The currency conversion features the conversion of amounts stored in a local currency into a group currency or additional reporting currencies. The model can be configured for any set of local currencies and for one or multiple group currencies and additional reporting currencies.

The Financial Consolidation model performs the currency conversion in different ways - depending on the consolidation level, cube, account, transaction type or conversion type.

The different kinds of currency conversion are:

| Number | Name | Consolidation levels | Cubes | Accounts | Conversion types |

| 1 | Conversion from local currency into the group currency for movements | Local GAAP – Combined Financial Statement (Calculated) | Profit and Loss, Profit and Loss (Segment), Cash Flow and the Cash Flow (Segment) | All the accounts in the P&L and Adjustments in the cash flow | Average |

| 2 | Conversion from group currency into additional reporting currencies for movements | Combined Financial Statement – Consolidated Financial Statement (Adjusted) | Profit and Loss, Profit and Loss (Segment), Cash Flow and the Cash Flow (Segment) | All the accounts in the P&L and Adjustments in the cash flow | Average |

| 3 | Conversion of movements in Assets & Liabilities with the exception for Investment account | Balance Sheet, Balance Sheet (Segment) | movements on BS accounts with month end conversion | Average | |

| 4 | Conversion of opening balances in the Balance Sheet | Balance Sheet, Balance Sheet (Segment) | All the BS accounts expect equity. | Month Start | |

| 5 | Currency conversion of Equity | Balance Sheet cube | Historic |

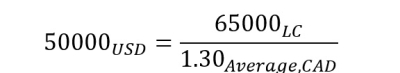

1. Conversion from local currency into group currency for movements is done with Average conversion type. This conversion applies to the Profit and Loss, Profit and Loss (Segment) cubes, and the adjustments in the Cash Flow and Cash Flow (segment) cubes. It’s also restricted to the initial levels of the consolidation process, starting from Local GAAP to the Combined Financial Statement (calculated).

All of the above cubes include the following dimensions:

-

Version: This dimension is shared between the fact cube and theExchange Rates_YTDcube. -

Month_YTD: This dimension is shared between the fact cube and theExchange Rates_YTDcube. -

Legal Entity: TheCurrencyattribute in theLegal Entitydimension will be used to identify the actual currency code of the local currency for this entity. -

PnL AccountorCF Accountdimension: This dimension defines whichConversion Typeis used to select the exchange rate from theExchange Rates_YTDcube. We are using theConversion Typefrom theAccount. Usually, we useAverageconversion type. -

Currency: This dimension separates input and output elements of the currency conversion. The table below defines the various elements of this dimension.

2. Conversion from group currency into additional reporting currencies for movements is done with Average conversion type. This conversion applies to the Profit and Loss, Profit and Loss (Segment) cubes, and the adjustments in the Cash Flow and Cash Flow (segment) cubes.

These elements from the Currency dimension are applicable on this consolidation level:

| Element | Definition |

Other currency codes, e.g., GPB |

Captures amounts in the group currency. Valid elements must include a code of three capital letters, as defined by ISO 4217. |

> …, e.g. MXN > USD |

Calculated base element showing the result of the currency conversion from the group currency. |

3. Conversion of movements in assets and liabilities is done on Average conversion type. This conversion applies to the Balance Sheet and Balance Sheet (Segment) cubes.

Two differences compared to the previous section:

-

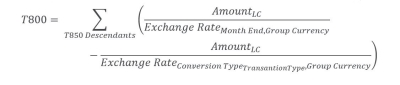

The Conversion Type for T850 descendants is taken from the Conversion Type attribute of the Transaction Type dimension.

-

The T800 FXDiff Transaction Type is calculated so that the total T999 Closing shows the amount converted at the month end exchange rate.

Example:

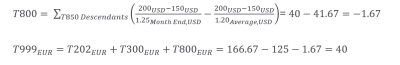

There are movements of 200 USD on the T202 (Additions) and -150 USD on the T300 (Decrease / Disposals) transaction type. Both are converted at an average rate of 1 EUR = 1.20 USD. The T000 (Opening) is assumed to be 0. The T800 (FXDiff) must be computed so that T999 (Closing) shows the conversion at a month end rate of 1 EUR = 1.25 USD.

4. Conversion of opening balances in assets and liabilities is done on Month start conversion type. This conversion applies to the Balance Sheet and Balance Sheet (Segment) cubes.

-

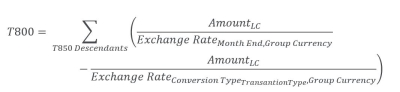

The Conversion Type for T000 opening is taken from the Conversion Type attribute of the Transaction Type dimension.

