Return to Financial Consolidation Model Overview.

The Local Accountant plays a key role in the Financial Consolidation process by managing the financial data of an individual legal entity. While group-level consolidation activities are carried out centrally, local accountants can access the system in a restricted manner, enabling them to review and adjust their legal entity’s financial statements. The primary function of the local accountant is to extend the data entry for their legal entity by posting adjustment journal entries when necessary. This ensures that the financial figures submitted for consolidation accurately reflect the position of the legal entity as of the group’s reporting date, even when local and group reporting periods differ due to regulatory constraints.

The following scenario can show a use case of the Local Accountant role: Consider a subsidiary whose financial year-end does not align with the group’s reporting period. Due to country-specific regulations, the subsidiary cannot alter its reporting dates. As a result, when the subsidiary submits its separate financial statements, those statements do not match the timing of the group’s consolidation period. In this case, the local accountant at the subsidiary is responsible for creating journal entries that amend the local figures. These adjustments are recorded in the Posting Journal at consolidation level Adjustment 0 and scope ~, ensuring the group receives accurate and up-to-date data.

Access and permissions

Local accountants are granted limited access to the Financial Consolidation application. This access allows them to adjust Local GAAP figures for their respective legal entities without visibility into other entities’ data. Their permissions are confined to a specific scope (~) and consolidation level (Adjustment 0), ensuring that any modifications made remain local to their entity.

In parallel, group accountants are given access to the entities within their group. They utilize the locally adjusted figures to complete the group-level consolidation process. Group accountants, like their local counterparts, are also restricted in their data visibility—limited to only the entities under their responsibility.

Adjustment process

All adjustment journal entries made by local accountants must be posted on the Adjustment 0 consolidation level and within the ~ (tilde) scope. This is the only scope they are authorized to access. Once posted, the values from Adjustment 0 at scope ~ are automatically propagated to all other relevant scopes. This propagation follows the same behavior as Local GAAP values at scope ~, streamlining the consolidation process.

To ensure that local accountants and group accountants can only access their respective legal entities, several system reports have been updated:

-

The Posting Journal report no longer displays scope

~. -

A new report, Local GAAP Adjustments, has been introduced to support entity-specific journal entries.

-

Access to the general Posting Journal report has been revoked for local users; they now use the specialized report created for their entity.

Consolidation workflow and rights setup

Before local accountants begin posting entries, administrative setup by the holding team is required to define access and initialize the consolidation process. The workflow typically includes the following steps:

-

Holding: Assign user rights to local and subgroup accountants.

-

Holding: Configure and initiate the consolidation process.

-

Subsidiary: Submit, review, and validate data for Separate Financial Statements (on

Local GAAP). -

Subsidiary: Post journal entries (on

Adjustment 0) to adjustLocal GAAPfigures. -

Subsidiary: Review the combined financials (

Local GAAP+Adjustment 0). -

Holding: Use the adjusted

Local GAAPdata for further consolidation steps.

Local accountant workflow in Financial Consolidation

The following example outlines the typical activities performed by a local accountant responsible for Legal Entity 11, as part of the subgroup AMER consolidation for period 2025-01_YTD.

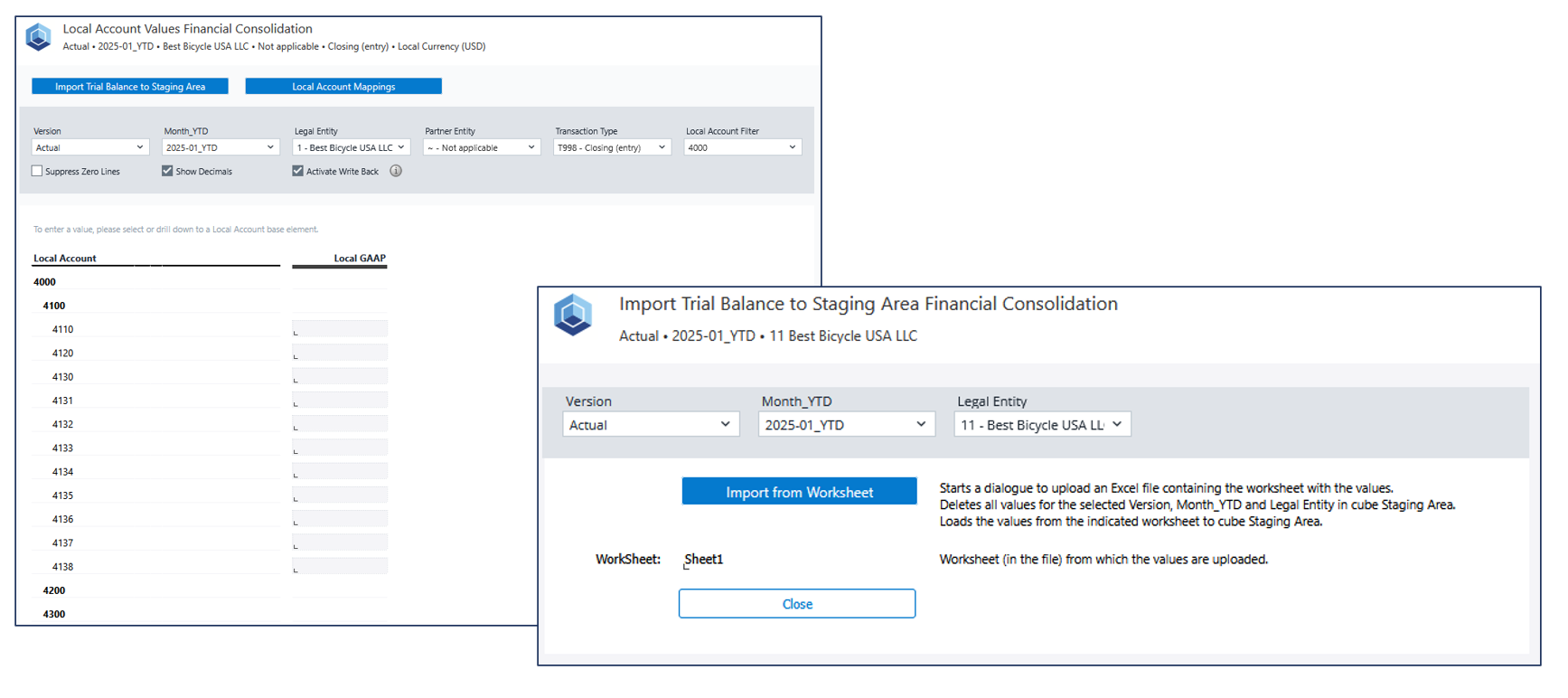

1. Data delivery to the consolidation process

The local accountant for Legal Entity 11 begins by submitting the entity’s separate financial statements of Legal Entity 11 for the consolidation of subgroup AMER in 2025-01_YTD. This is done using either the standard Staging Area or a custom-built data integration project.

Jedox supports multiple methods for data integration, allowing flexibility based on the entity’s systems and requirements.

2. Review and validation of Local GAAP figures

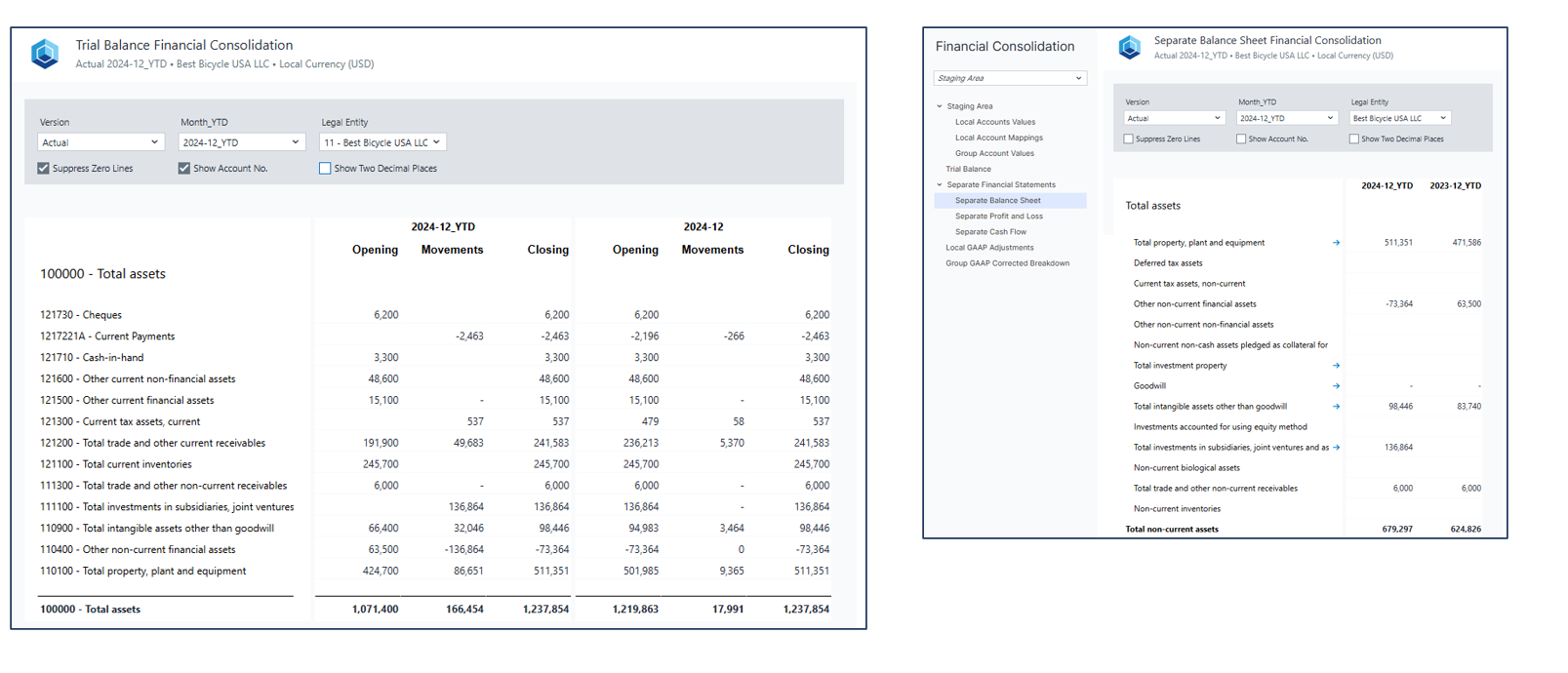

Once the financial data has been delivered, the local accountant of Legal Entity 11 reviews and validates the Local GAAP figures using standard Jedox reports such as the Trial Balance and Separate Financial Statements reports.

