Return to the Financial Consolidation Model Overview

In IFRS-based group reporting, goodwill is treated as an asset of the foreign investee. Consequently, foreign exchange (FX) differences may arise when translating the financial statements of a foreign subsidiary into the group’s presentation currency.

Here is an example scenario of foreign exchange (FX) differences:

-

A parent company reporting in USD acquires a subsidiary operating in EUR.

-

At the acquisition date, goodwill of 10 million EUR is recognised.

-

The exchange rate at acquisition is 1 EUR = 1.2 USD, resulting in goodwill of 12 million USD.

-

At a later date, the exchange rate changes to 1 EUR = 1.1 USD.

-

The goodwill translated into group currency is now 11 million USD.

-

This results in a 1 million USD FX loss, which must be recognized (along with the corresponding change in goodwill).

The Jedox Financial Consolidation model provides sample configuration rules that demonstrate how such FX differences on goodwill can be calculated and posted automatically during capital consolidation.

This article explains the underlying accounting need, the sample configuration provided in the Jedox model, and the current limitations of the automated process.

Why FX Differences on goodwill are required

Under IFRS 10 (Consolidated Financial Statements) and IAS 21 (The Effects of Changes in Foreign Exchange Rates), goodwill that results from acquiring a foreign operation is considered part of the net assets of this foreign operation (see IAS 21.47). During consolidation, the subsidiary’s financial statements—including goodwill—must be translated into the group’s presentation currency. This translation process creates foreign exchange differences that accumulate in the foreign currency translation reserve.

Because of this requirement, goodwill must be translated into the group currency at historic rates in the first consolidation period, as well as in each subsequent period. Any FX differences arising from currency fluctuations must be recognised by posting changes both to the Goodwill account and to the Reserve of exchange differences on translation account.

In the Jedox Financial Consolidation model, currency conversion for most items is performed during pre-consolidation. Goodwill, however, is created only after pre-consolidation (during capital consolidation) and is stored directly in group currency. For this reason, goodwill cannot be included in the general currency conversion mechanisms and requires separate handling within the capital consolidation step.

Capital consolidation – FX Differences on goodwill

To support this requirement, the Jedox Financial Consolidation model allows customers to configure Consolidation Rules that automate the calculation and posting of FX differences on goodwill during the first and subsequent consolidation periods.

Automatic recognition of goodwill FX Differences

The sample configuration illustrates how to set up automatic calculation and posting of foreign exchange differences related to goodwill. This configuration consists of two parts for the automatic recognition of these differences due to goodwill translations:

-

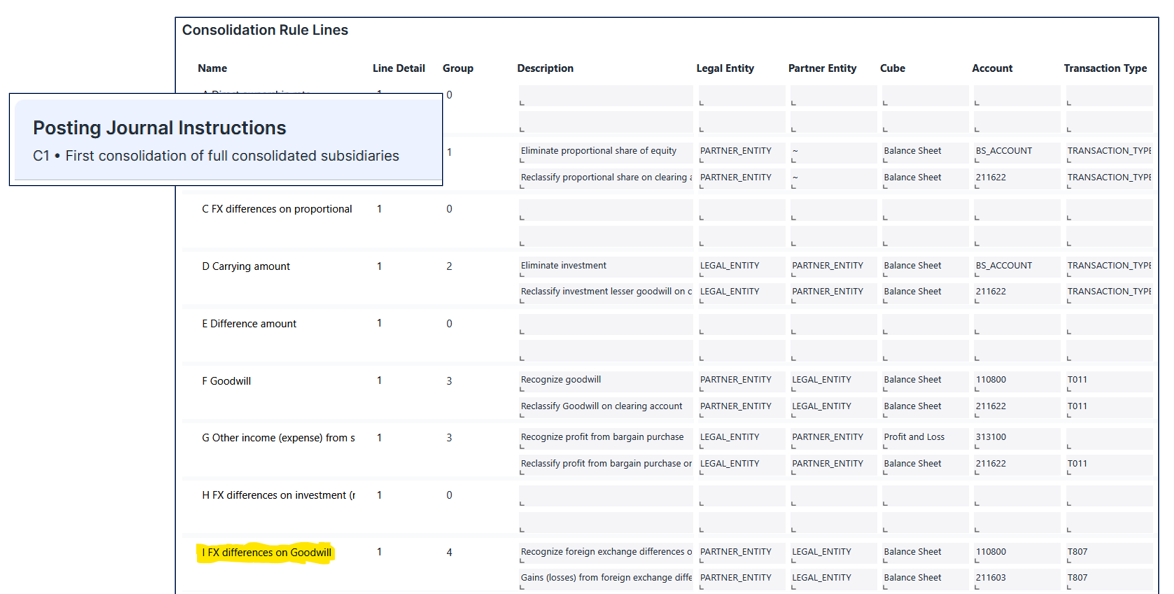

Extension of Consolidation Rule C1 for the first consolidation of fully consolidated subsidiaries to calculate and post foreign exchange differences on goodwill.

-

Creation of an additional Consolidation Rule C8 to calculate and post foreign exchange differences on goodwill in subsequent consolidation periods.

Extension of Consolidation Rule C1

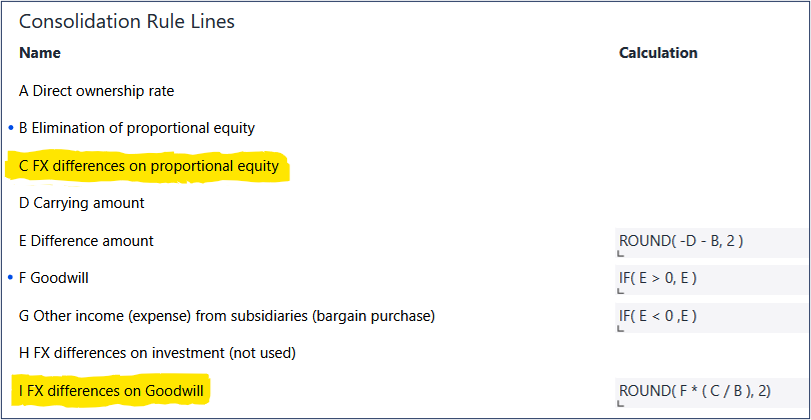

The sample data Consolidation Rule C1 has been extended to account for foreign exchange (FX) differences on goodwill for the first consolidation period.

This Consolidation Rule C1 includes additional Consolidation Rule Lines C and I, which are designed to calculate FX differences on goodwill. In addition, there are Posting Journal Instructions on Consolidation Rule Line I to ensure that the corresponding journal entries are posted during the execution of the Consolidation Procedure.

Furthermore, the results from Consolidation Rule Lines B and F are also necessary for these calculations.

