependencies between consolidation rules.

Therefore, divestment consolidation rules must be executed at the end of the consolidation process. This ensures that all other possible business transactions that have occurred in the same period for the same entities are eliminated entirely.

This requirement is fulfilled by the attribute Group, which defines the execution order of consolidation rules. For more information, see the Consolidation Rule Dimension article.

The following cases are considered in the Jedox Financial Consolidation model:

1) No divestment available – the application works as before;

C6andC7do not apply2) There is a total divestment transaction of a 100% subsidiary – the

C6rule is applied after all other consolidation rules.Debt Consolidationrules are invalid because no internal debts need to be eliminated.3) There is a total divestment transaction of a subsidiary with external owners. In this case,

C6andC7rules are applied after all other consolidation rules.Debt Consolidationrules are invalid in this case because no internal debts need to be eliminated.4) Several divestment transactions in one period for the same business combination – out of scope.

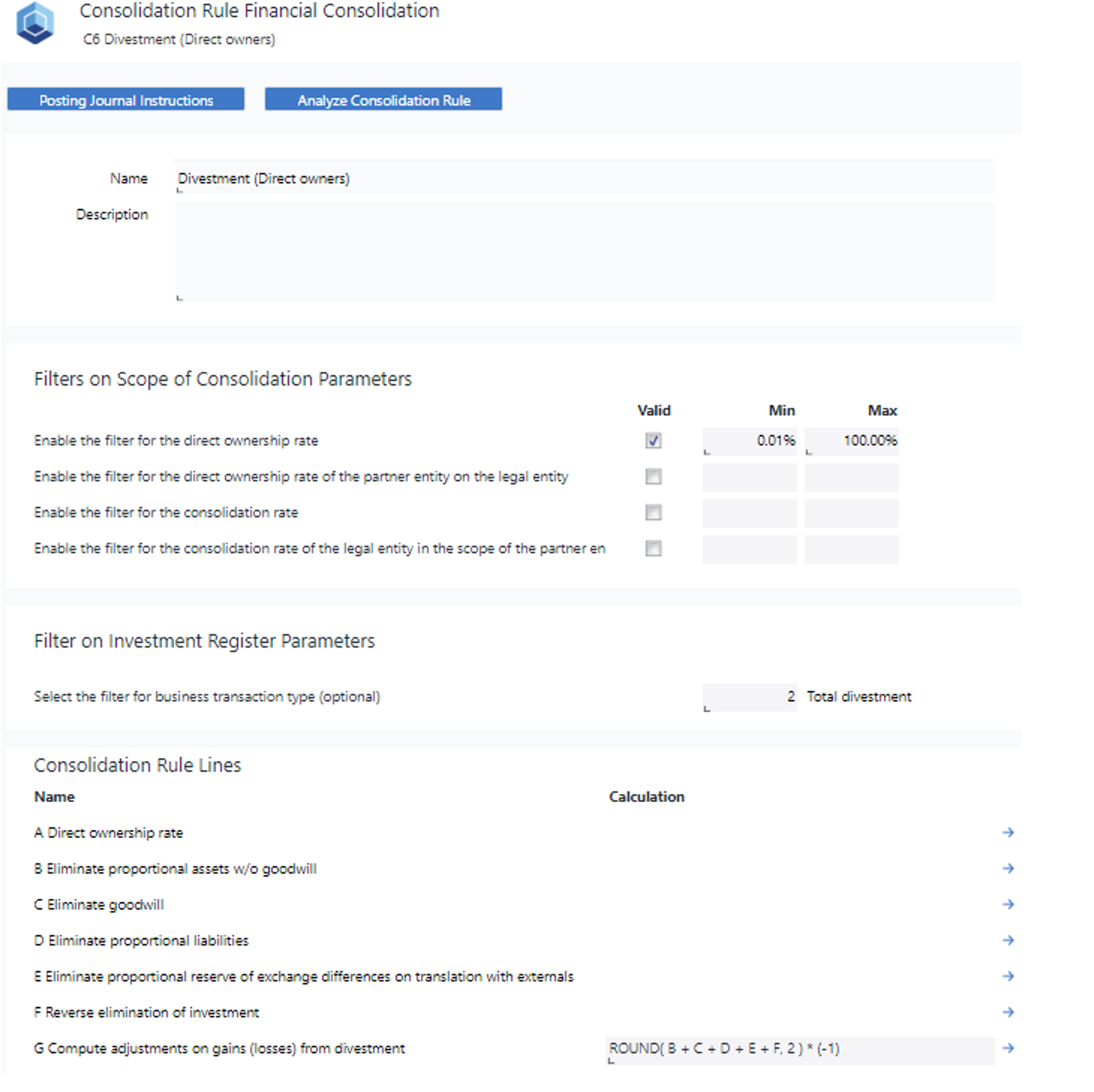

C6 (Direct Owners)

| Line | Description | Implementation |

| (A) Direct Ownership Rate | Retrieves direct ownership rate of Legal Entity on Partner Entity. |

Uses fact selector DO |

| Eliminate proportional shares assets w/o goodwill | Eliminates proportional assets without goodwill, considering the direct ownership rate of the divested entity on Transaction Type T991. |

Uses fact Selector PEQ which retrieves all asset accounts from the BS Account dimension corresponding to the regular expression ^(110[12345679]\d{2}|111\d{3}|120000)$ for all Partner Entities for Transaction Types corresponding to the regular expression ^T(00[01]|01[0-9]|[1-7][0-9]{2}|80[01]|8[2-9][0-9]|90[01]|9[1-8][0-9]|99[01])$ for the Consolidated element of the Consolidation dimension.

The amounts are inverted with the selected Factor (-1) and calculated proportionally dependent on a Direct Ownership Rate.

The resulting amounts are written to Transaction Type T991.

|

| (B) Eliminate goodwill | Eliminates proportional goodwill for the divested entity on Transaction Type T991. |