If additional project-specific reports have been developed, these may also be used to support validation tasks.

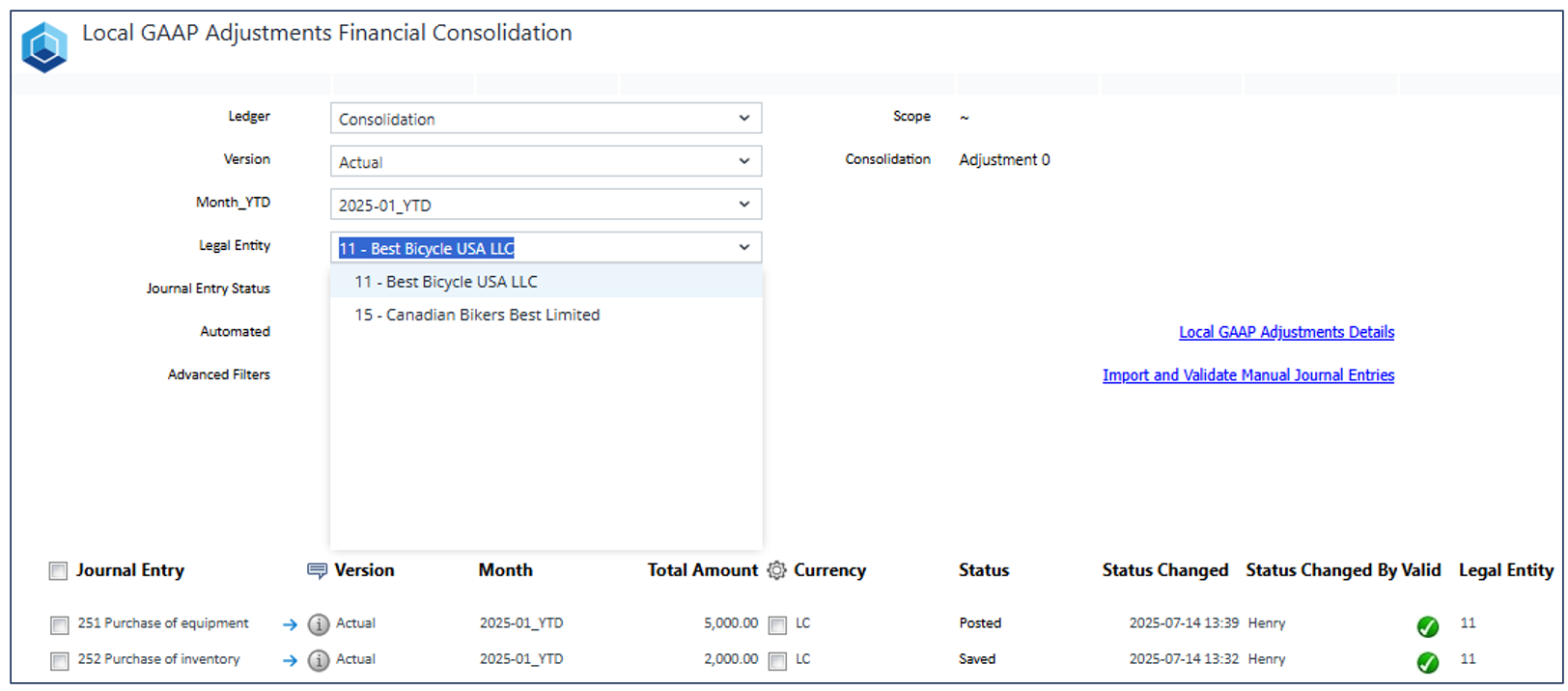

3. Accessing Local GAAP adjustments

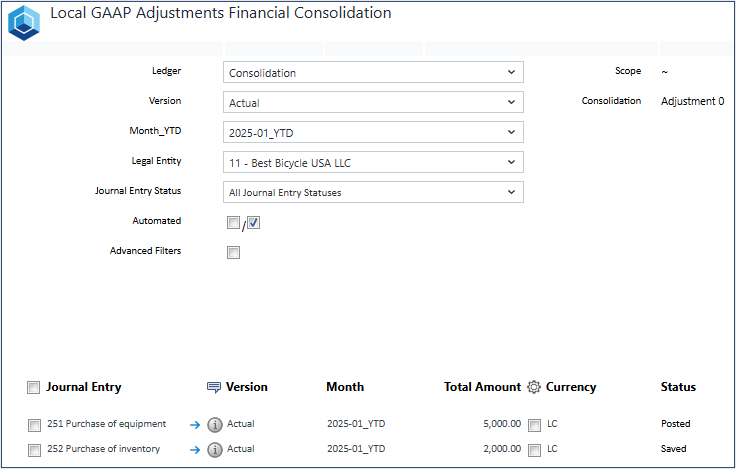

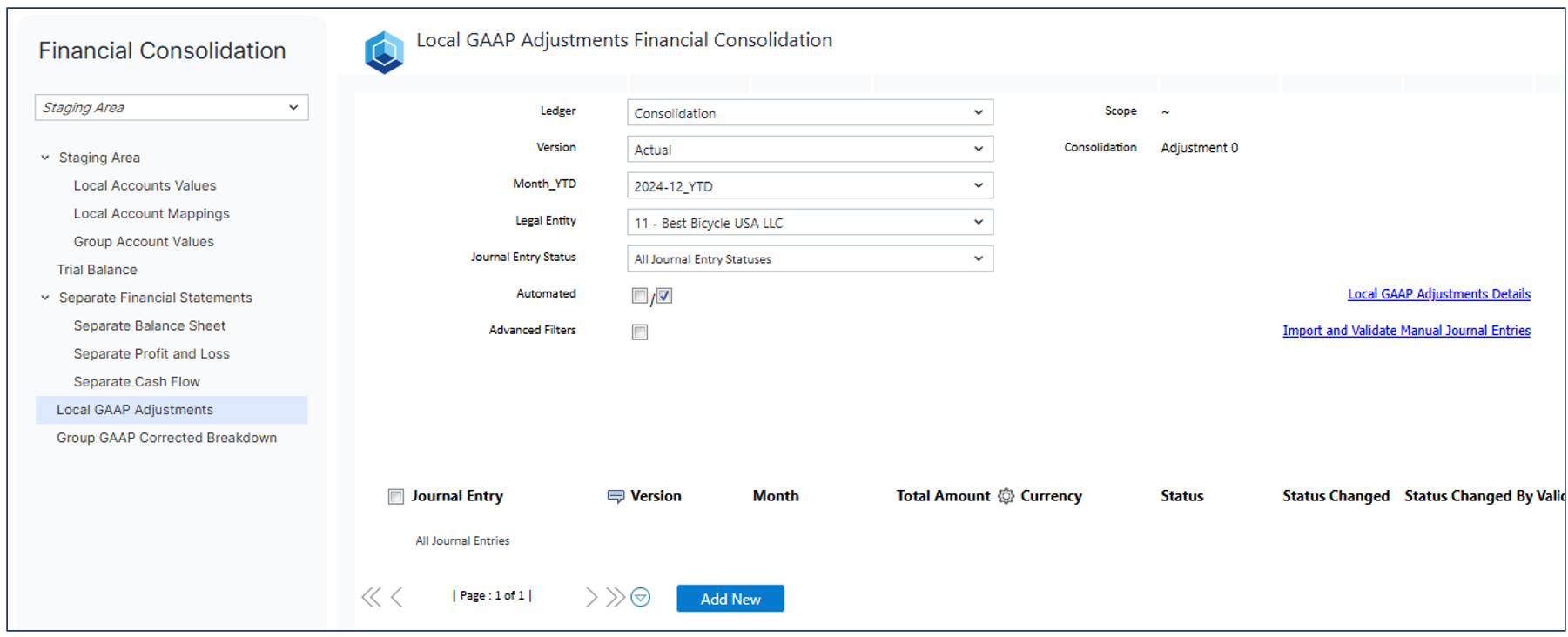

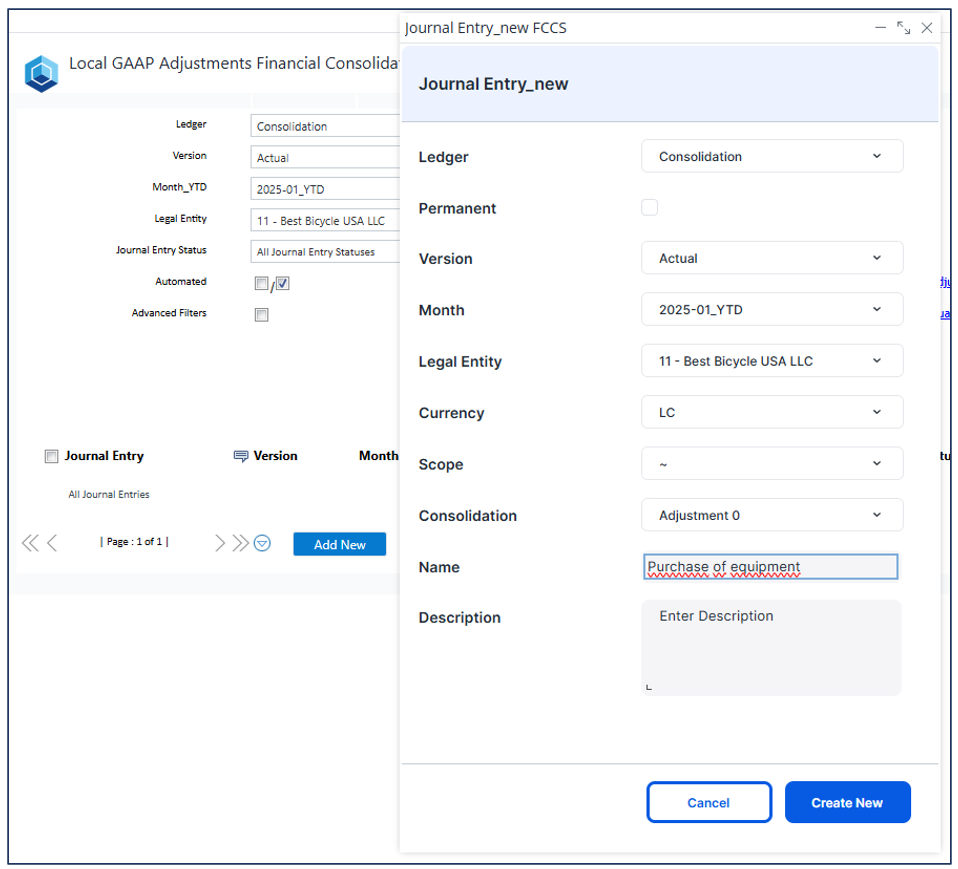

To enter adjustment entries, the local accountant opens the Local GAAP Adjustments report.

This report is specifically designed for local users, displaying only journal entries related to scope ~ and consolidation level Adjustment 0.

Access is restricted at the legal entity level using filters in the report header, ensuring that the accountant can only view entries for Legal Entity 11.

4. Adding adjustment journal entries

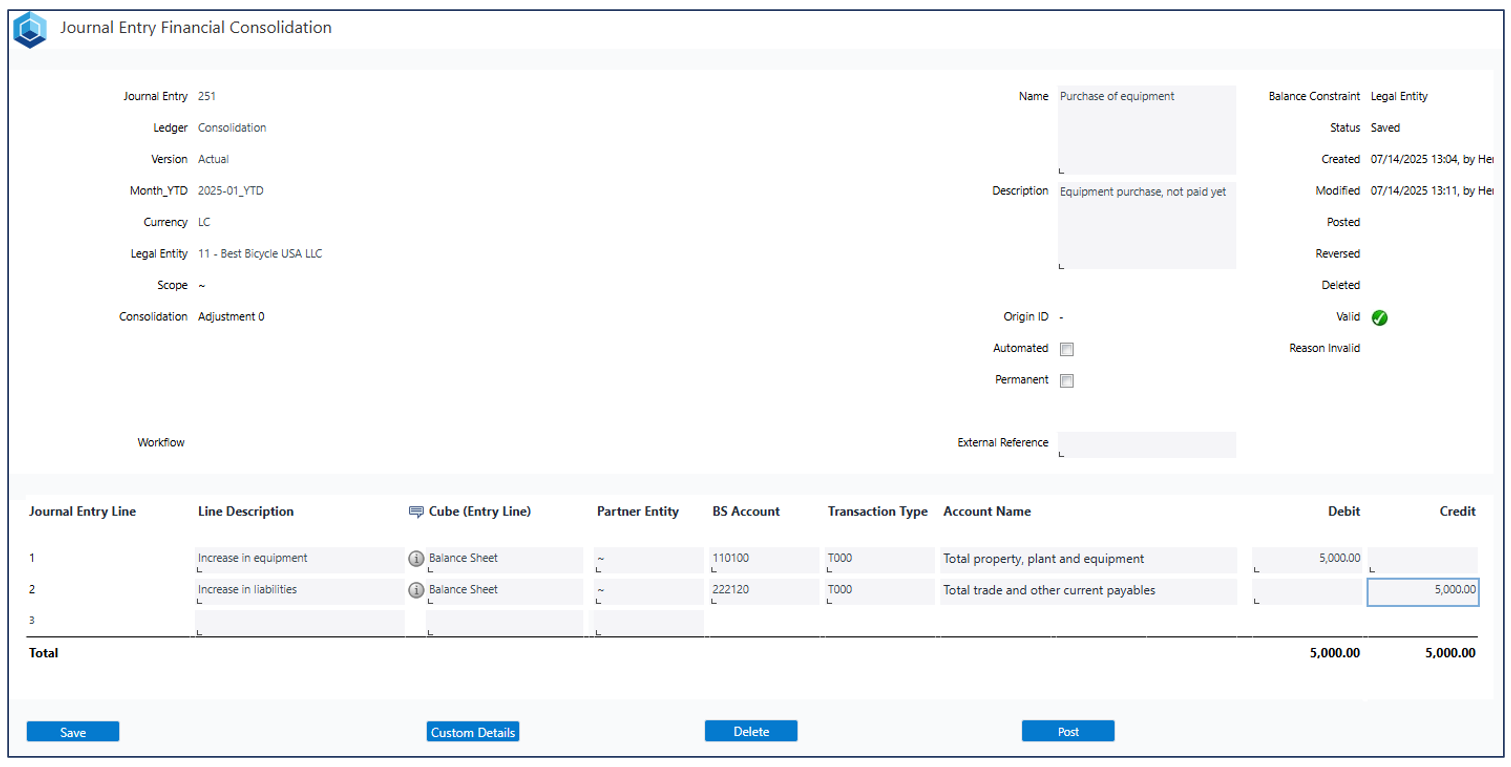

