Return to Financial Consolidation Model Overview.

Merging Data from the Investment Register into the Balance Sheet Cubes

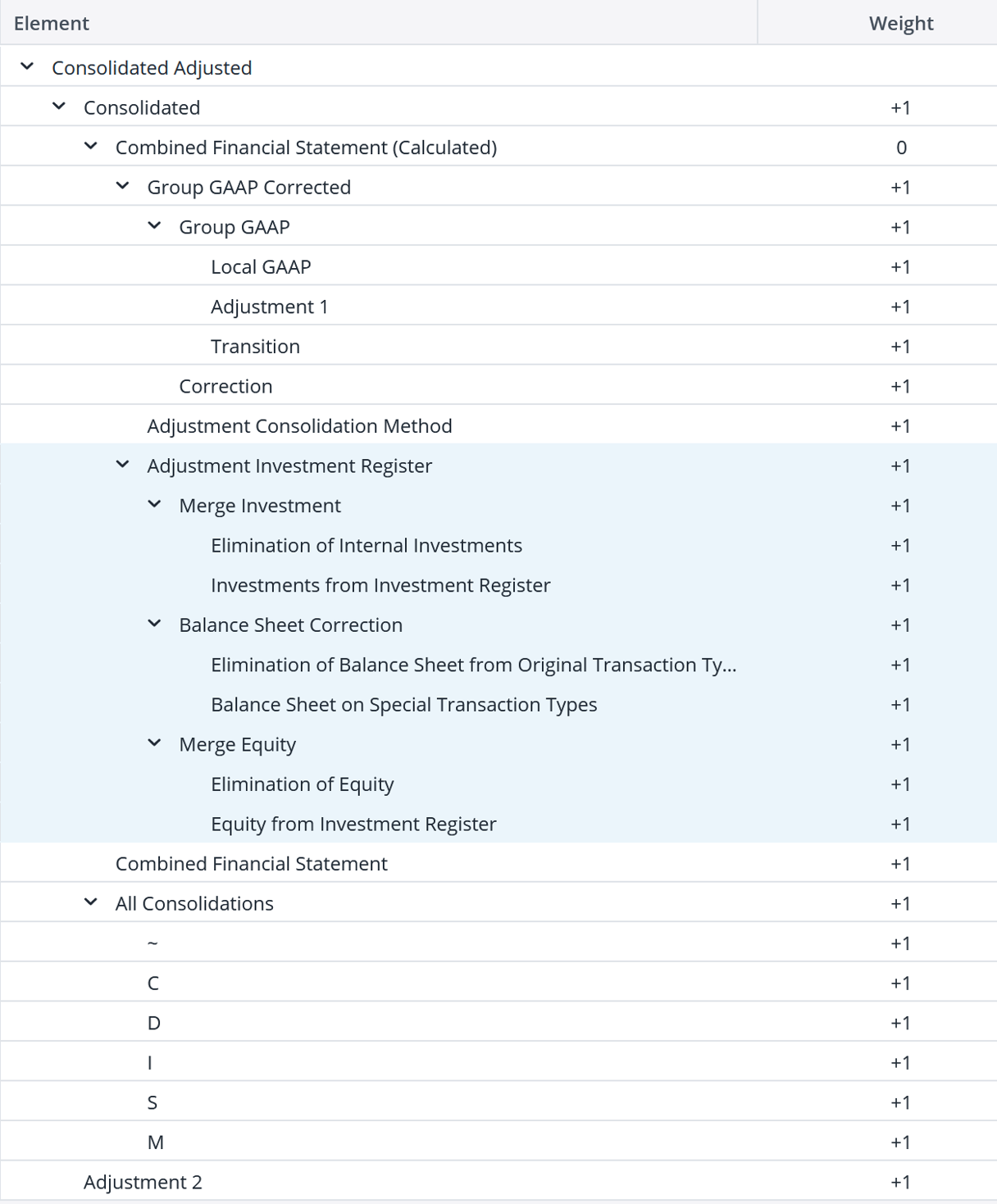

The primary data stream processed in the consolidation procedure originates from the separate financial statements collected in the source element Local GAAP category of the Consolidation dimension.

As the consolidation progresses, various processing stages align with different base elements within this dimension. For instance, base elements such as Adjustment 1, Transition, and Correction are journaled, implying that their data is entirely defined through journal entries in the posting journal. Conversely, elements like the Adjustment Consolidation Method are not journaled, meaning their data is directly inputted into the cubes without any entries in the posting journal.

The data merged from the investment register into the Balance Sheet and Balance Sheet (Segment) cubes are written to the base elements in the new Adjustment Investment Register hierarchy, which are not journaled.