Uses fact Selector PEQ which retrieves goodwill account(s) (110800) from the BS Account dimension for all Partner Entities for Transaction Types corresponding to the regular expression ^T(00[01]|01[0-9]|[1-7][0-9]{2}|80[01]|8[2-9][0-9]|90[01]|9[1-8][0-9]|99[01])$ for the Consolidated element of the Consolidation dimension.

The amounts are inverted with the selected Factor (-1) and calculated proportionally dependent on a Direct Ownership Rate.

The resulting amounts are written to Transaction Type T991.

|

| (C) Eliminate proportional liabilities | Eliminates proportional liabilities for the divested entity on Transaction Type T991. |

Uses fact Selector PEQ which retrieves equity account(s) (220000) from the BS Account dimension for all the Partner Entities for Transaction Types corresponding to the regular expression ^T(00[01]|01[0-9]|[1-7][0-9]{2}|80[01]|8[2-9][0-9]|90[01]|9[1-8][0-9]|99[01])$ for the Consolidated element of the Consolidation dimension.

The amounts are inverted with the selected Factor (-1) and calculated proportionally dependent on a Direct Ownership Rate.

The resulting amounts are written to Transaction Type T991.

|

| (D) Eliminate proportional reserve of exchange differences on translation with externals | Eliminates proportional reserves of exchange differences on translation with externals for the divested entity on Transaction Type T991. |

Uses fact Selector PEQ which retrieves equity account(s) (211603) from the BS Account dimension for all the Partner Entities for Transaction Types corresponding to the regular expression ^T(00[01]|01[0-9]|[1-7][0-9]{2}|80[01]|8[2-9][0-9]|90[01]|9[1-8][0-9]|99[01])$ for the Consolidated element of the Consolidation dimension.

The amounts are inverted with the selected Factor (-1) and calculated proportionally dependent on a Direct Ownership Rate.

The resulting amounts are written to Transaction Type T991.

|

| (E) Reverse elimination of the investment | For the divestment period, the investment has already been eliminated on Local GAAP; therefore, the investment elimination from the subsequent capital consolidation is obsolete and reversed. | Uses fact Selector BS, which retrieves asset account (111100) from BS Account dimension for all the Partner Entities for Transaction Types T999 for the Consolidated element of the Consolidation dimension.