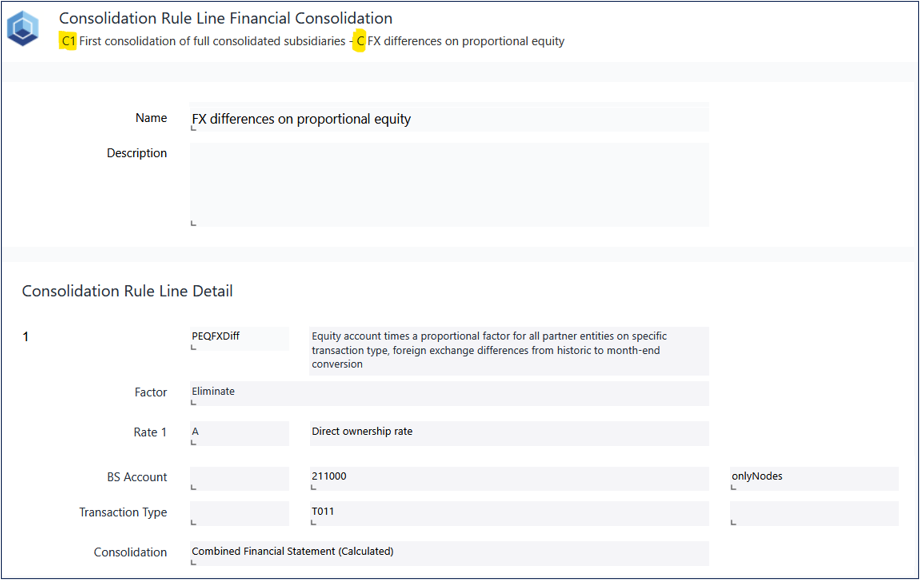

Consolidation Rule C1 Line C

The Consolidation Rule for Line C calculates the foreign exchange (FX) differences for proportional equity. Its configuration closely follows that of Line B, but with specific adjustments to the Consolidation Function (Fact Selector), the Account Mode, and the applicable consolidation level to accommodate the requirements of this calculation. In this context, the PEQFXDiff Consolidation Function is used to determine the FX differences for the selected proportional equity.

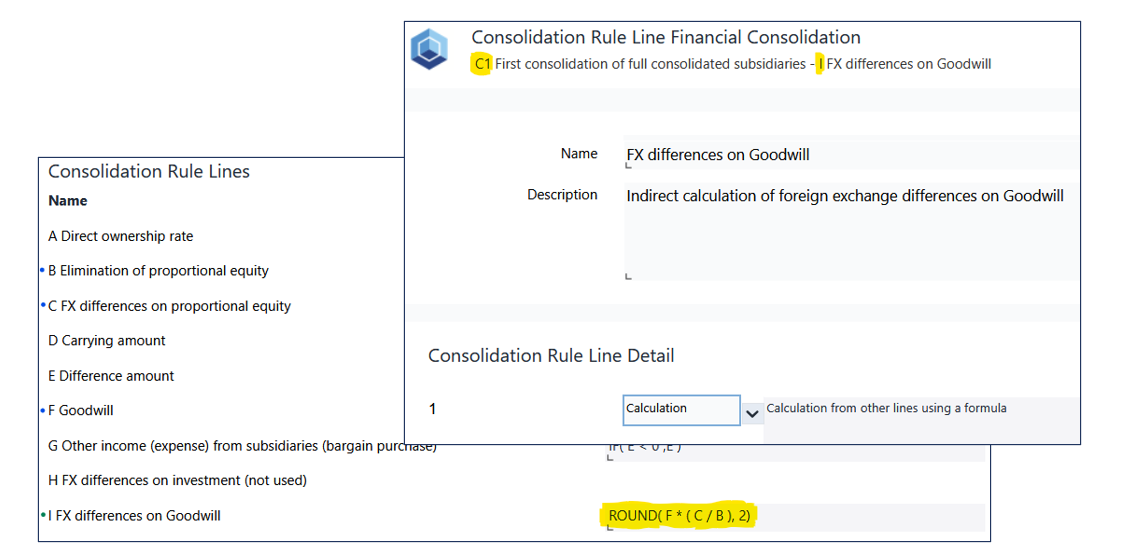

Consolidation Rule C1 Line I

The Consolidation Rule for Line I calculates the foreign exchange (FX) differences related to goodwill by applying the ratio of the FX difference on proportional equity to the proportional equity itself and multiplying this ratio by the value of goodwill. To arrive at this result, the calculation draws on figures produced by other Consolidation Rule Lines.

Consolidation Rule C1 Posting Journal Instructions

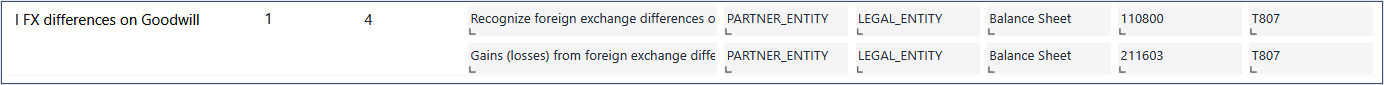

The Posting Journal Instructions defined for Consolidation Rule Line I ensure that the calculated FX differences on goodwill are automatically recorded during the execution of the consolidation procedure. These instructions generate the required journal entries, posting the foreign exchange differences to both the goodwill account and the Reserve of exchange differences on translation. The resulting postings are applied to the partner entity (rather than the legal entity) and use transaction type T807 (FXDiff, historic).