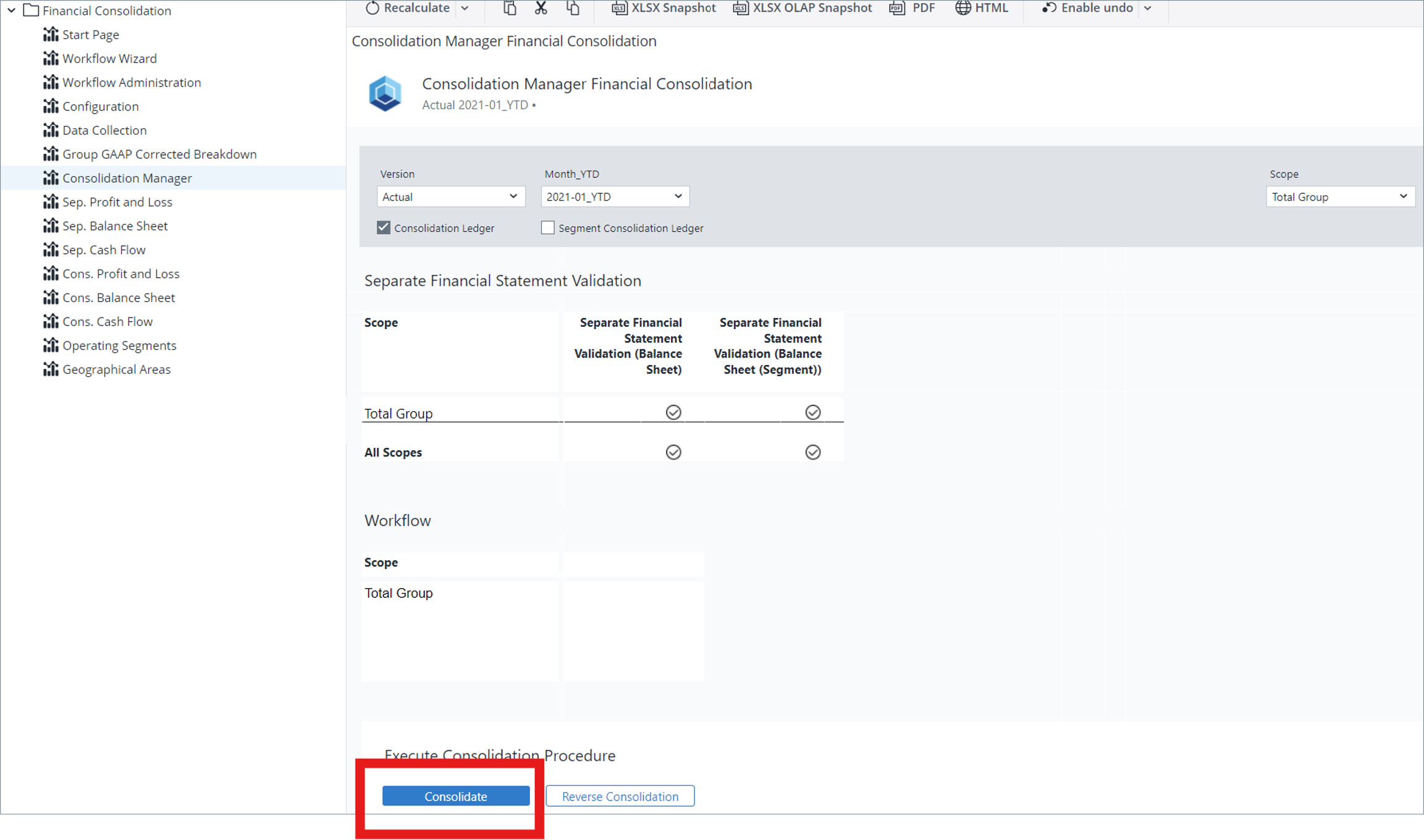

Incorporating data from the investment register into the Balance Sheet and Balance Sheet (Segment) cubes constitutes an integral step within the consolidation process. This operation is executed across one or more combinations of Version, Month_YTD, and Scope. It can be run for either the consolidation ledger, thereby adjusting the Balance Sheet cube, or for the segment consolidation ledger, adjusting the Balance Sheet (Segment) cube. Alternatively, it can be applied to both ledgers simultaneously, thereby modifying both balance sheet cubes concurrently.

This subprocess consists of the following steps:

-

Clear data on the Adjustment Investment Register

-

Merge Investments

-

Moving the balance sheet from the investee to special transaction types

-

Merge Equity (in progress)

The following sections describes these steps in detail.