-

The T800 FXDiff Transaction Type is calculated so that the total T999 Closing shows the amount converted at the month end exchange rate.

Example:

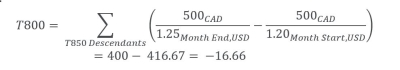

There is an opening balance of 500 CAD on the T000 (Opening) transaction type. This is converted at an opening rate of 1 USD = 1.20 CAD. The T850 (Movements) are assumed to be 0. The T800 (FXDiff) must be computed so that T999 (Closing) shows the conversion at a month end rate of 1 USD = 1.25 CAD.

The closing balance is a consolidated element, and the total needs to be shown at the Month end rate, in the model total is calculated (summed up) after FXDiff is computed.

5. Currency conversion for equity accounts or any other balance sheet account with the Historic conversion type in Balance Sheet, and Balance Sheet (Segment) cubes use historic rates. (These are converted at the moment when the transaction took place).

-

T999 Closing balance for these accounts is calculated at a historic rate. Historic conversion rates are not stored in the model; instead, we store a pair of local currency and group currency values converted at the historic rates.

-

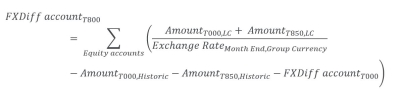

FXDiff is computed on a separate account

Reserve of exchange differences on translationunder total equity. We are computing the difference between Historic currency conversion and conversion at the month end rate. We only use the Month End on Conversion type attribute for this FXDiff account. All equity accounts with historic currency conversion have one FXdiff account to compensate for the difference.

There can be other groups of accounts that use historic currency conversion and different FXDiff accounts.

Historic values are stored in the currency dimension on dedicated elements:

…_Historic, e.g., USD_Historic |

Captures amounts in the group currency or any additional target currency converted at historic rates. |

Computation of exchange differences is done with two steps:

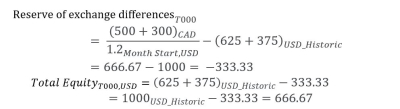

1. We are calculating the opening balance for the foreign exchange differences account. We should bring total equity to the month start rate.

We sum the total equity accounts in local currency, convert these at the month-start rate, and from that value, we deduct the historic amounts.

This difference is shown on the opening balance of the foreign exchange differences account.

Example:

There is an opening balance of 500 CAD in Issued capital and 300 CAD in Retained earnings recorded in historic values on the T000 (Opening) transaction type in local currency. There is an opening balance of 625 USD in Issued capital and 375 USD in Retained earnings are converted at historic rates on the T000 (Opening) transaction type in group currency. TheReserve of exchange differences on translationmust be computed so thatTotal equityshow the conversion at a month start rate of 1 USD = 1.20 CAD. An example is from the table below.

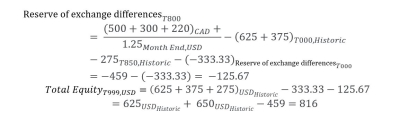

2. Need to calculate foreign exchange differences so that the closing balance of the total equity shows the amount converted at the month end exchange rate.

We convert the opening balance and all movements of the equity accounts at a month end rate, and from that value, we deduct the historic amounts. Then we deduct the foreign exchange differences calculated in the first step.

Example:

Extending the example of step 1, the T850 (Movements) are assumed to be 220 CAD and converted at an average rate of 1 USD = 1.20 CAD. The Reserve of exchange differences on translation must be computed so that Total equity shows the conversion at a month end rate of 1 USD = 1.25 CAD.

| Currency | BS Account | T000 - Opening | T850 - Movements | T800 - FX Diff | T999 - Closing |

LC(CAD)

|

Issued capital | 500 | 500 | ||

| Retained earnings | 300 | 220 | 520 | ||

| Reserve of exchange differences on translation | |||||

| Total equity | 800.00 | 200.00 | 0.00 | 1,020.00 | |

USD_Historic

|

Issued capital | 625 | 625 | ||

| Retained earnings | 375 | 275 | 650 | ||

| Reserve of exchange differences on translation | -333 | -125 | -459 | ||

| Total equity | 666.00 | 275.00 | -125.00 | 816.00 | |

Currency conversion does not apply

KPI’s like FTE and Headcount must not be currency converted. This can be configured by setting the Conversion Type attribute to ~. As an alternative, you also store such values on the XXX element in the Currency dimension.

Updated November 15, 2022