Creation of Consolidation Rule C8

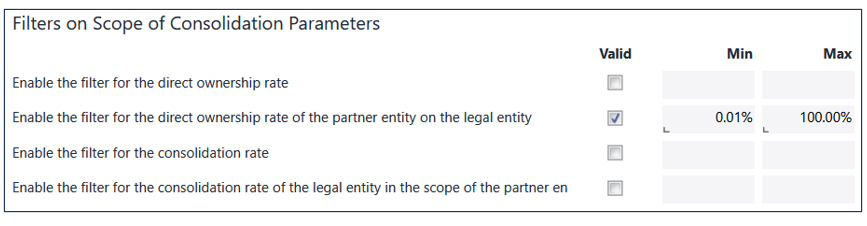

Consolidation Rule C8 is introduced in the sample configuration to handle foreign exchange differences on goodwill in all subsequent consolidation periods. Triggered by a filter evaluating the direct ownership rate of the partner entity in the legal entity, this rule calculates the FX differences arising from translating goodwill into the group currency after the initial consolidation period. The calculation is based on the opening balance of goodwill, meaning that accurate determination and posting of goodwill and its related FX differences during the first consolidation (via Consolidation Rule C1) is essential for the correct execution of Rule C8 in later periods.

Consolidation Rule C8 calculation

To calculate the FX differences on goodwill in a subsequent consolidation period, the model relies on several interconnected components. This calculation requires that goodwill and its initial foreign exchange differences have already been correctly determined and posted during the first consolidation of the subsidiary via Consolidation Rule C1. Using values drawn from multiple Consolidation Rule Lines, the model derives the current period FX difference on the goodwill opening balance.

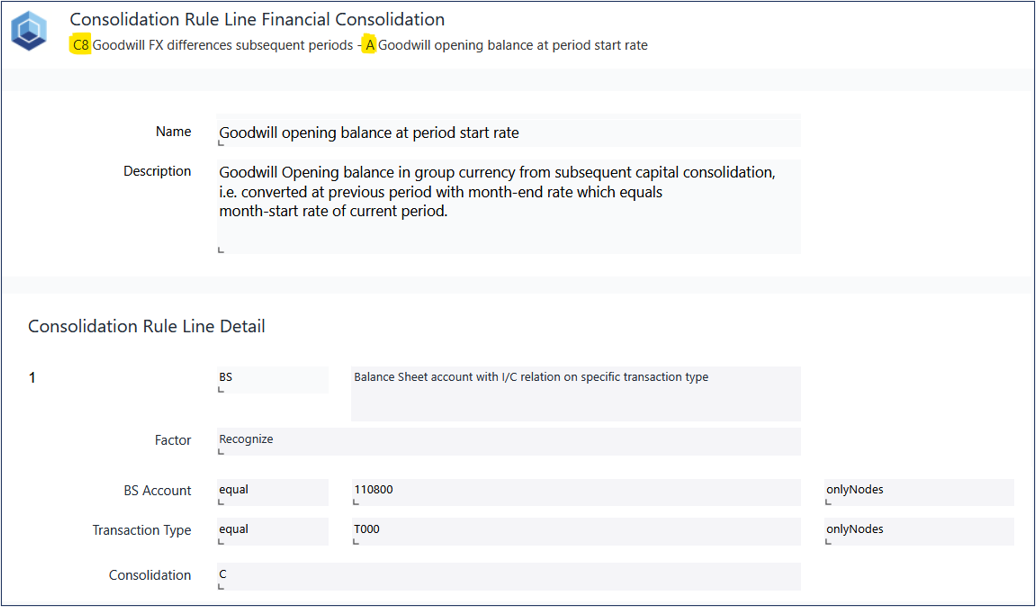

Consolidation Rule C8 Line A

Line A retrieves the opening balance of goodwill. This opening balance is obtained using the Consolidation Function BS, which reads the T000 balance of the Goodwill account (110800). The value is always available when the Consolidation Rule is executed, as goodwill and its historical FX differences are carried forward into the current period through the subsequent capital consolidation, which runs before the consolidation rules are applied.

