Consolidation rules are defined by consolidation rule lines (A, B, C, ...) , each consisting of one or more consolidation rule line details (1, 2, 3, ... ). Each of those uses a Consolidation Function, which can be

-

A Scope of Consolidation parameter

-

A fact selector

-

A calculation or

-

An elimination function

-

An investment Register Fact selector

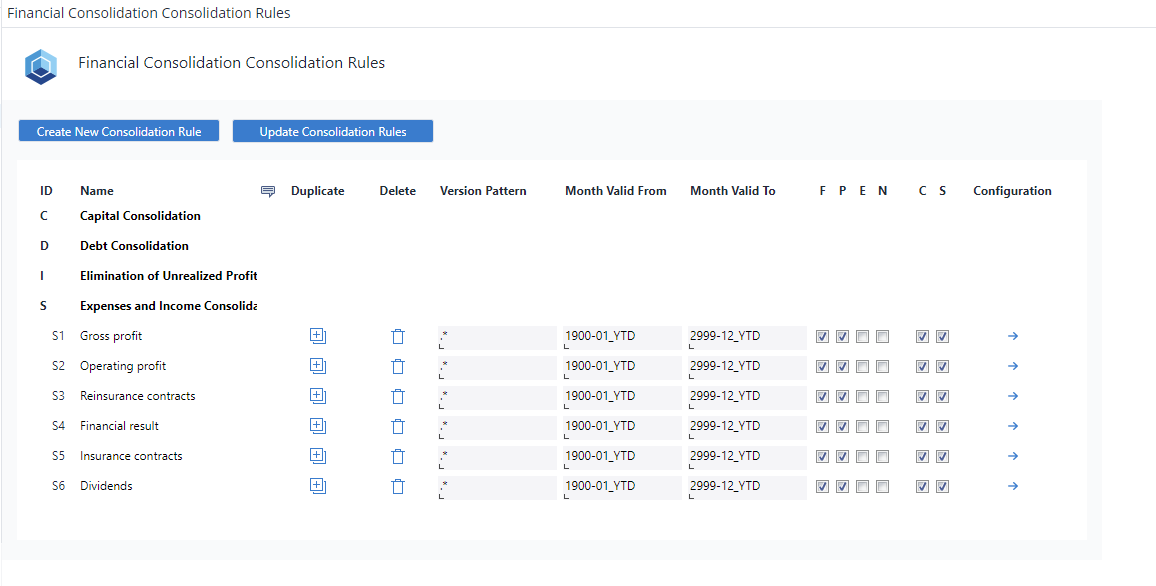

To set up the consolidation rule lines and enable the relevant Filter on Scope of Consolidation Parameters, users should access the blue arrow in the configuration column for the concerned rule.