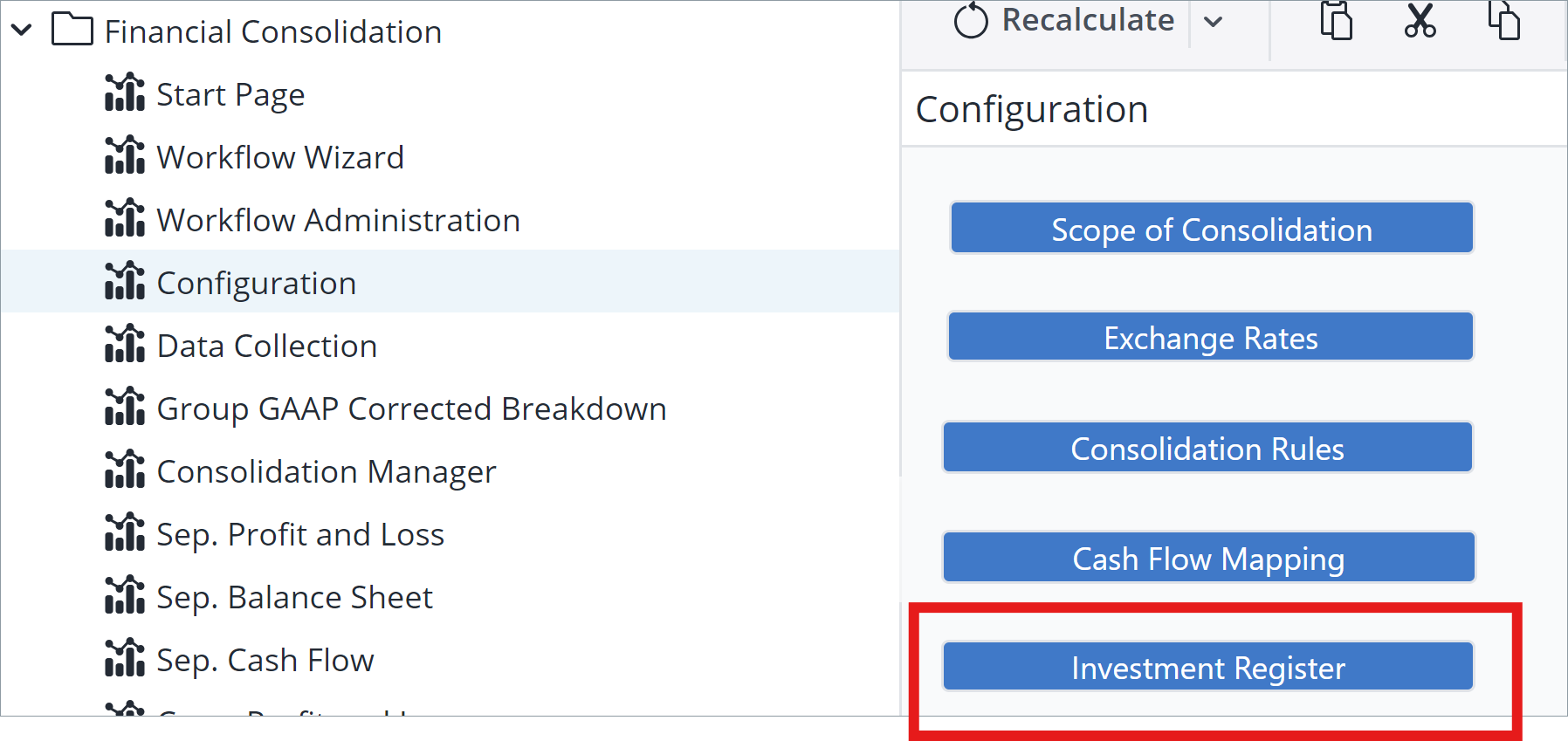

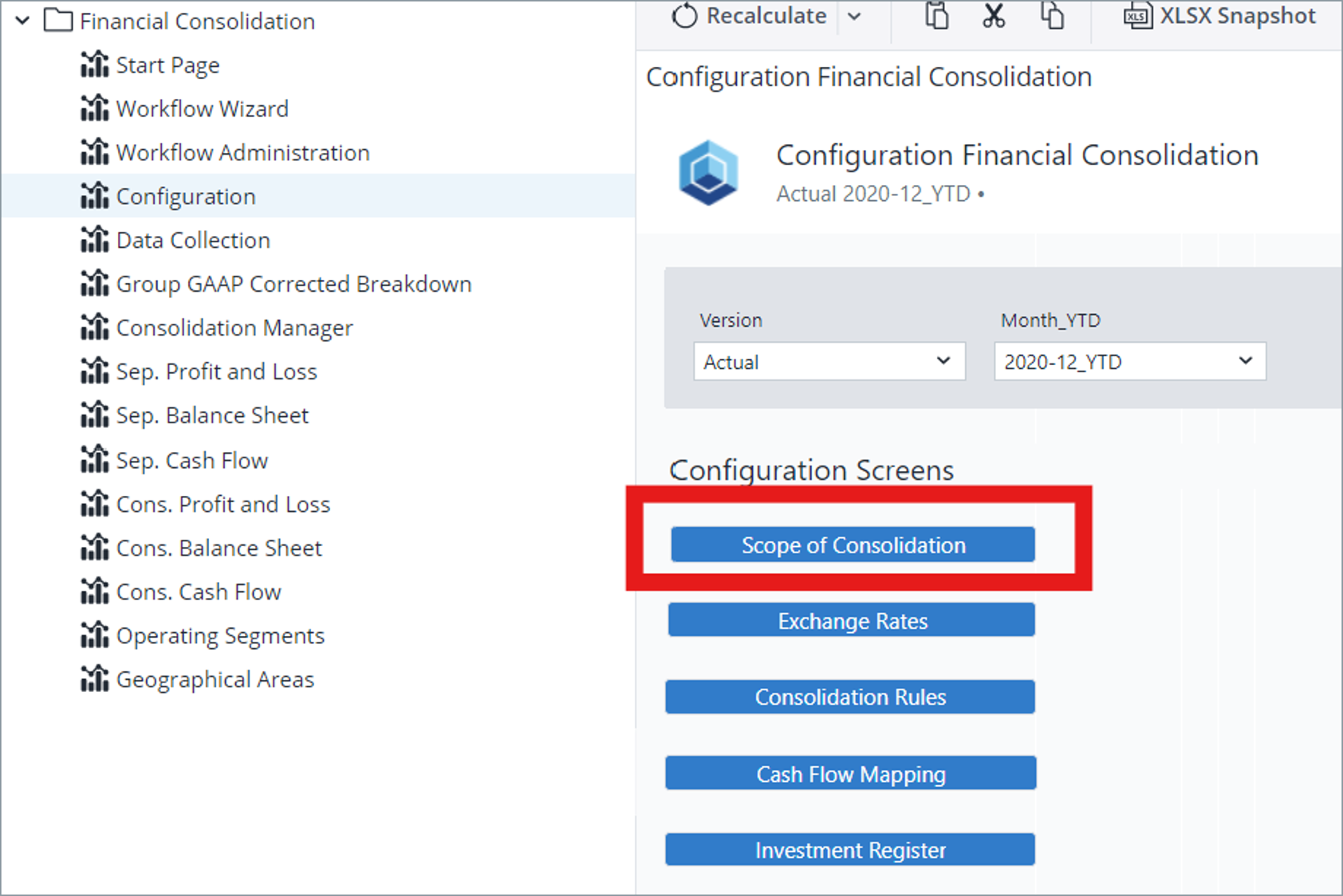

1: Clear Data on Adjustment Investment Register

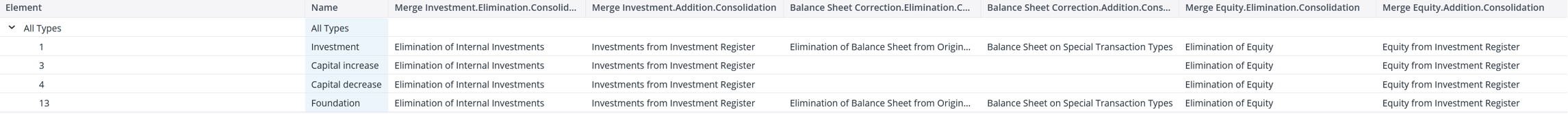

As a preliminary step, all data on the base elements of the Adjustment Investment Register hierarchy within the Consolidation dimension is removed from both the Balance Sheet and Balance Sheet (Segment) cubes for the current Version, Month_YTD, and Scope under processing. It's important to note that the Adjustment Investment Register element is not hardcoded; rather, this action effectively clears all consolidation levels as configured in:

Merge Investment.Elimination.Consolidation,

Merge Investment.Addition.Consolidation, Balance Sheet

Correction.Elimination.Consolidation, Balance Sheet

Correction.Addition.Consolidation, Merge Equity.Elimination.Consolidation, and Merge Equity.Addition.Consolidation attributes of the Business Transaction Type dimension.

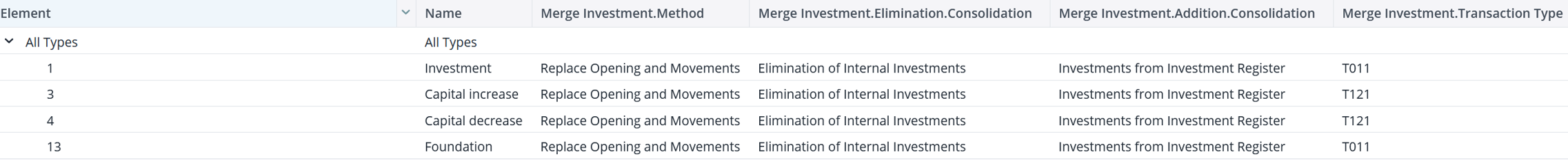

2. Merge Investments

The investment register records changes in the investor's investment account. This data can be merged into the Balance Sheet and Balance Sheet (Segment) cubes. Currently, the only available method is replacing the investments reported in the separate financial statements with the investments from the investment register.

A. Replace Opening and Movements on Internal Investments

The values in the selected investment account (on the Group GAAP Corrected level after the changes on the Adjustment Consolidation Method level) are replaced with the values from the investment register corresponding to the same Version, Legal Entity, and Scope.

This replacement process exclusively applies to investments into entities within the current scope. This is defined by the Partner Entity of the investment as a descendant of the current Scope within the Partner Entity dimension.

Note that this modifies the investment value if the investment register is inconsistent with the separate financial statement. This is intentional.