If adjustments are required, the local accountant can add journal entries to adjust the Local GAAP figures for 2025-01_YTD.

All journal entries created by the local accountant are automatically restricted to Legal Entity 11, Scope ~, and consolidation level Adjustment 0, ensuring that adjustments remain isolated to the appropriate entity.

5. Posting adjustments

After entering and saving the journal entry, the local accountant can post it.

Only posted entries are considered in subsequent reporting and consolidation steps.

The system allows for modification of entries prior to posting, ensuring accuracy.

6. Importing Journal Entries (optional)

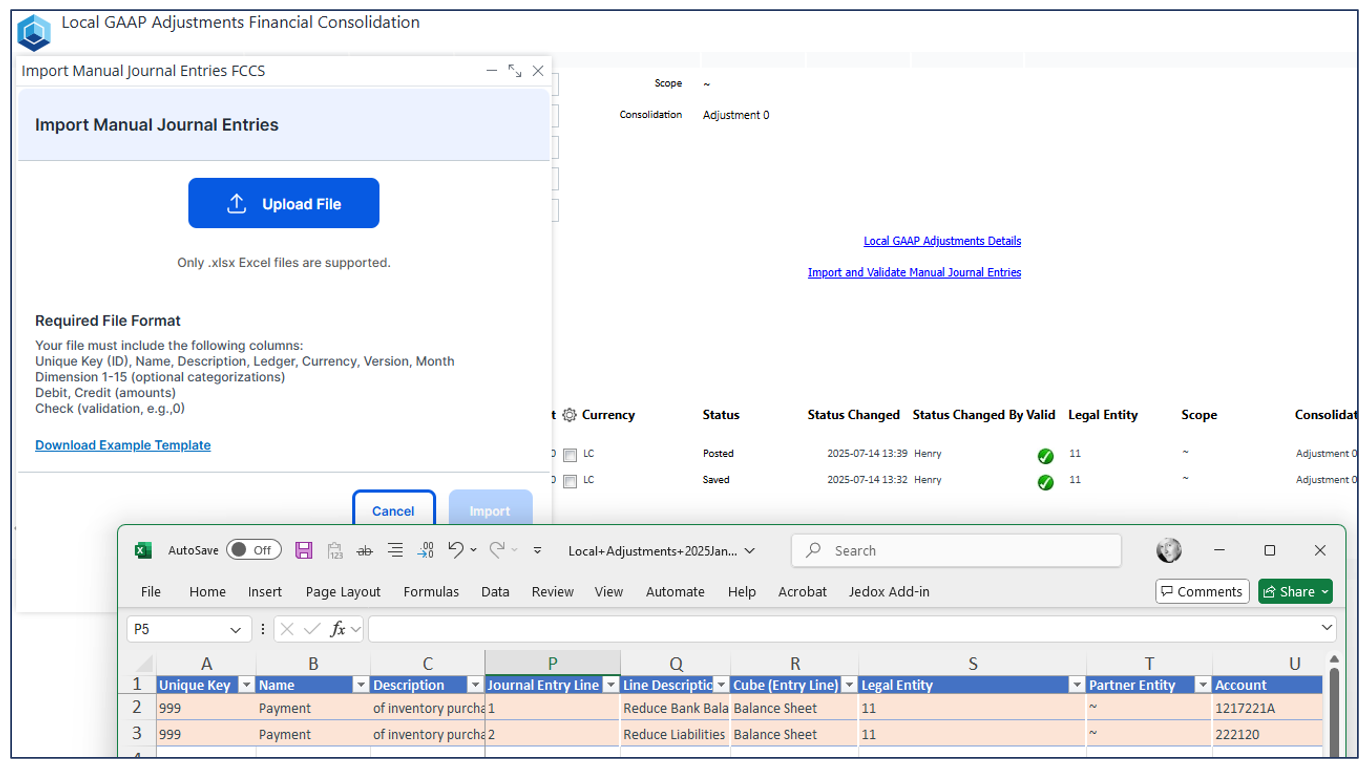

Alternatively, to adjust Local GAAP figures, the local accountant can import manual journal entries via Excel, provided they comply with the required format.