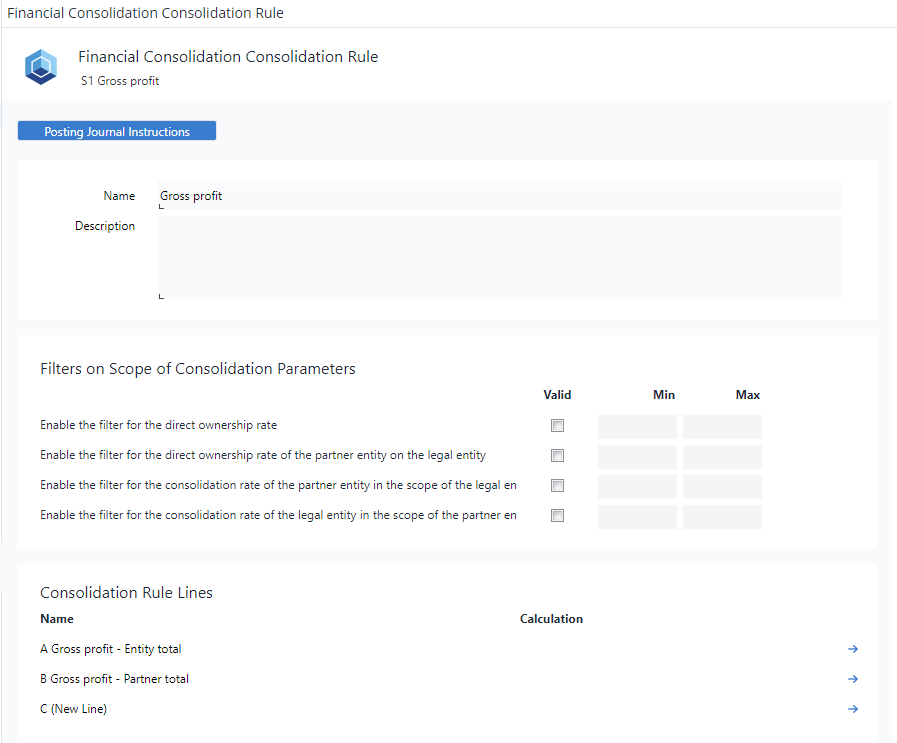

This leads to the subreport Financial Consolidation Consolidation Rule. For example, S1 Gross Profit that can be seen in the screenshot below

Filter on Scope of Consolidation Parameters

There are four filters in the scope of consolidation parameters that can be activated/enabled by the user in the Financial Consolidation Consolidation Rule report.

-

The Direct ownership rate: This Filter retrieves pairs of the holding entity as the legal entity with any entity which is included in the group with a direct ownership rate as the partner entity.

-

The Filter for the direct ownership rate of the partner entity on the legal entity: This is a mirrored direct ownership rate filter. This Filter retrieves pairs of the holding entity as the partner entity with any entity which is included in the group with a direct ownership rate as the legal entity

-

The Filter for the consolidation rate of the partner entity in the scope of the legal entity: This Filter retrieves pairs of the holding entity as the legal entity with any entity which is included in the group with a non-zero consolidation rate as the partner entity

-

The Filter for the consolidation rate of the legal entity in the scope of the partner entity: This is a mirror of the above consolidation rate filter. This Filter retrieves pairs of the holding entity as the partner entity with any entity which is included in the group with a non-zero consolidation rate as the legal entity.

When the consolidation procedure is executed, the consolidation engine processes all pairs of a legal entity (e.g., 11, 12, 14, etc.) from the Legal Entity dimension and a partner entity (11, 12, 13, etc.) from the Partner Entity dimension. The above consolidation functions retrieve amounts stored in the Profit and Loss or the Balance Sheet cube for the combination

The fields from the Financial Consolidation Consolidation Rule report are described below

| Field | Description |

| Name | Application takes the names from Financial Consolidation Create Consolidation rule report, can be overwritten. |

| Description | Application takes the Description from Financial Consolidation Create Consolidation rule report, can be overwritten. |

| Filters on Scope of Consolidation parameters | By enabling/activating a filter consolidation rule access, particular pairs of a legal entity (e.g., 11, 12, 14, etc.) from the Legal Entity dimension and a partner entity (11, 12, 13, etc.) from the Partner Entity dimension processes all the pairs |

| Consolidation Rule Lines | Consolidation Rule Lines are configured in the next report, and users should access the blue arrow of the concerned rule line. |

After selecting the relevant Filter on Scope of Consolidation Parameters in Financial Consolidation Consolidation Rule report.