Consolidation Rule C8 Line B

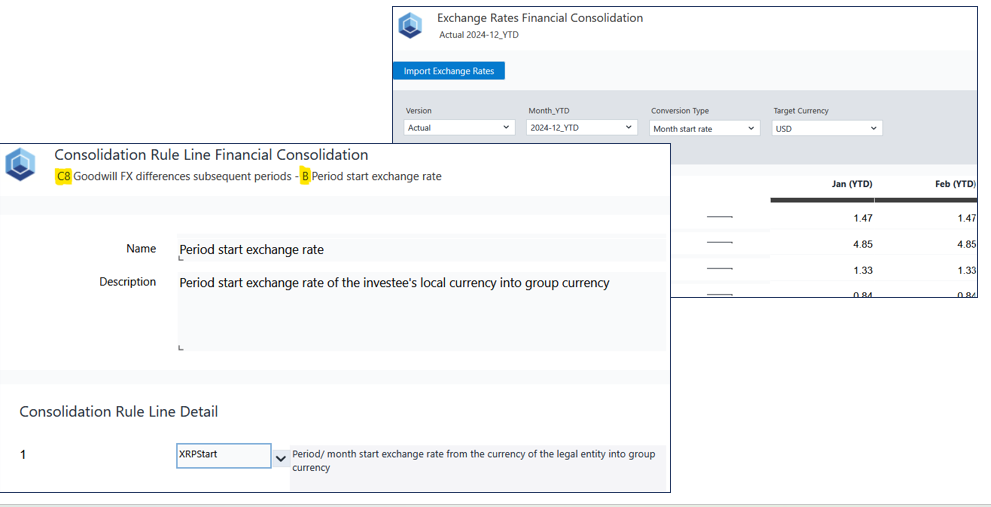

The XRPStart Consolidation Function retrieves the exchange rate used to convert a legal entity’s local currency into the group currency at the beginning of the period.

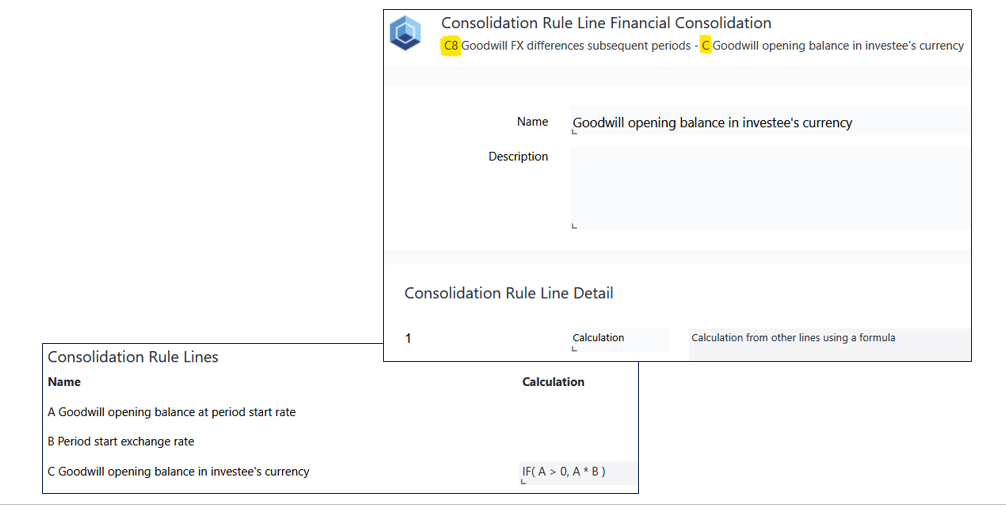

Consolidation Rule C8 Line C

Consolidation Rule Line C calculates the opening balance of goodwill in the subsidiary’s local currency. This calculation relies on the values obtained in Consolidation Rule Lines A and B.