As with manually created entries, imported adjustments are also restricted to scope ~ and Adjustment 0.

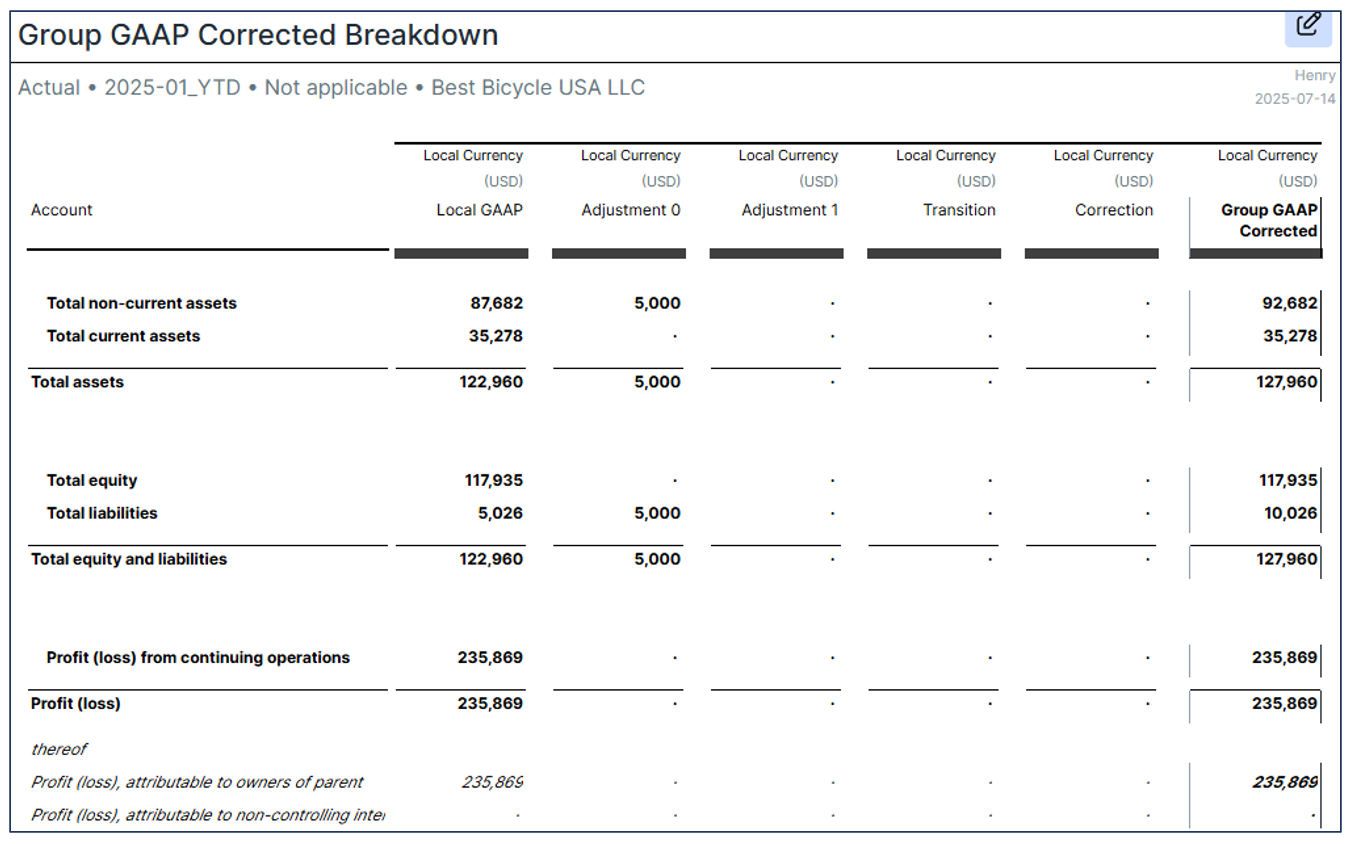

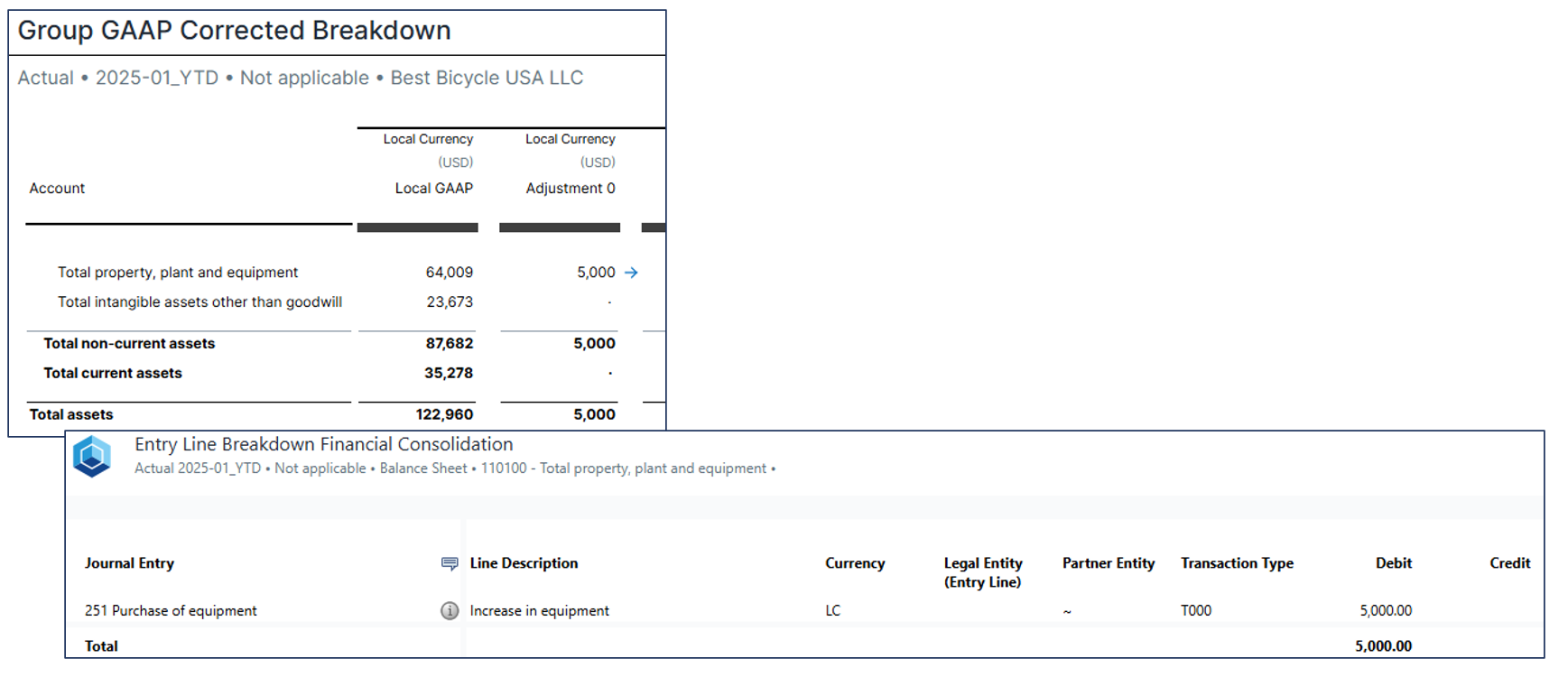

7. Reviewing adjusted figures

After adjustments are posted, the local accountant can review the combined financial figures, which now include the original Local GAAP data and Adjustment 0 values (and other levels which have no values on scope ~). Note that only posted Adjustment 0 values are included in the report.

These can be reviewed using the Group GAAP Corrected Breakdown report.

8. Tracing adjustment values

To ensure transparency and traceability, the report allows drill-down to base accounts. This enables the accountants to trace back the adjusted Local GAAP figures for 2025-01_YTD.

For base accounts and journaled figures, a blue arrow provides a direct link to the report with the journal entry (or entries) which compose(s) the adjustment value.

This enables the local accountant to trace any adjusted figure back to its journal source, verifying accuracy and audit compliance.

Group accountant workflow in Financial Consolidation

The following example outlines how a group accountant for the AMER subgroup works with Local GAAP Adjustments submitted by Legal Entity 11 as part of the consolidation process for period 2025-01_YTD.

1. Reviewing Local GAAP Adjustments

The group accountant accesses the Local GAAP Adjustments report to review adjustment journal entries submitted by the local accountant of Legal Entity 11.

Access is restricted based on group affiliation, for example, here the group accountant can only select and view legal entities within the AMER subgroup.

This ensures that each group accountant can only monitor and validate data relevant to their own consolidation scope.