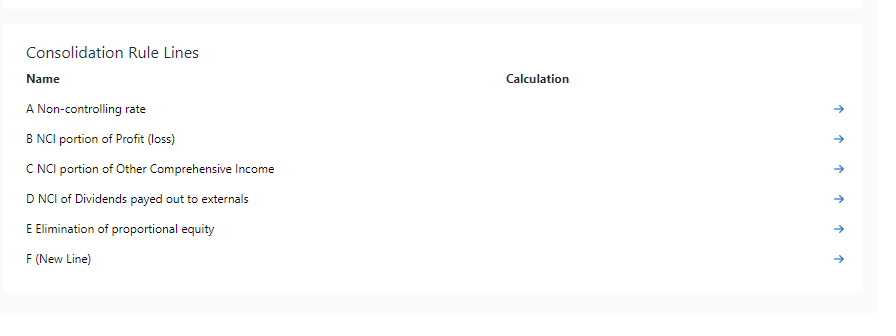

Consolidation Rule lines can be accessed by clicking the blue arrow hyperlink. This leads to the Financial Consolidation Consolidation rule line report, where the relevant consolidation function can be selected for each consolidation rule line.

Each of the Consolidation Rule lines uses Consolidation Functions, which can be

-

A Scope of Consolidation parameter

-

A fact selector

-

A calculation or

-

An elimination function

-

An investment Register Fact selector

Consolidation Functions are explained below:

Scope of consolidation parameters

When a scope of consolidation parameter function is selected from the below table, Function picks up the rate that was inputted by the user in the Financial Consolidation Scope of Consolidation report stored in Scope of Consolidation Cube. The selected scope of consolidation parameter consolidation functions will retrieve amounts stored in the Profit and Loss or the Balance Sheet cube for the combination

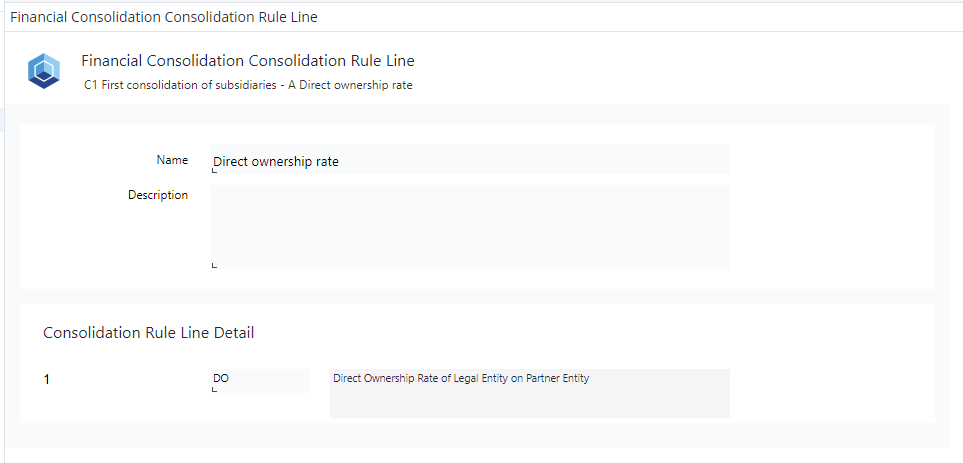

| Selector | Description |

| CRT | Consolidation Rate of holding on the Partner Entity |

| NCR-1- | Consolidation Rate of holding on Partner Entity |

| DO | Direct Ownership Rate of Legal Entity |

| DOX | Direct ownership rate of partner entity on Legal Entity |

| TXR | Tax rate of legal entity |

| TXRP | Tax rate of the partner entity |

| XR | Exchange rate from the currency of the legal entity into group currency |

| XRX | Exchange rate from the currency of the Partner entity into group currency |

| PM | Profit margin |

| PMX | The profit margin with inverted I/C relation |

For example: DO - Direct Ownership Rate of Legal Entity

For C1 First consolidation of subsidiaries – A Direct ownership rate from sample configuration.

When the consolidation procedure is executed, the consolidation engine processes all pairs of a legal entity (e.g., 11, 12, 14, etc.) from the Legal Entity dimension and a partner entity (11, 12, 13, etc.) from the Partner Entity dimension. The selected scope of consolidation parameter consolidation function retrieves the amounts stored in the Profit and Loss or the Balance Sheet cube for the combination

A fact selector

When a fact selector consolidation function is selected from the table below, the user must input parameters: Factor, Rate, BS Account or PnL account, Transaction Type, and Consolidation as part of the consolidation rule line. The selected fact selector with parameters parameter consolidation function retrieves the amounts stored in the Profit and Loss or the Balance Sheet cube

-

Factor: To specify elimination or recognition.