The amounts are inverted with the selected Factor (-1) and calculated proportionally dependent on a Direct Ownership Rate.

The resulting amounts are written to Transaction Type T991.

|

| (F) Compute adjustments on gains (losses) from divestment | Computes adjustments on gains (losses) from divestment for the divested entity on Transaction Type T991. |

Uses the formula ROUND( B + C + D + E + F, 2 ) * (-1) to compute adjustment on gain (losses) from divestment. |

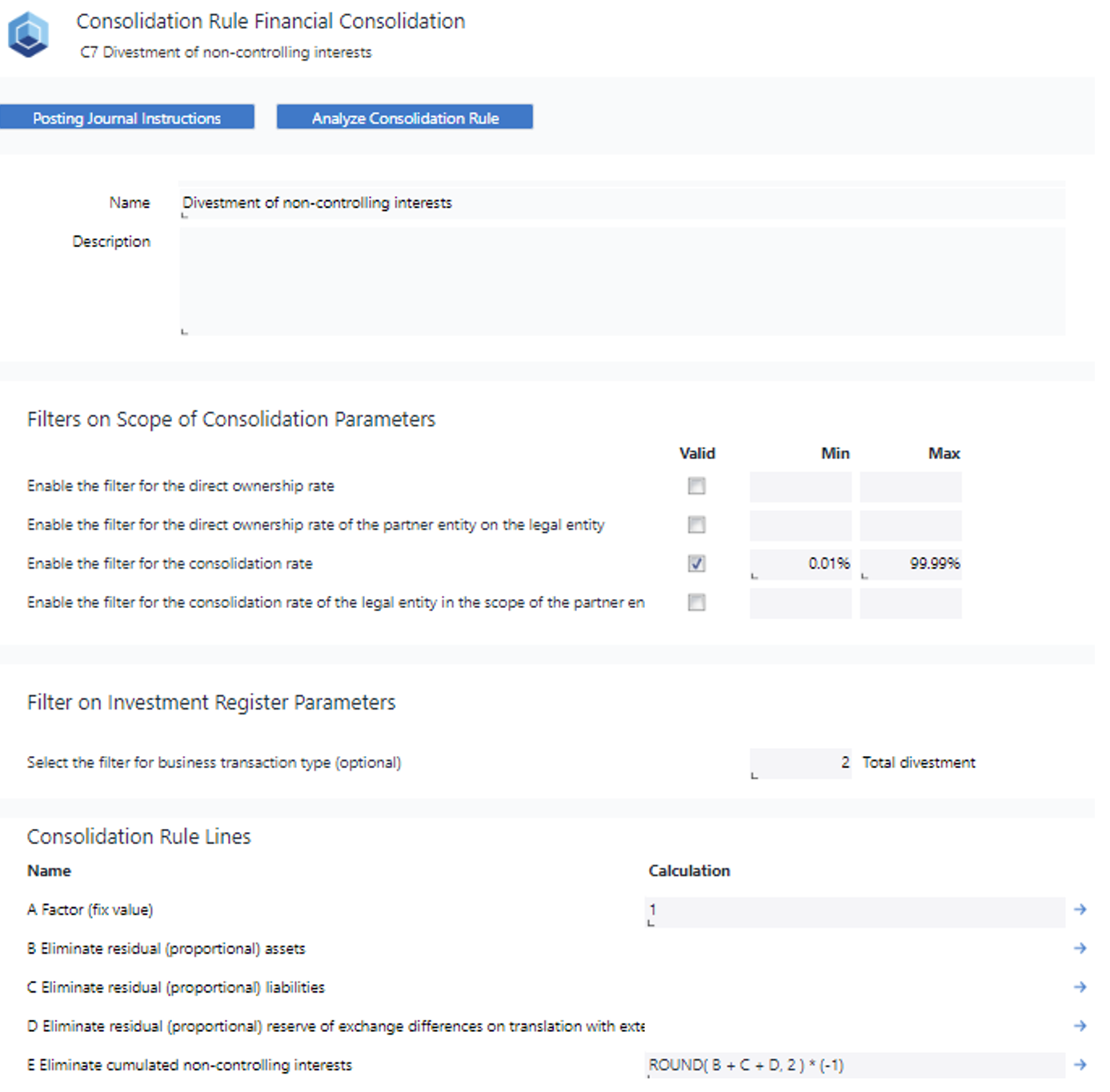

C7 (Divestment of non-controlling interests)