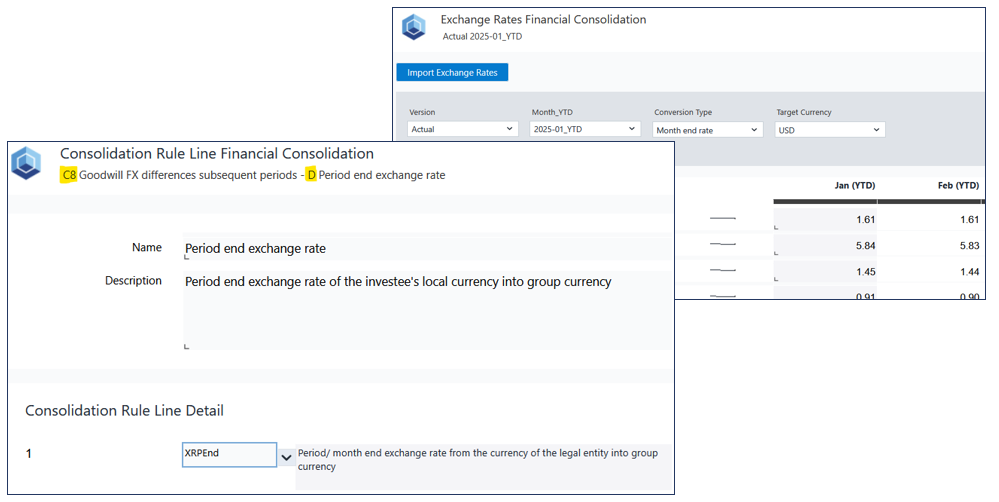

Consolidation Rule C8 Line D

A Consolidation Function XRPEnd retrieves the exchange rate used to convert the legal entity’s local currency into the group currency at the end of the period. In Consolidation Rule C8, XRPEnd is specifically applied to obtain the period-end rate required for calculating the foreign exchange differences on goodwill.

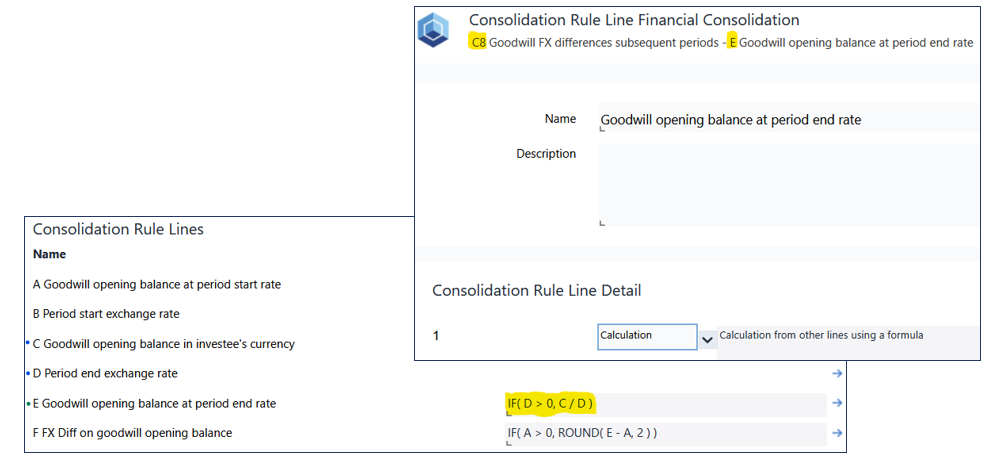

Consolidation Rule C8 Line E

Consolidation Rule Line E calculates the goodwill opening balance converted at the period-end exchange rate. This calculation draws directly on the results of Consolidation Rule Lines C and D, which provide the necessary local-currency balance and the applicable exchange rate.