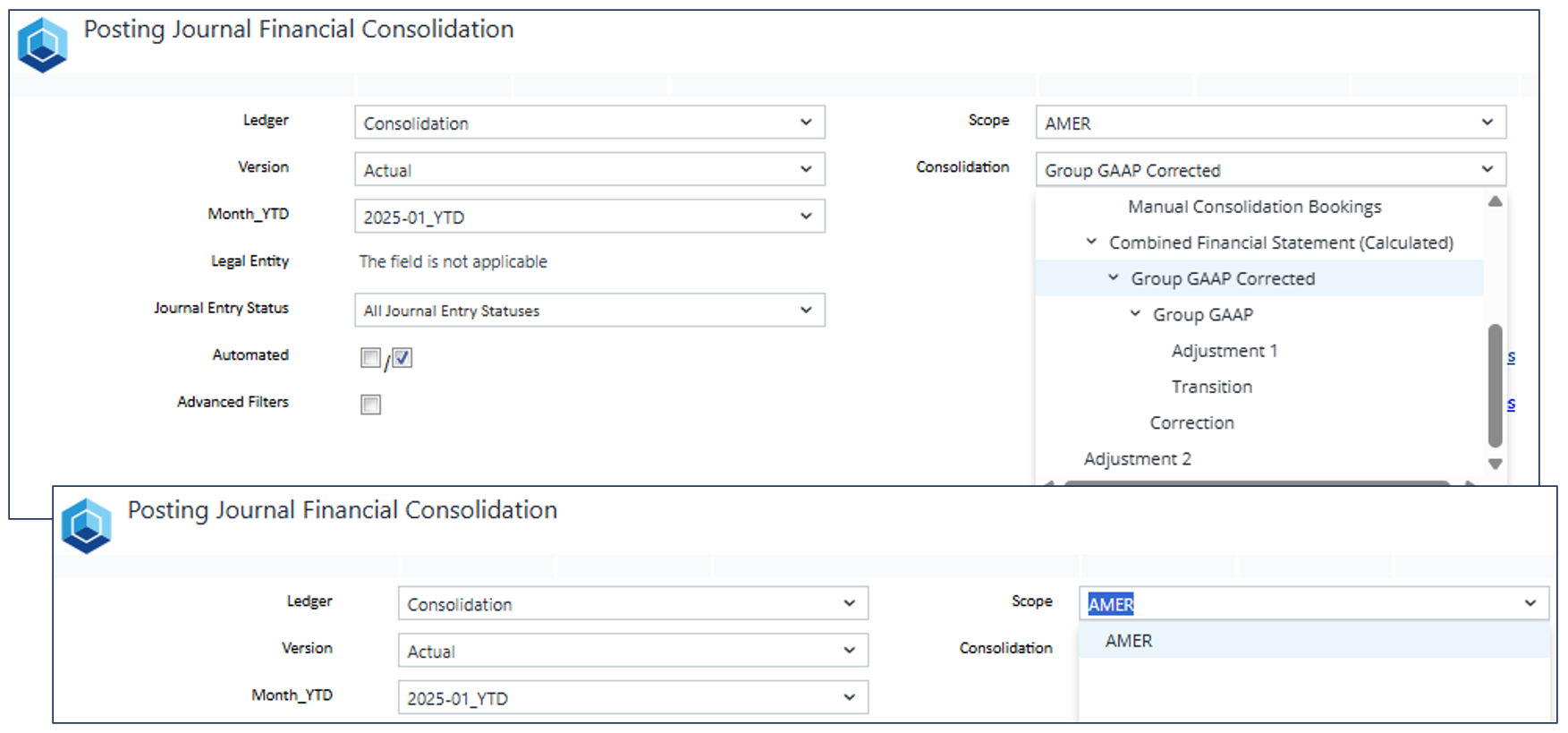

2. Access restrictions in the Posting Journal

When accessing the Posting Journal report, the group accountant is limited to selecting journal entries belonging to their group scope (e.g., AMER).

For security and compliance reasons, scope~ and consolidation level Adjustment 0 are not available in the general Posting Journal report for group users.

This prevents group accountants from accessing raw local-level data or entries outside their responsibility.

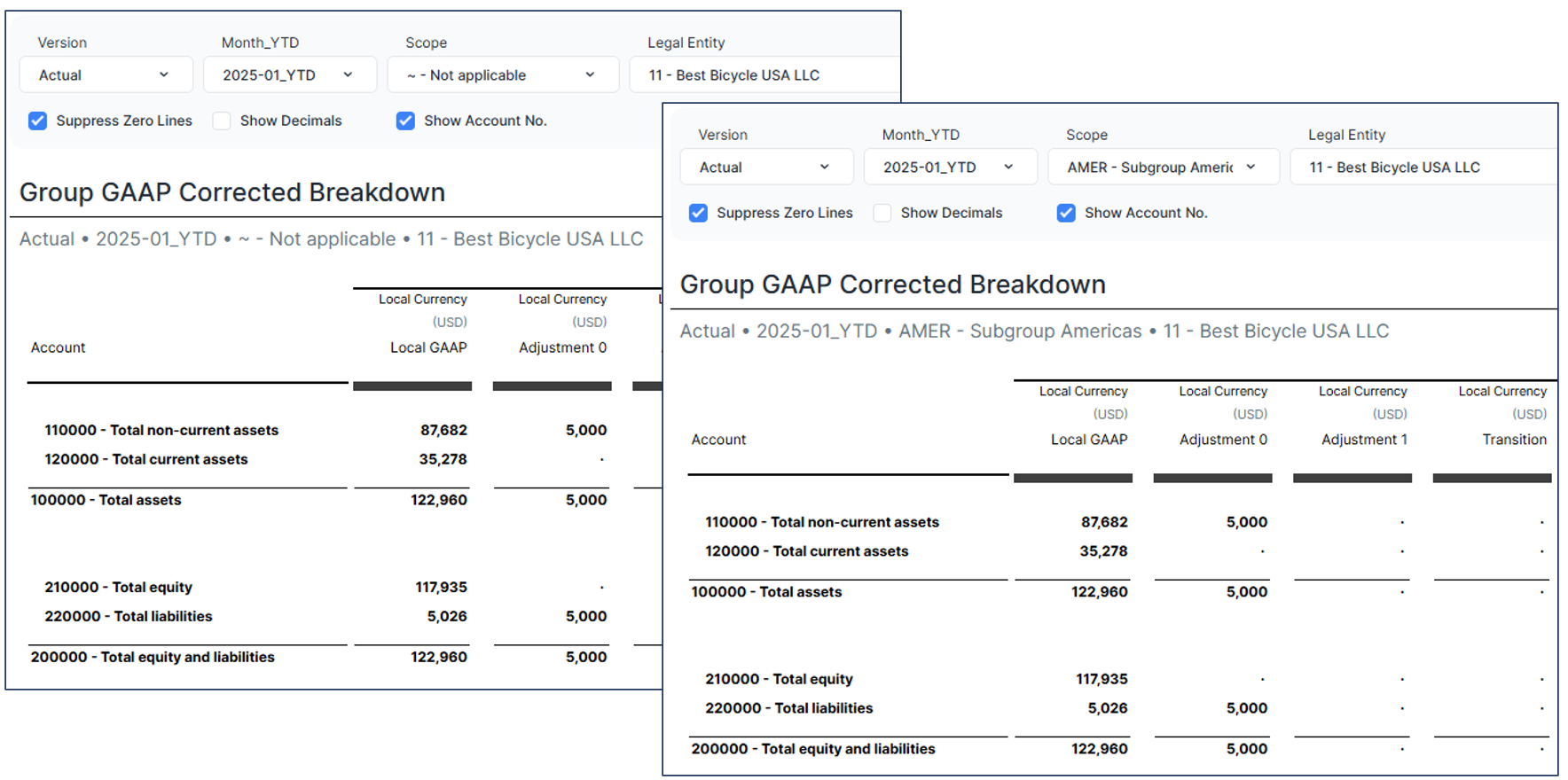

3. Viewing adjusted Local GAAP figures

The Group GAAP Corrected Breakdown report allows the group accountant to view their scope and scope ~.

The values of the scope ~ and consolidation levels Local GAAP and Adjustment 0 are automatically propagated to consolidation scopes (e.g., AMER), where they become available for the group consolidation process.

Thus, the group accountant does not need direct access to the local entries in scope ~, as their impact is already integrated into the data for their assigned scope.