| Line | Description | Implementation |

| (A) Factor (fixed value) | Hardcoded value (1) for the following calculations | |

| (B) Eliminate residual (proportional) assets | Eliminates residual assets for the divested entity on Transaction Type T991. |

Uses fact Selector PEQ which retrieves asset account (100000) from the BS Account dimension for all the Partner Entities for Transaction Types corresponding to the regular expression ^T(00[01]|01[0-9]|[1-7][0-9]{2}|80[01]|8[2-9][0-9]|90[01]|9[1-8][0-9]|99[01])$ for the Consolidated element of the Consolidation dimension.

The amounts are inverted with the selected Factor (-1). The resulting amounts are written to Transaction Type T991.

|

| (C) Eliminate residual (proportional) liabilities | Eliminates residual liabilities for the divested entity on Transaction Type T991. |

Uses fact Selector PEQ which retrieves equity account (220000) from the BS Account dimension for all the Partner Entities for Transaction Types corresponding to the regular expression ^T(00[01]|01[0-9]|[1-7][0-9]{2}|80[01]|8[2-9][0-9]|90[01]|9[1-8][0-9]|99[01])$ for the Consolidated element of the Consolidation dimension.

The amounts are inverted with the selected Factor (-1). The resulting amounts are written to Transaction Type T991.

|

| (D) Eliminate residual (proportional) reserve of exchange differences on translation with externals (Is this C or D?) | Eliminates any remaining exchange difference reserves (after executing C6, this corresponds to the proportional reserve of exchange differences for non-controlling interests). | Uses fact Selector PEQ which retrieves equity account(s) (211603) from the BS Account dimension for all the Partner Entities for Transaction Types corresponding to the regular expression ^T(00[01]|01[0-9]|[1-7][0-9]{2}|80[01]|8[2-9][0-9]|90[01]|9[1-8][0-9]|99[01])$ for the Consolidated element of the Consolidation dimension.

The amounts are inverted with the selected Factor (-1).

The resulting amounts are written to Transaction Type T991.

|

| (E) Eliminate cumulated non-controlling interests | For the divestment period, the investment is already eliminated on Local GAAP, therefore the investment elimination from the subsequent capital consolidation is obsolete and reversed. | Uses formula ROUND( B + C + D, 2 ) * (-1) to compute the cumulated non-controlling interests. |

Post-transaction movements

The total divestment process requires detailed information on assets and liabilities at the time of divestment. Since the investment register is not equipped to capture these details, we must rely on figures from the separate financial statements up to the point of divestment, excluding any post-transaction data.