B. Eliminate Internal Investments from the Separate Financial Statements

The base elements of the T999 Closing element within the Transaction Type dimension of the investment account, at the Group GAAP Corrected or Adjustment Consolidation Method level, are removed for the configured transaction type (e.g., T011 - Incoming Units) and consolidation level (Merge Investment.Elimination.Consolidation).

C. Add Past Investments from the Investment Register

The T000 - Opening is replaced by the total of all business transactions in the past (which are transactions applying to a Month_YTD that was before the current reporting period. (As an example, for the current reporting period 2020-06_YTD, any transaction applicable to 2019-12_YTD or earlier is in the past.)

Replacing the opening balance with values from the investment register will not only replace the values submitted in the local currency LC but also enrich the data by the amount converted at historic rates (e.g., on the USD_Historic currency). This is important because such data is available in the investment register but eventually missing in the reported separate financial statements.

D. Add Current Investments from the Investment Register

All movements in the current reporting period (T850 - Movements, T800 – FXDiff, and their descendants) are replaced by investments from investment register entries. (As an example, for the current reporting period 2020-06_YTD, any transaction applicable between 2020-01_YTD and 2020-06_YTD is in the current period.)

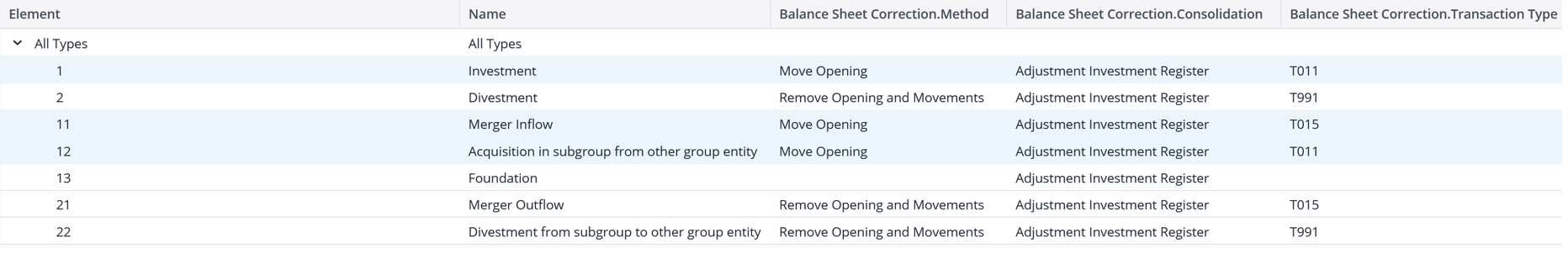

3. Move the balance sheet from the investee to special transaction types

The investee reports its financial statements (including an opening balance, movements, and a closing balance) from the perspective of a single company.1

Please note that this method is triggered by the business transaction on an investee and then operates entirely on amounts in the balance sheet cubes. It does not process any amounts from the investment register.

A. Move Opening

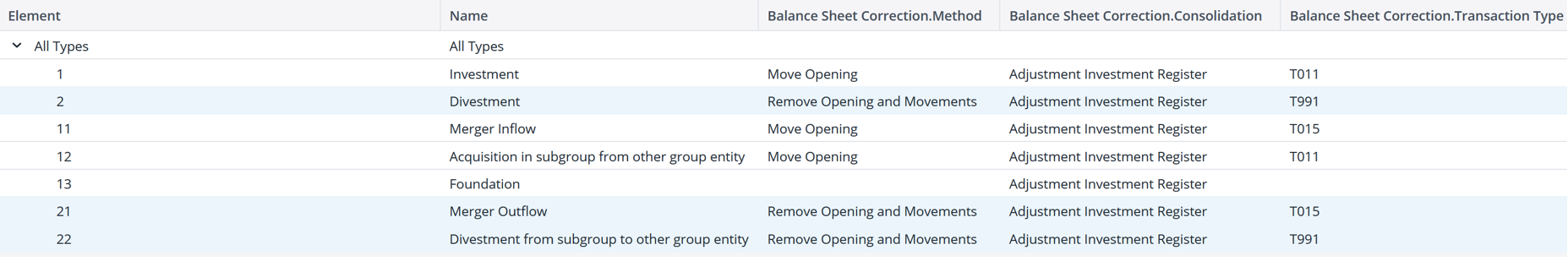

When an entity is consolidated within a scope, its opening balance should not be incorporated into the opening balance of the scope. This rule is applicable to any business transaction having one of the following types:

-

1 - Investment

-

11 - Merger Inflow

-

12 - Acquisition in the subgroup from other group entity

Typically, this step applies to any element within the Business Transaction Type dimension that has the Move Opening in the Balance Sheet Correction.Method attribute:

The values are eliminated from the T000 - Opening transaction type and moved to the T011 - Incomming units transaction type (or whatever transaction type configured in the Balance Sheet Correction.Transaction Type attribute).

B. Remove Opening and Movements (deprecated)

When an entity is removed from a scope, its closing balance, which comprises both its opening balance and movements, should be excluded from the closing balance of the scope. This rule applies to any business transaction having one of the following business transaction types:

-

2 - Divestment

-

21 - Merger Outflow

-

22 - Divestment from subgroup to other group entity

Typically, this step applies to any element in the Business Transaction Type dimension that has the Remove Opening and Movements in the Balance Sheet Correction.Method attribute:

The sum of the T000 (Opening), T850 (Movements), and T800 (FXDiff) is offset against the T991 (Outgoing units) transaction type or any other transaction type configured in the Balance Sheet Correction.Transaction Type attribute.

Capital Increase (Decrease)

Capital Increase (Decrease) refers to a scenario where an investor increases or decreases their capital contribution to a subsidiary, without affecting the ownership percentage within the consolidation scope (group). This proportional change adjusts the investor’s recorded investment and the subsidiary’s equity balances accordingly —meaning all shareholders participate equally, and ownership percentages remain unchanged. This is commonly used in planned equity funding or capital restructuring, where the structure of ownership isn’t affected but the absolute investment values are.

A centralized and transparent process for managing Capital Increase (Decrease) events through the Investment Register, allowing users to:

-

Record capital changes consistently across entities.

-

Leverage a configurable, pre-built consolidation rule that automates journal entries.

-

Support complex transactions such as

Total Divestment, without manual adjustments.

High-Level Process Flow

-

Investor: Initiates a change in their investment amount.

-

Subsidiary: Reflects a change in the equity account balances based on ownership.

-

Subsidiary: Non-Controlling Interests (NCI) are recalculated from the closing balance.

-

Subsidiary: The portion of equity attributable to the Parent Company is updated.

-

Investor: The impact of the capital adjustment is computed from a group consolidation perspective.

Notes:

-

Values in the separate balance sheet and the investment register must be aligned to ensure consistency and avoid discrepancies.