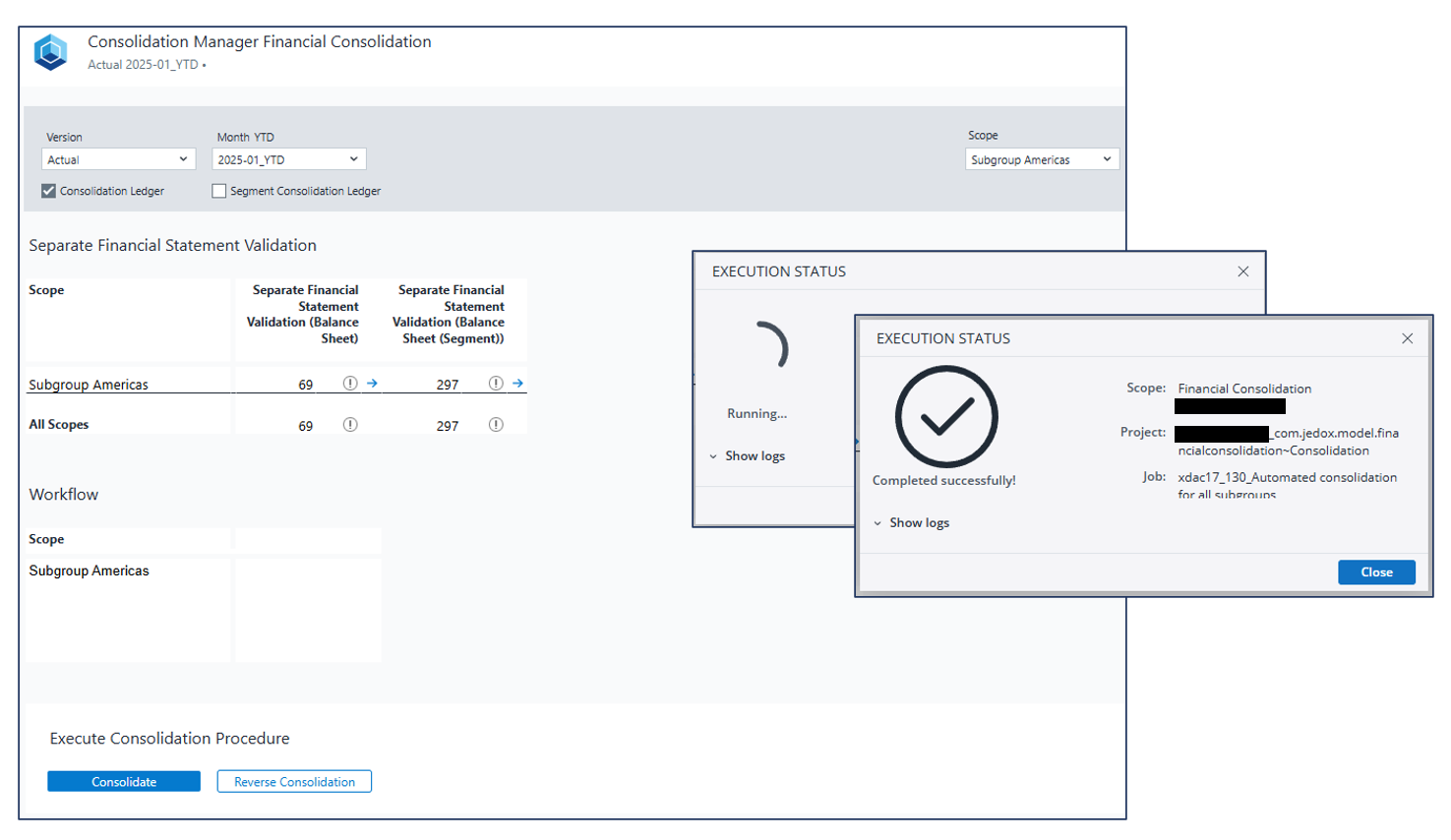

4. Executing Group-Level Consolidation

Once all local entities have submitted and reviewed their Local GAAP Adjustments, and the data has been validated, the group accountant proceeds with the consolidation.

Using the Consolidation Manager, the group accountant can execute the consolidation process specifically for the AMER scope.

Because the adjusted local values (from Local GAAP and Adjustment 0) have already been propagated to AMER, they are automatically included in the group-level calculations.

User rights configuration for local and group accountants

Proper configuration of Roles and Groups is essential for ensuring that local and group accountants have access only to the data and functionality relevant to their responsibilities. In the following reference example, an administrator configures user access for two key roles:

-

A local accountant for

Legal Entity11(e.g., for user Henry) -

A group accountant for subgroup

AMER(e.g, for user Amerigo)

The steps below describe the complete setup of user roles, groups, and assignments using the sample data provided in the Financial Consolidation model.

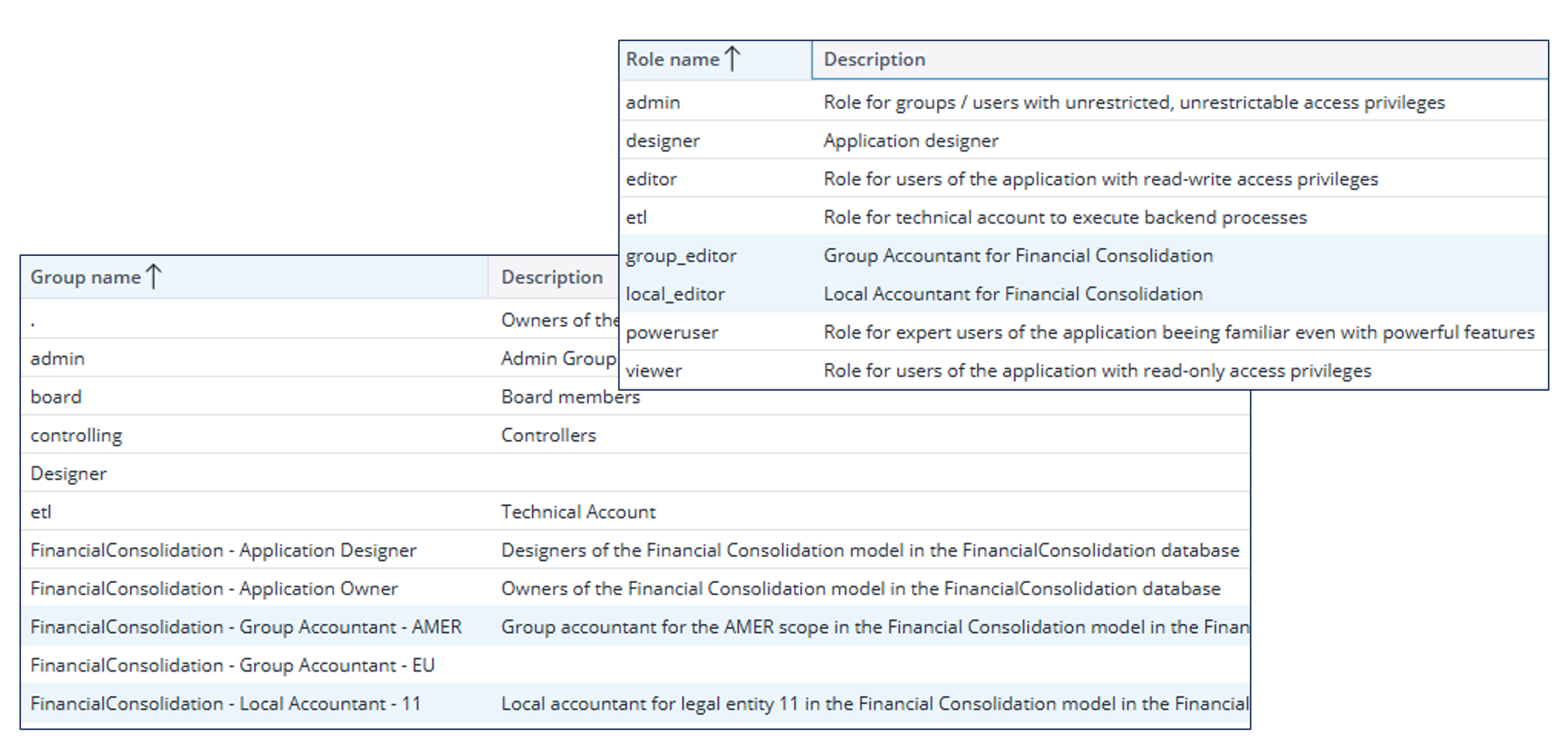

1. Initial setup of roles and groups

Before users can begin working in the system, the administrator must configure the required Roles and User Groups for each type of accountant.

User rights configuration can be done manually or automated using database scripts.