-

Rate: Specify rate for calculation from the input given by the user in the Scope of Consolidation report.

-

BS Account: On which account, elimination or recognition should happen.

-

PnL account: On which account, elimination or recognition should happen.

-

Transaction Type: On which transaction type, elimination or recognition should happen for the relevant account.

-

Consolidation: The Consolidation rule should be applied to the respective level of Consolidation

Users must input information based on the selected fact selector. Input boxes are provided for

the selected consolidation function in the Financial Consolidation Consolidation Rule line report. Fact selectors: BSR, BSRX, PBSR, PBSRX, PEQ, PEQHist, PEQFXDiff need rate for the execution of consolidation rule.

| Selector | Description | Parameters |

| PnL | Profit and Loss account with I/C relation | Factor, PnL Account (operator, account, mode), Consolidation |

| PnLX | Profit and Loss account with inverted I/C relation | Factor, PnL Account (operator, account, mode), Consolidation |

| BS | Balance Sheet account with I/C relation on specific transaction type | Factor, BS Account (operator, account, mode), Transaction Type (operator, account, mode), Consolidation |

| BSX | Balance Sheet account with inverted I/C relation on specific transaction type | Factor, BS Account (operator, account, mode), Transaction Type (operator, account, mode), Consolidation |

| BSHist | Balance sheet account with I/C relation on specific transaction type, converted at historic rate into the group currency | Factor, BS Account (operator, account, mode), Transaction Type (operator, account, mode), Consolidation |

| BSXHist | Balance Sheet account with inverted I/C relation on specific transaction type, converted at historic rate into the group currency | Factor, BS Account (operator, account, mode), Transaction Type (operator, account, mode), Consolidation |

| BSFXDIFF | Balance sheet account with I/C relation on specific transaction type, foreign exchange differences from historic to month-end conversion | Factor, BS Account (operator, account, mode), Transaction Type (operator, account, mode), Consolidation |

| BSXFXDIFF | Balance Sheet account with inverted I/C relation on specific transaction type, foreign exchange differences from historic to month-end conversion | Factor, BS Account (operator, account, mode), Transaction Type (operator, account, mode), Consolidation |

| BSR | Balance Sheet account times a rate with I/C relation on specific transaction type | Factor, Rate, BS Account (operator, account, mode), Transaction Type (operator, account, mode), Consolidation |

| BSRX | Balance Sheet account times a rate with inverted I/C relation on specific transaction type | Factor, Rate, BS Account (operator, account, mode), Transaction Type (operator, account, mode), Consolidation |

| PBSR | Balance Sheet account times a rate and a proportional factor with I/C relation on specific transaction type | Factor, Rate, BS Account (operator, account, mode), Transaction Type (operator, account, mode), Consolidation |

| PBSRX | Balance Sheet account times a rate and a proportional factor with inverted I/C relation on specific transaction type | Factor, Rate, BS Account (operator, account, mode), Transaction Type (operator, account, mode), Consolidation |

| BSExt | Balance Sheet account for the external (~) partner entity on specific transaction type | Factor, BS Account (operator, account, mode), Transaction Type (operator, account, mode), Consolidation |

| BSXExt | Balance Sheet account reported by the partner entity with external (~) partner entity on specific transaction type | Factor, BS Account (operator, account, mode), Transaction Type (operator, account, mode), Consolidation |

| PEQ | Equity account times a proportional factor for all partner entities on specific transaction type | Factor, Rate, BS Account (operator, account, mode), Transaction Type (operator, account, mode), Consolidation |