-

Values in the Separate Financial Statements are recorded based on Local GAAP, on the Transaction type T121 of the local currency, and within the ~ scope.

-

The investment account values for subsidiaries must be consistent between the Local GAAP Separate Financial Statements and the Investment Register

Example

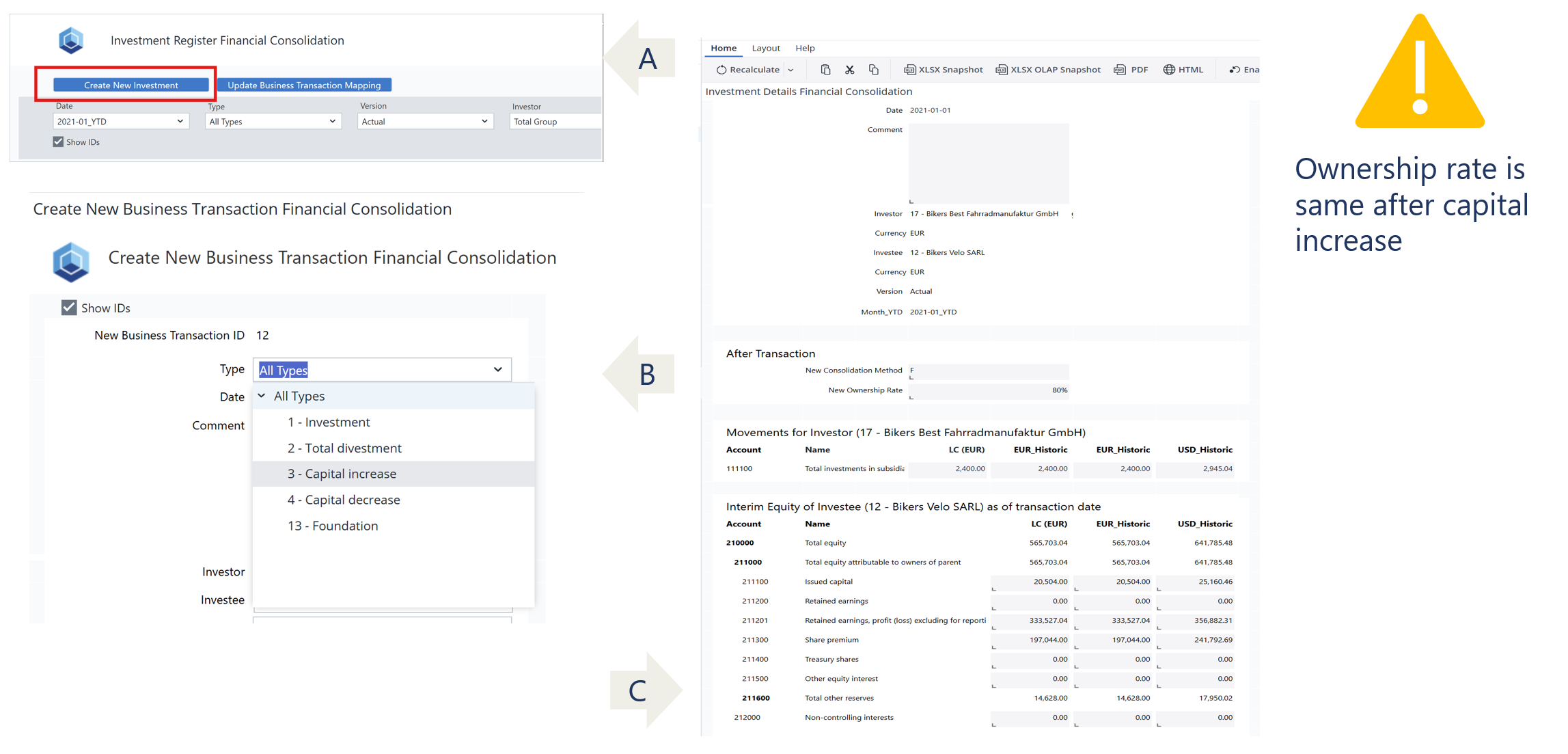

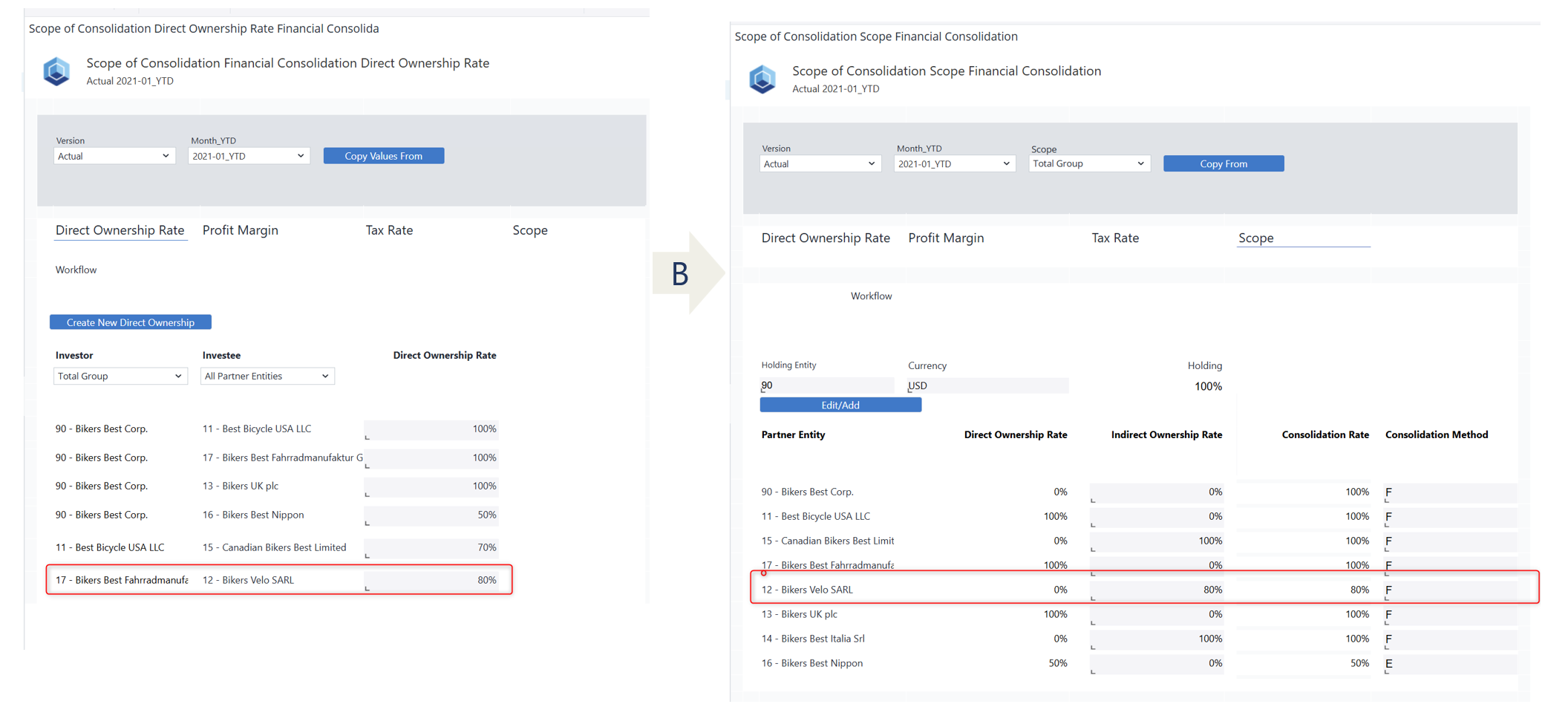

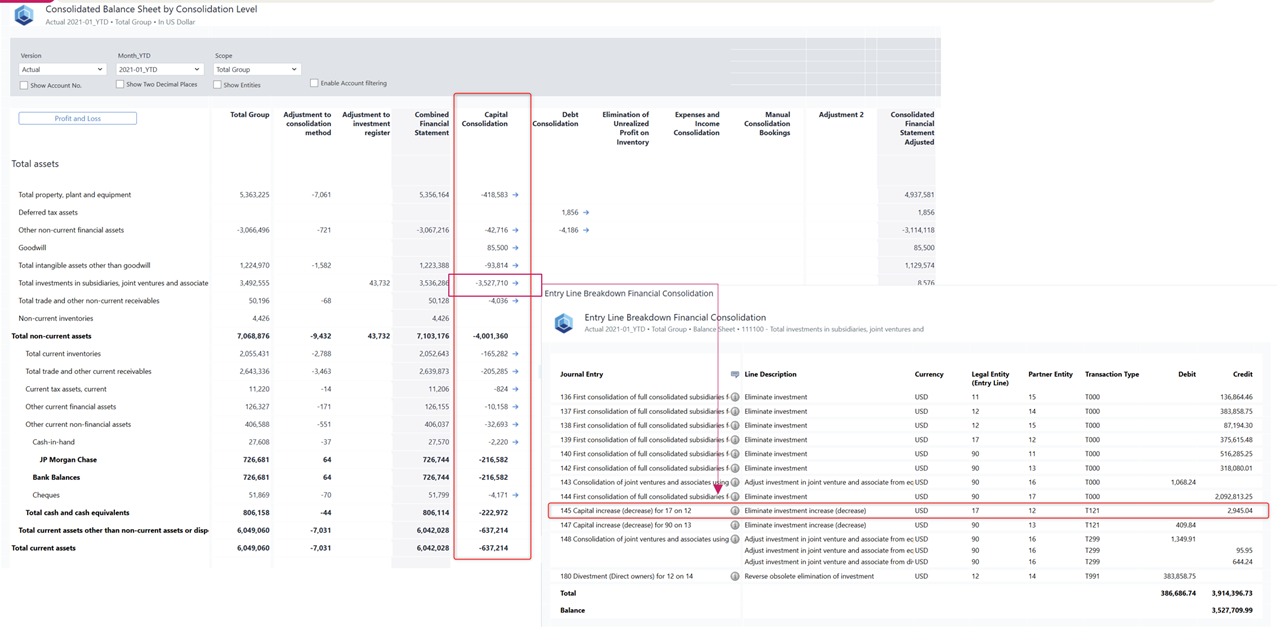

The following example illustrates a step-by-step guide to the Capital Increase transaction initiated by Legal Entity 17 – Bikers Best Fahrradmanufaktur GmbH in Legal Entity 12 – Bikers Velo SARL on January 31, 2021.

-

Recording Capital Increase or Decrease events directly in the Investment Register

-

Defining Consolidation Scope Parameters:

i) Ownership Percentage (%): Specify the investor’s share in the subsidiary.

ii) Consolidation Method: Select the applicable method, e.g., F – Full Consolidation. -