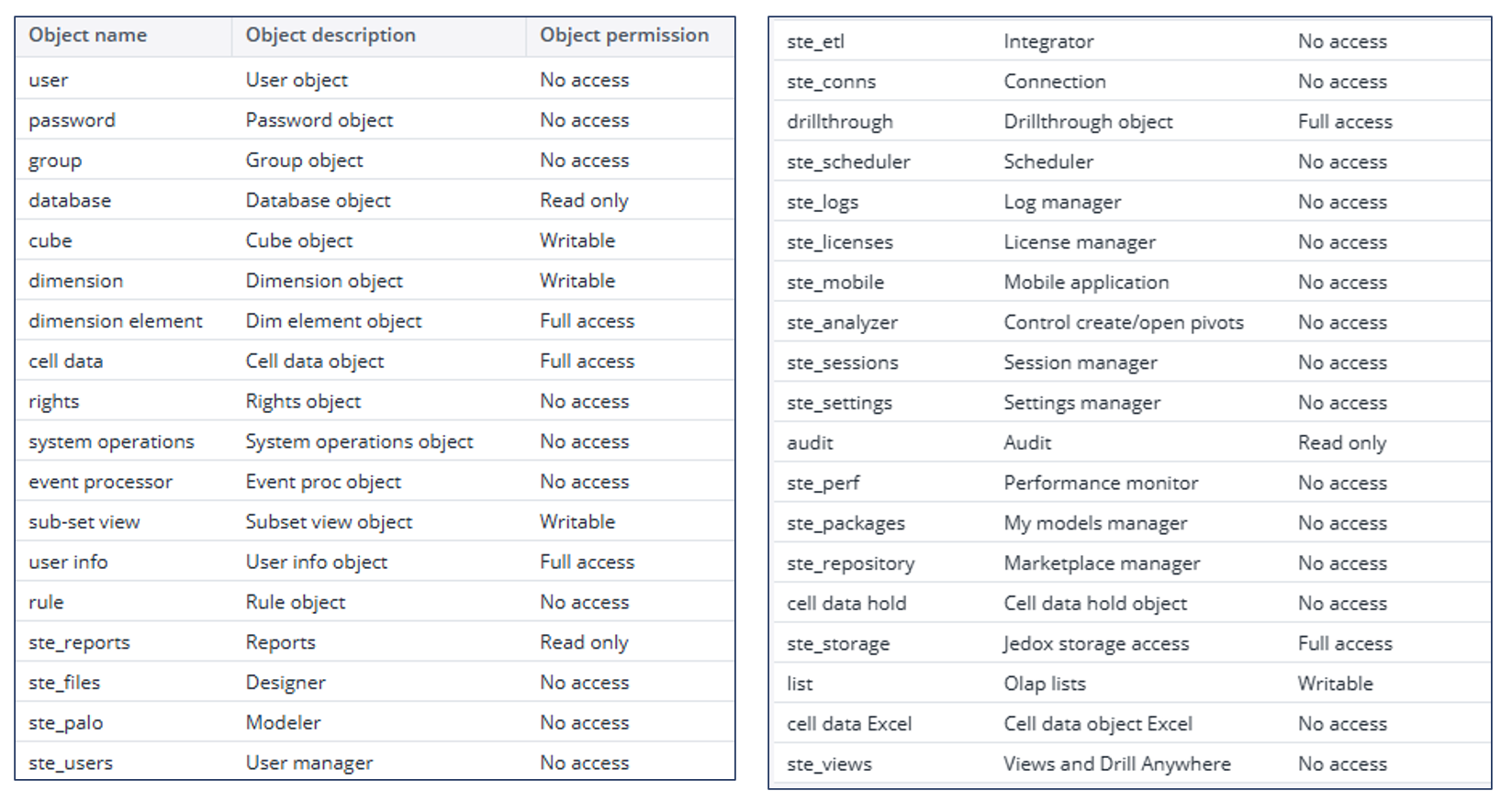

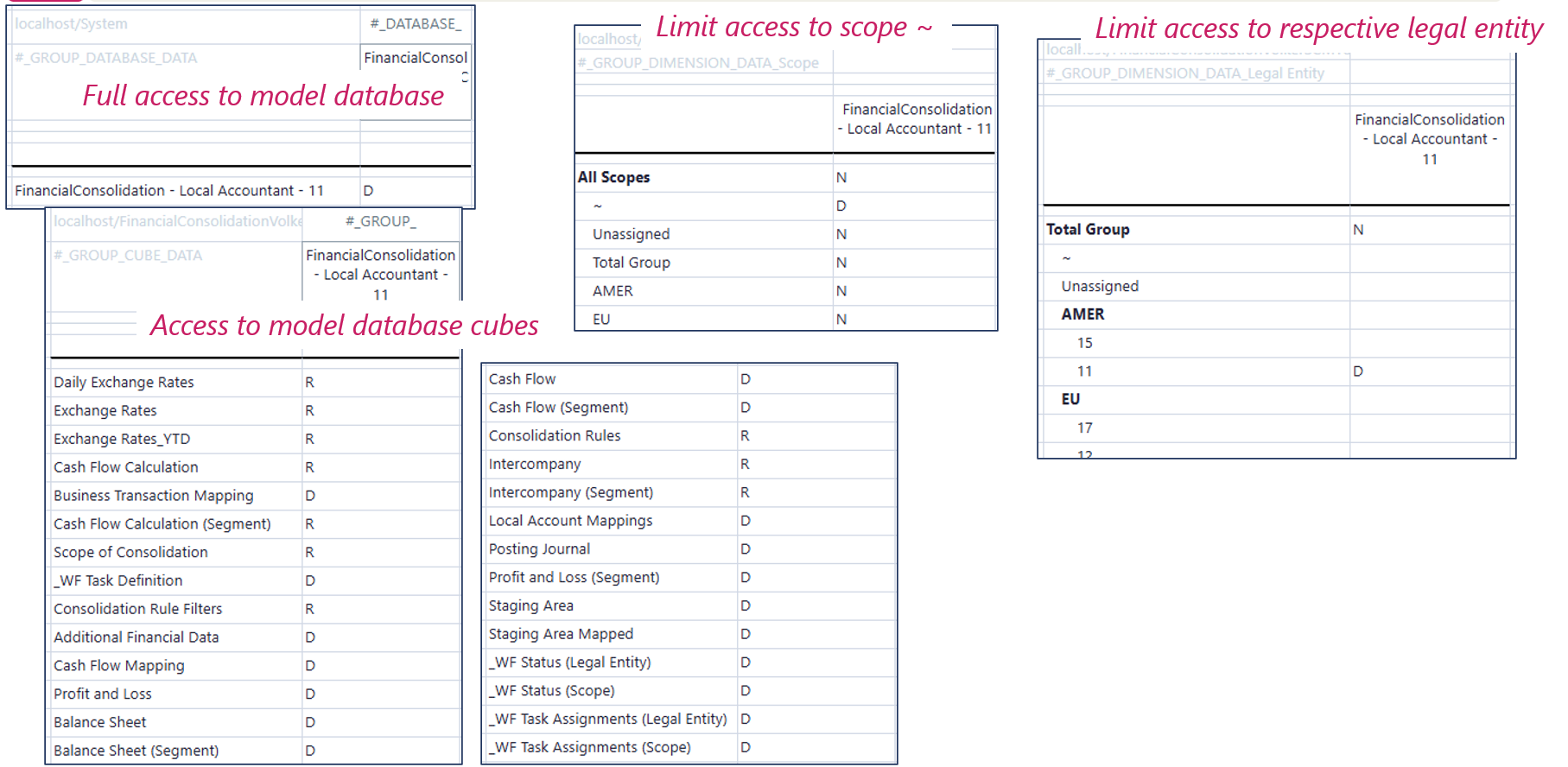

2. Role configuration: local_editor for local accountants

The admin creates a user role called local_editor, which defines the specific permissions for local accountants.

The example role of the Legal Entity 11 includes:

-

Access to the model database.

-

Permissions limited to their assigned legal entity (e.g.,

Legal Entity11). -

Access to dimensions such as

ScopeandLegal Entity, restricted to~and the respective entity. -

Write access to adjustment entries at consolidation level

Adjustment 0.

This setup ensures that local accountants can submit and review data relevant only to their legal entity.

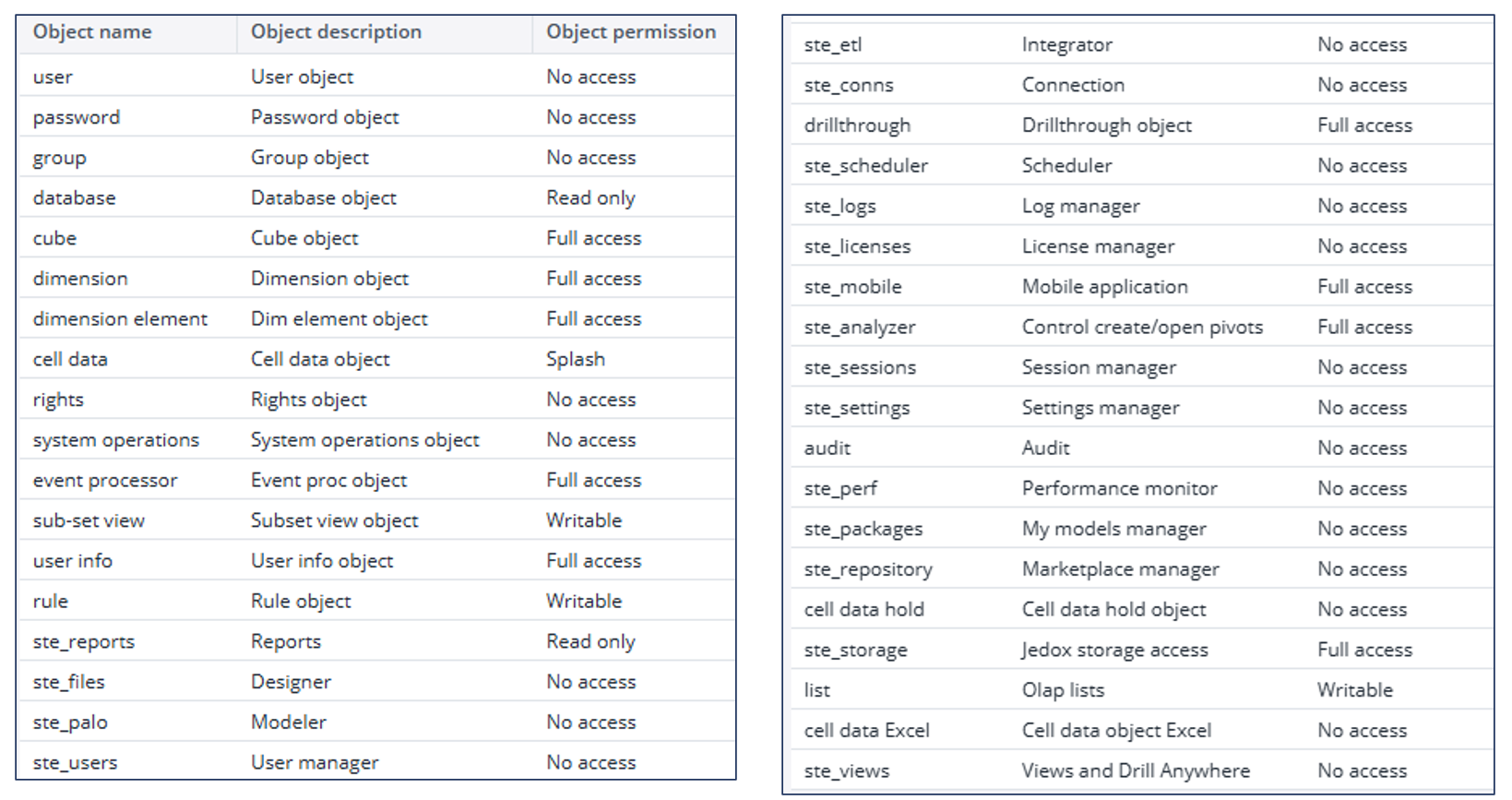

3. Role Configuration: group_editor for Group Accountants

Similarly, the admin defines a user role called group_editor, intended for group or subgroup accountants (e.g., for scope AMER).