| PEQHist | Equity account times a proportional factor for all partner entities on specific transaction type, converted at historic rate into the group currency | Factor, Rate, BS Account (operator, account, mode), Transaction Type (operator, account, mode), Consolidation |

| PEQFXDiff | Equity account times a proportional factor for all partner entities on specific transaction type, foreign exchange differences from historic to month-end conversion | Factor, Rate, BS Account (operator, account, mode), Transaction Type (operator, account, mode), Consolidation |

| BSInt | Balance Sheet account with I/C relation on specific transaction type | Factor, BS Account (operator, account, mode), Transaction Type (operator, account, mode), Consolidation |

| Calculation | Calculation from other lines using a formula |

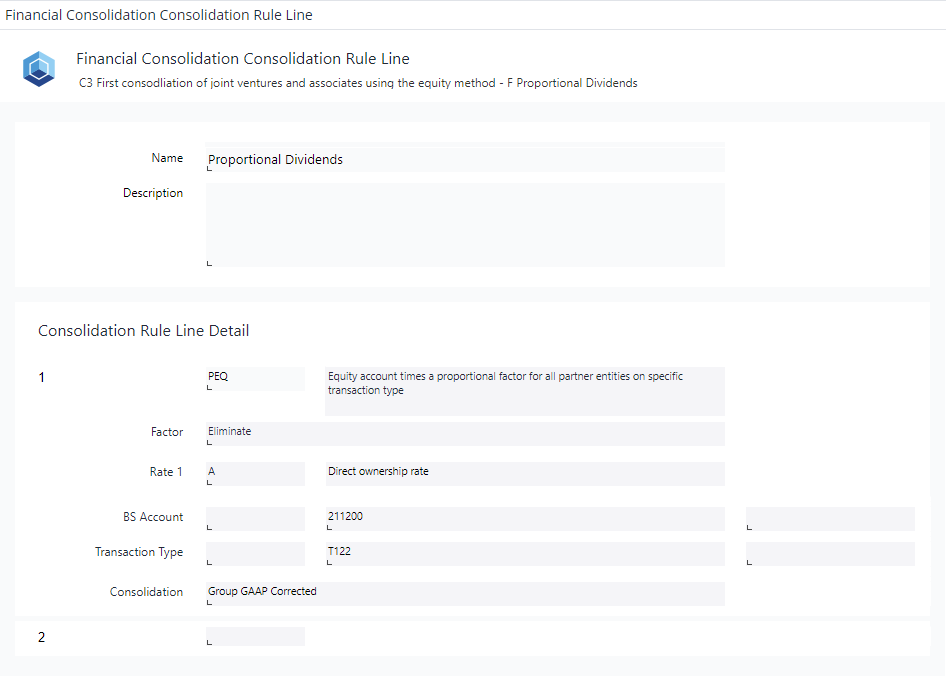

For example, PEQ - Equity account times a proportional factor for all partner entities on specific transaction type consolidation Function

From sample configuration: First Consolidation of joint ventures and associates using the equity method – Proportional Dividends as shown below

| Field | Description |

| Name | The consolidation Rule line name can be given and edited in the Financial Consolidation Consolidation rule line report. For example, Proportional Dividends. |

| Description | The description for the consolidation rule line is provided here |

| Consolidation Function | Selecting the relevant consolidation function as a part of the consolidation rule line. For example, PEQ fact selector (Equity account times a proportional factor for all partner entities on specific transaction type) |

| Factor | Chose to Eliminate or Recognize from the picklist |

| Rate | The rate for calculation as part of consolidation rule. For example, A – From Consolidation Rule line A, Direct ownership rate. |

| BS Account | Elimination or recognition should happen in this BS Account. For example, 211200 - Retained earnings account |

| Transaction Type | On which transaction type elimination or recognition should happen for the relevant account. For example, T22 transaction type in 211200 Retained earnings account |

| Consolidation | The Consolidation rule should be applied to the respective level of Consolidation. For example, Group GAAP Corrected. |