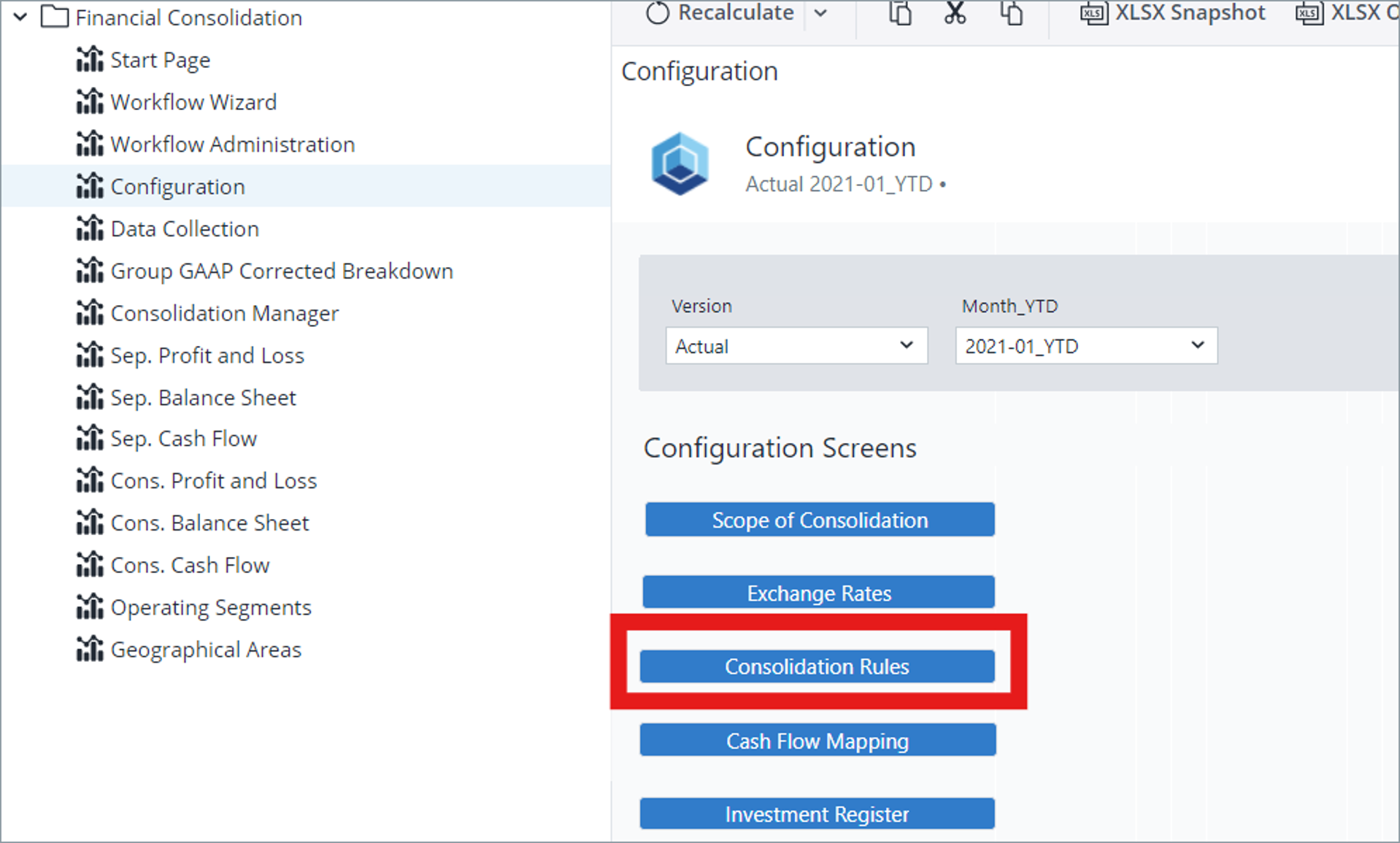

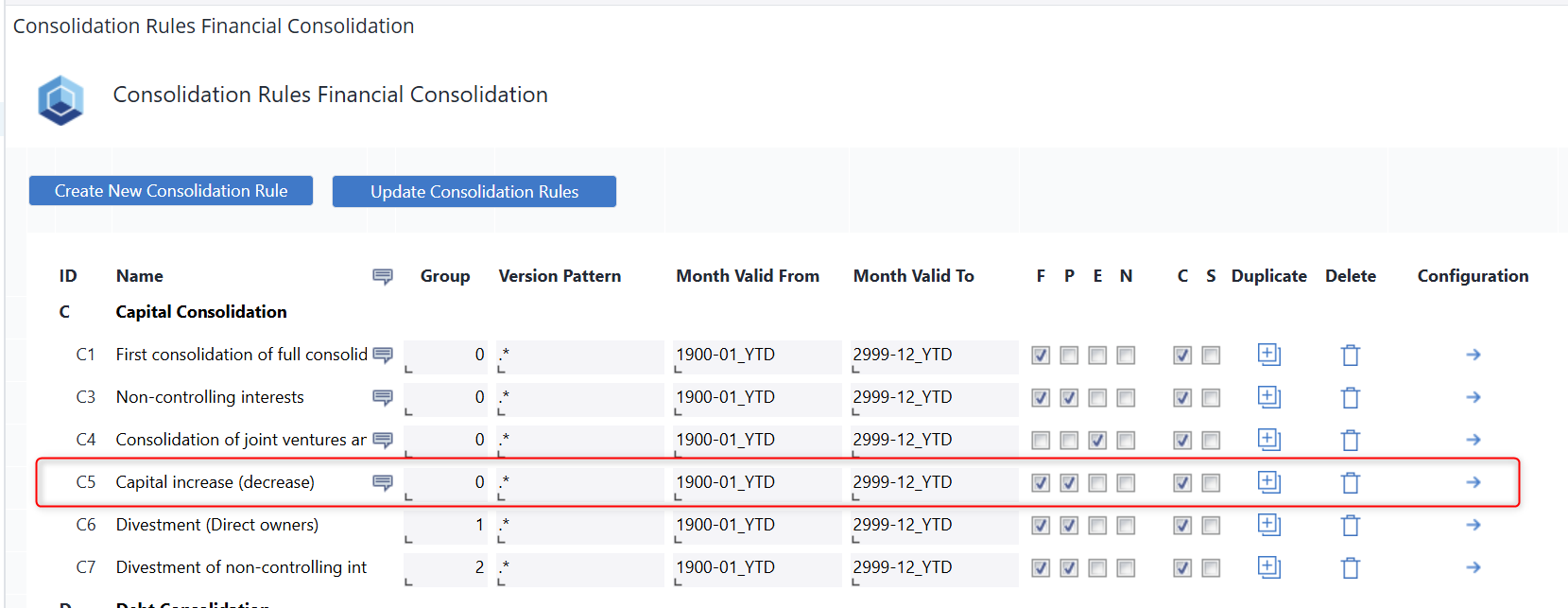

Step 3: Consolidation Rules Configuration

-

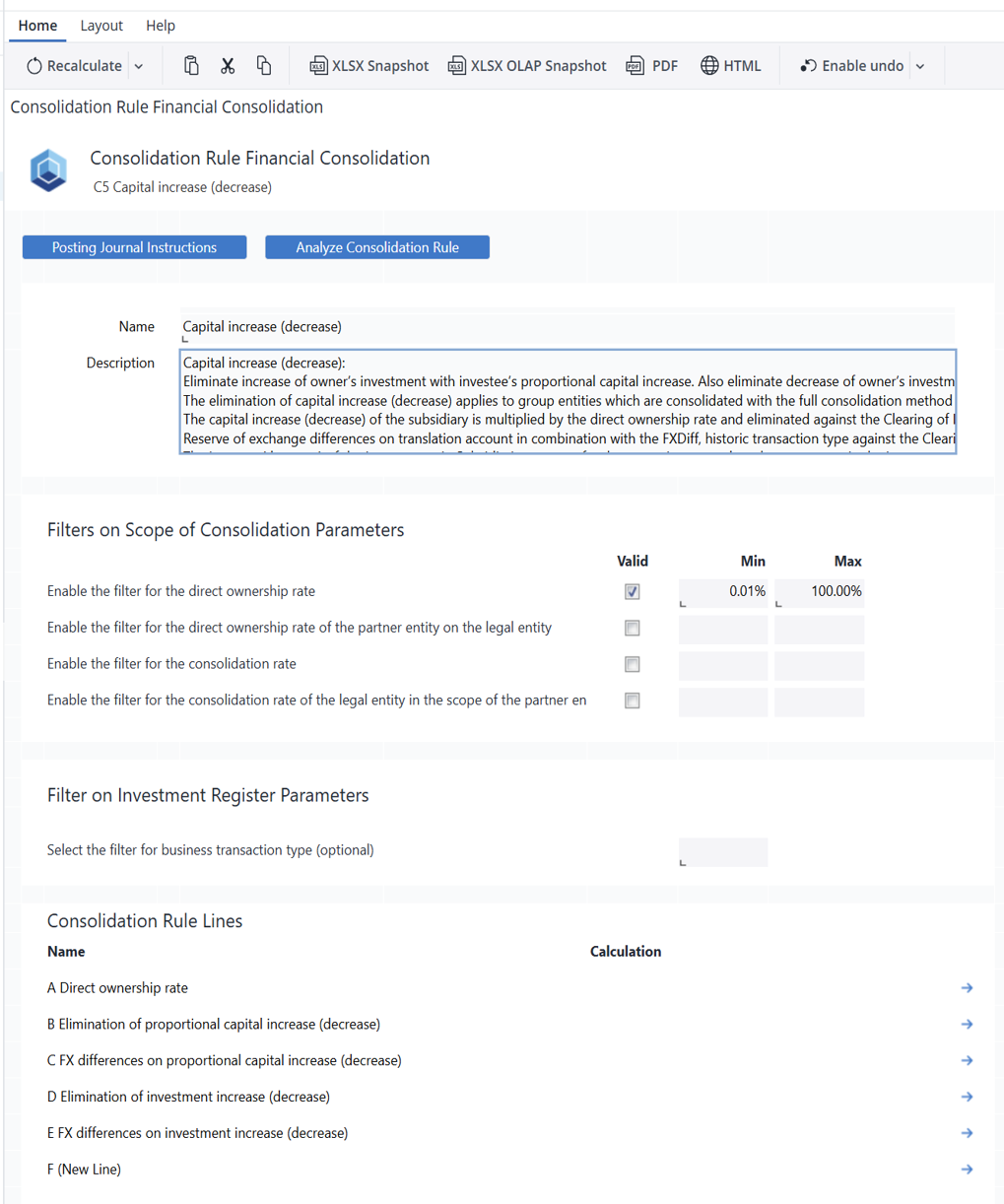

Configure Consolidation Rule C5

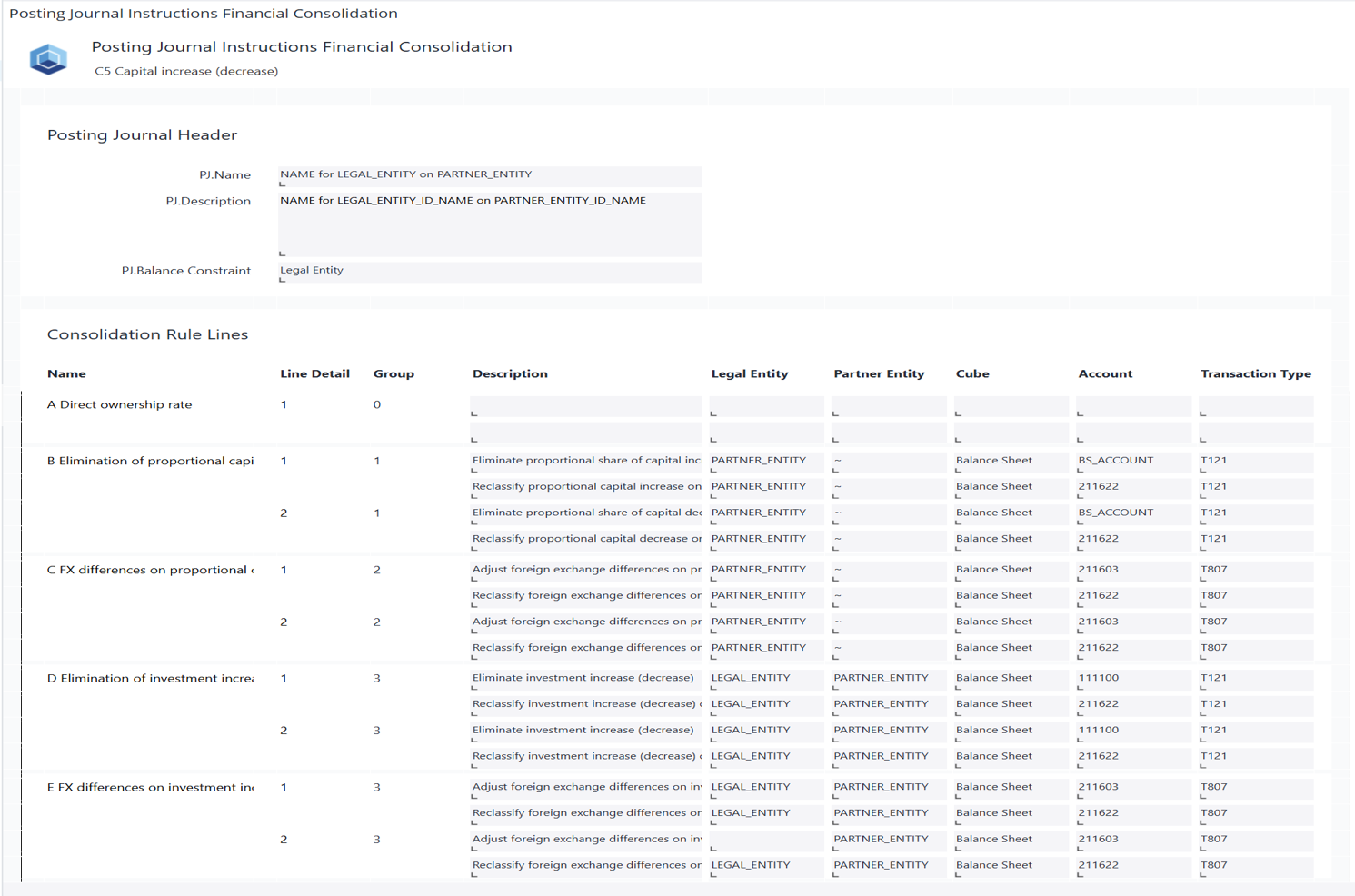

Rule C5 applies to fully consolidated group entities and is used to eliminate Capital Increase (Decrease) transactions between a direct owner (investor) and the investee, ensuring that intra-group equity movements do not distort consolidated financials.

From the investor’s perspective, any increase or decrease in the investment is eliminated and reclassified to the consolidation clearing account. Additionally, any foreign exchange differences resulting from the investment change are adjusted and also reclassified to the clearing account, ensuring that currency effects do not impact the consolidated equity balances.

From the investee’s perspective, the proportional share of the capital increase or decrease is eliminated and reclassified to the clearing account. Any related foreign exchange differences are similarly adjusted and moved to the clearing account. Furthermore, non-controlling interests (NCI) are updated proportionally based on the ownership structure, ensuring the correct allocation of equity among parent and minority shareholders.

-

Verifying Results

Updated February 25, 2026