Permissions of the group example include:

-

Read access to financial data from entities within the group

-

Access to scopes corresponding to their assigned consolidation level (e.g.,

AMER) -

Permission to execute group-level consolidation

-

Access to group-level reports but not to raw local adjustment entries (e.g., scope

~is restricted)

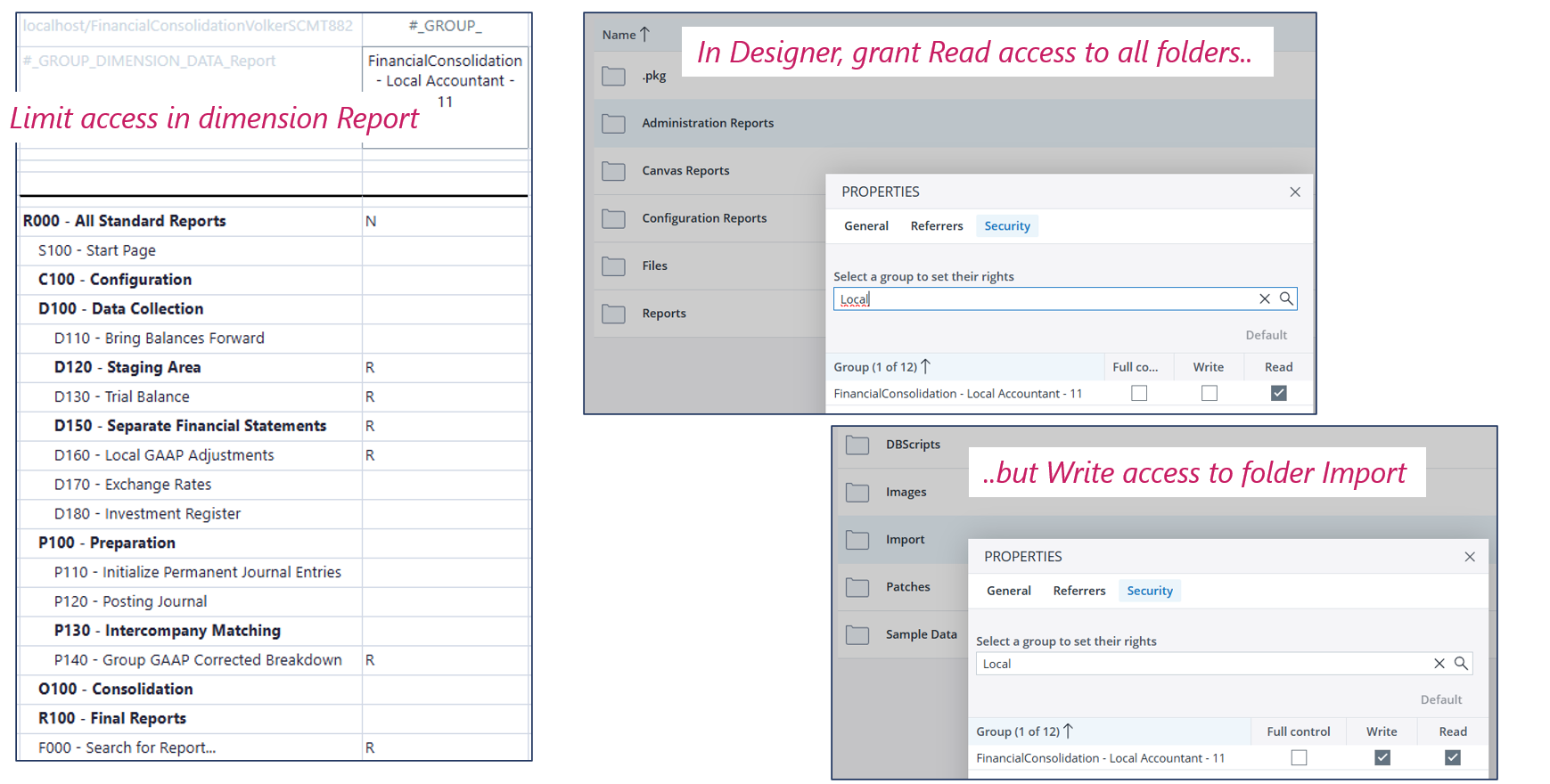

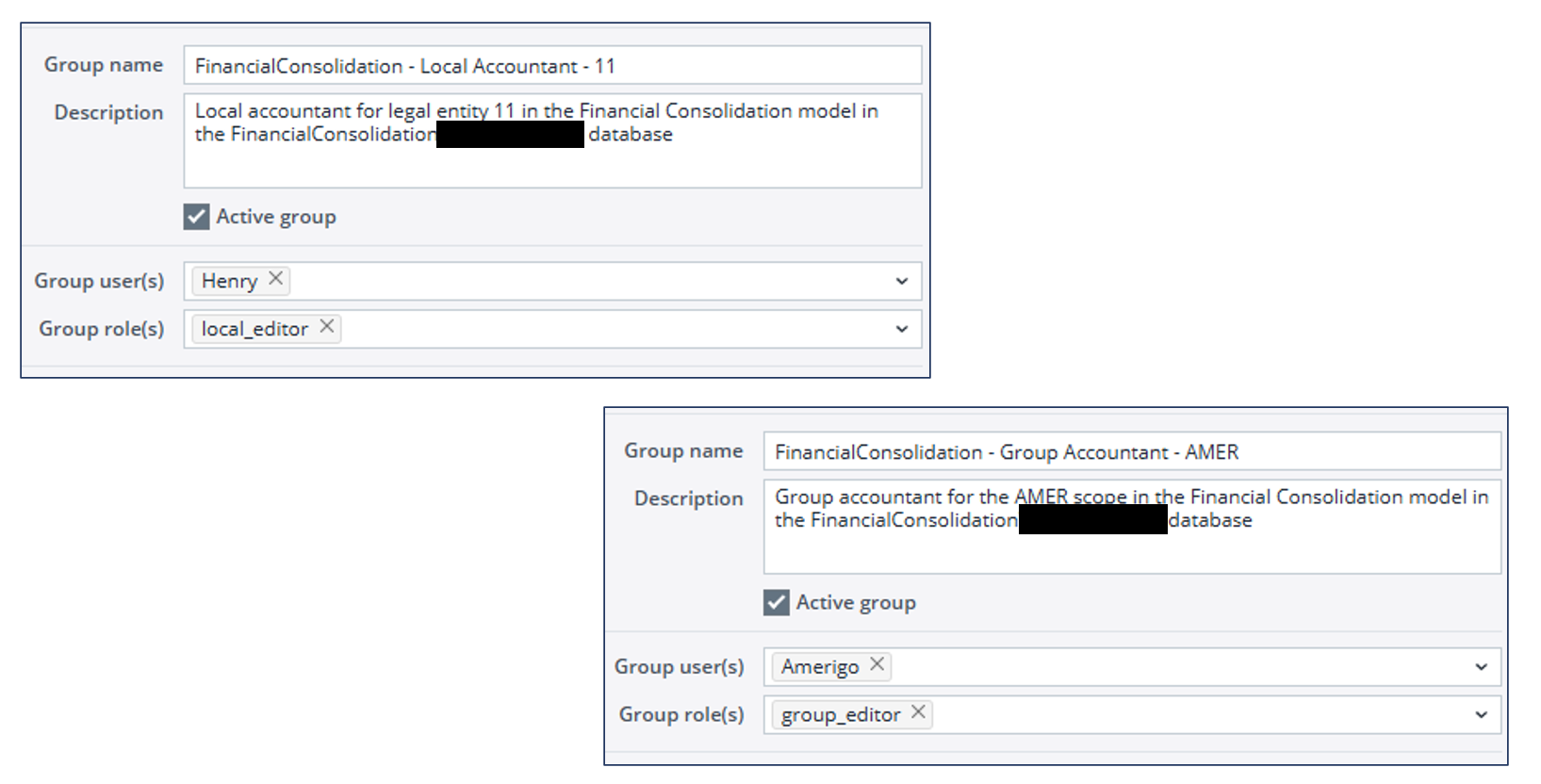

4. User Group Configuration for Local Accountant (Legal Entity 11)

The admin then creates a User Group for local accountant Henry, responsible for Legal Entity 11.

This group is configured with:

-

Access to the model’s database and relevant cubes.

-

Restricted access to

Legal Entity11and scope~. -

Report access tailored to local workflows (e.g., Local GAAP Adjustments, Trial Balance).

-

No access to the general Posting Journal or other entities’ data.

5. User Group Configuration for Group Accountant (AMER)

Next, a User Group is created for group accountant Amerigo, responsible for scope AMER.

This group is granted:

-

Access to the model’s database and required cubes

-

Permissions limited to scope

AMERand the legal entities within that scope -

Access to reports necessary for group-level activities (e.g., Group GAAP Corrected Breakdown, Consolidation Manager)

-

No access to scope

~or adjustment entries at the local level

6. Final User Assignment

With roles and groups configured, the admin assigns the users to their respective roles and user groups:

-

Henry is added to the group for

Legal Entity11and assigned thelocal_editorrole -

Amerigo is added to the group for scope

AMERand assigned thegroup_editorrole

This reference setup ensures correct segregation of duties and data access, forming a secure foundation for the Financial Consolidation process.

Updated February 23, 2026