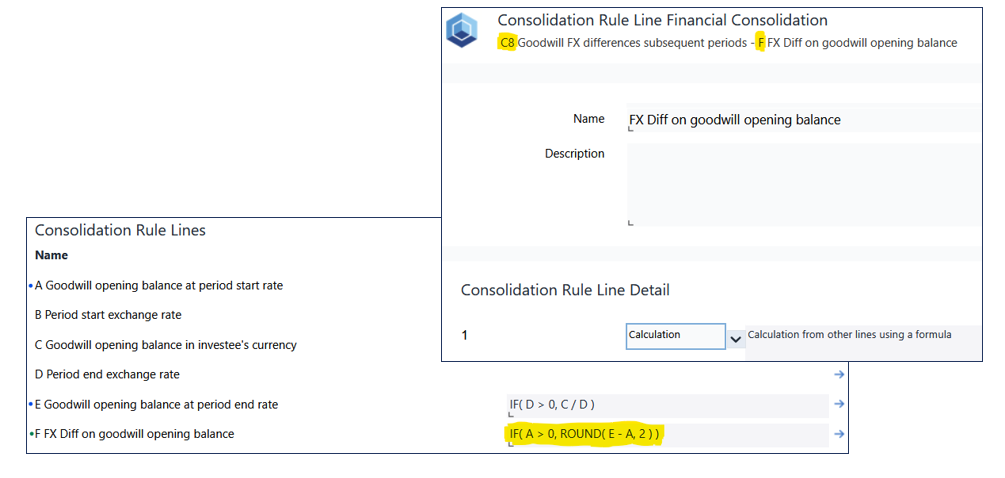

Consolidation Rule C8 Line F

Consolidation Rule Line F calculates the foreign exchange differences arising from the conversion of the goodwill opening balance. This calculation relies on the results produced in Consolidation Rule Lines A and E, which provide the required opening balance values at the respective exchange rates.

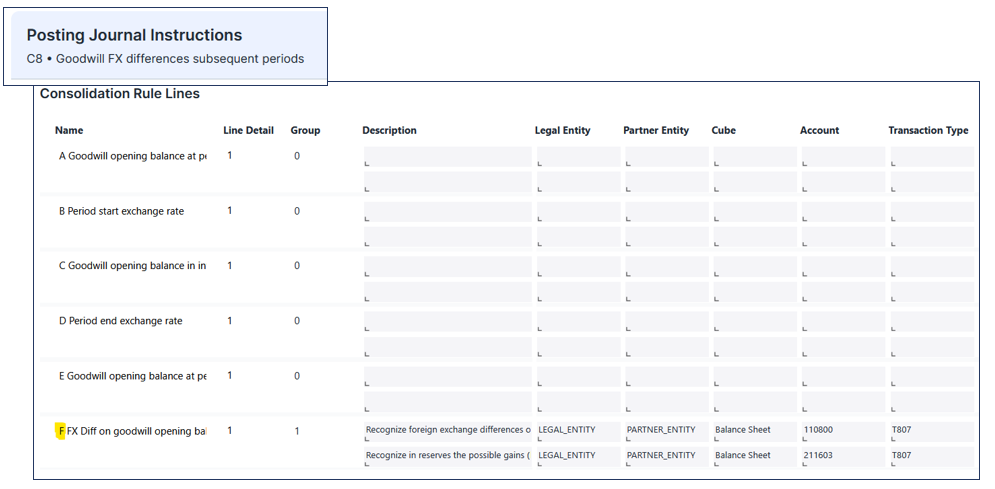

Consolidation Rule C8 Posting Journal Instructions

The Posting Journal Instructions for recognizing FX differences on goodwill in subsequent consolidation periods are defined exclusively on Consolidation Rule Line F. These instructions automatically generate the required journal entries, posting the foreign exchange differences to the Goodwill account and the Reserve of exchange differences on translation. The resulting entries are recorded on the legal entity, rather than the partner entity, and use transaction type T807 (FXDiff, historic).

Resulting journal entries

After the Consolidation Procedure has been executed, the system automatically generates the corresponding journal entries based on the configured rules. These resulting entries are then available for review in the Posting Journal, where users can verify the calculated amounts and ensure that the FX differences on goodwill have been correctly recorded.

Limitations of this sample configuration

The automatic recognition of foreign currency differences on goodwill described in this article is limited to fully consolidated subsidiaries; entities consolidated at equity or using the proportional method are not included in the sample logic. In addition, subsequent adjustments to goodwill, such as those arising from impairment tests, are not handled by the automated processing provided in these sample Consolidation Rules. The recognition of foreign exchange differences in other comprehensive income (OCI) is also currently out of scope and has not yet been implemented in the sample configuration. As these rules form part of the sample configuration, they are intended only as illustrative examples. Each customer must configure their own Consolidation Rules to reflect their specific requirements, including the applied accounting standards and chart of accounts.

Updated February 23, 2026