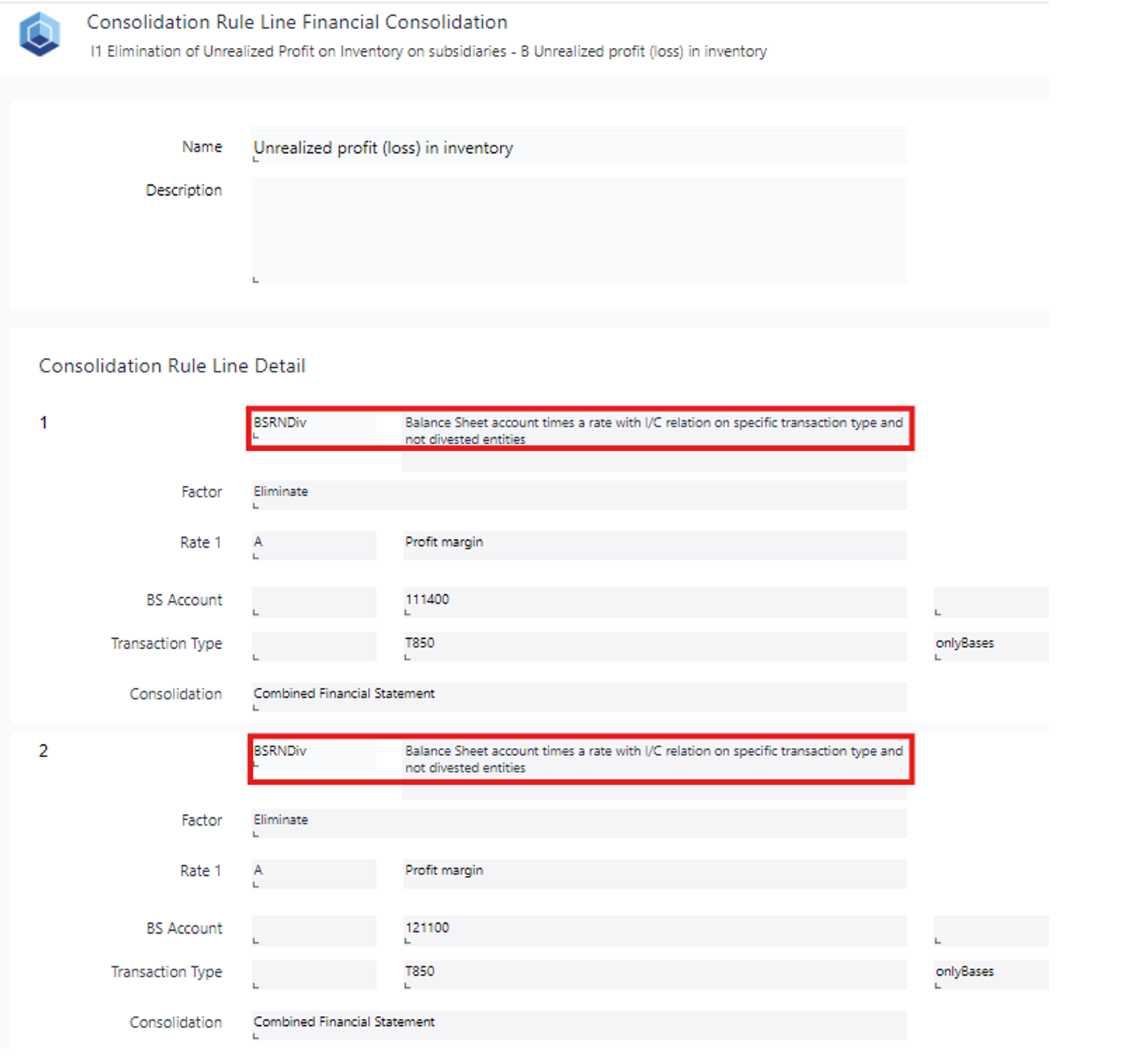

Update of existing Financial Consolidation version

If your Investment Register contains a business transaction of the type Total Divestment and you are using the fact selectors BS, BSX, and BSR, replace these with BSNDiv, BSXNDiv, and BSRNDiv respectively.

For Elimination functions such as Elim.Assets, ElimX.Assets, Elim.Liabilities, and ElimX.Liabilities (e.g., in Debt Consolidation rules), no changes are necessary since they have already been updated to the new Fact Selectors.

For example, in the I Consolidation Rule found in the sample data, you need to modify Consolidation Rule Line B as follows:

Out of scope

The following points are out of the scope of the Business Transaction Type Total Divestment.

-

This divestment feature covers only total divestiture when a subsidiary (investee) is consolidated with method F - Full or P – Proportional before the divestment completely leaves a group (scope of consolidation).

-

Partial divestments are not covered here.

-

Closure/ liquidation subsidiary (investee) will be considered as a different feature.

-

The case in which a subsidiary is consolidated at equity before the divestment is not treated here.

-

The consolidation rules are part of the sample configuration. Therefore, they only represent an example of how consolidation rules for the divestment case could be set up. Every customer needs to set up their own consolidation rules according to their requirements (e.g., applied accounting standard) and specific configuration (e.g., chart of accounts).

Updated July 3, 2025