An elimination function

An elimination function is used to eliminate assets, liabilities, Income and expenses using below listed functions

| Selector | Description |

| Elim.Assets | Eliminate assets |

| ElimX.Assets | Eliminate assets (with inverted I/C relation) |

| Elim.Liabilities | Eliminate liabilities |

| ElimX.Liabilities | Eliminate liabilities (with inverted I/C relation) |

| Elim.Income | Eliminate Income |

| ElimX.Income | Eliminate Income (with inverted I/C relation) |

| Elim.Expenses | Eliminate expenses |

| ElimX.Expenses | Eliminate expenses (with inverted I/C relation) |

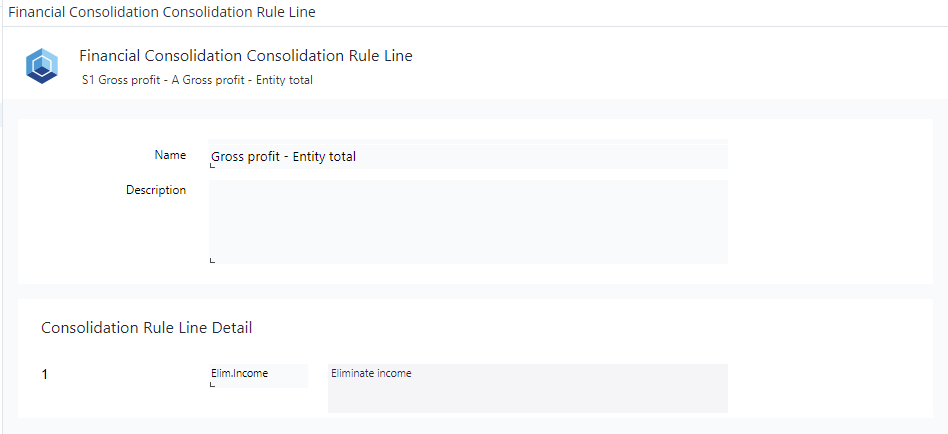

For example, Elim.Income – Eliminate income

From sample configuration: S1 Gross profit – Entity total

| Field | Description |

| Name | The consolidation Rule line name can be given and edited in the Financial Consolidation Consolidation rule line report. E.g., Proportional Dividends. |

| Description | The Description for the consolidation rule line is provided here |

| Consolidation Function | Selecting the relevant consolidation function as a part of the consolidation rule line. E.g., Elim.Income – Eliminate income |

Investment Register Fact selectors

Investment Register Fact selectors can access amounts from the Investment register, and this data is stored on Additional Financial Data cube. Investment Register Fact selector is used to convert at historic rate into group currency or for foreign exchange difference from historic to month-end conversion. The user must input parameters: Factor, Rate, Transaction Type as part of the consolidation rule line.

| InvRegBSHist | Investment ( balance sheet account) from the investor, converted at historic rate into group currency | Factor, Business Transaction Type (operator, business transaction type name) |

| InvRegPnL | Profit (loss) (profit and loss account from the investor), converted at historic rate into the group currency | Factor, Business Transaction Type (operator, business transaction type name) |

| InvRegPEQHist | Equity account times a proportional factor for all partner entities, converted at historic rate into the group currency | Factor, Rate, BS Account (operator, account, mode), Business Transaction Type (operator, business transaction type name) |

| InvRegBSFXDiff | Investment ( balance sheet account) from the investor, foreign exchange difference from historic to month-end conversion | Factor, Business Transaction Type (operator, business transaction type name) |

| InvRegPnLFXDiff | Profit (loss) (profit and loss account from the investor), foreign exchange difference from historic to month-end conversion | Factor, Business Transaction Type (operator, business transaction type name) |

| InvRegPEQFXDiff | Equity account times a proportional factor for all partner entities, foreign exchange difference from historic to month-end conversion | Factor, Rate, BS Account (operator, account, mode), Business Transaction Type (operator, business transaction type name) |

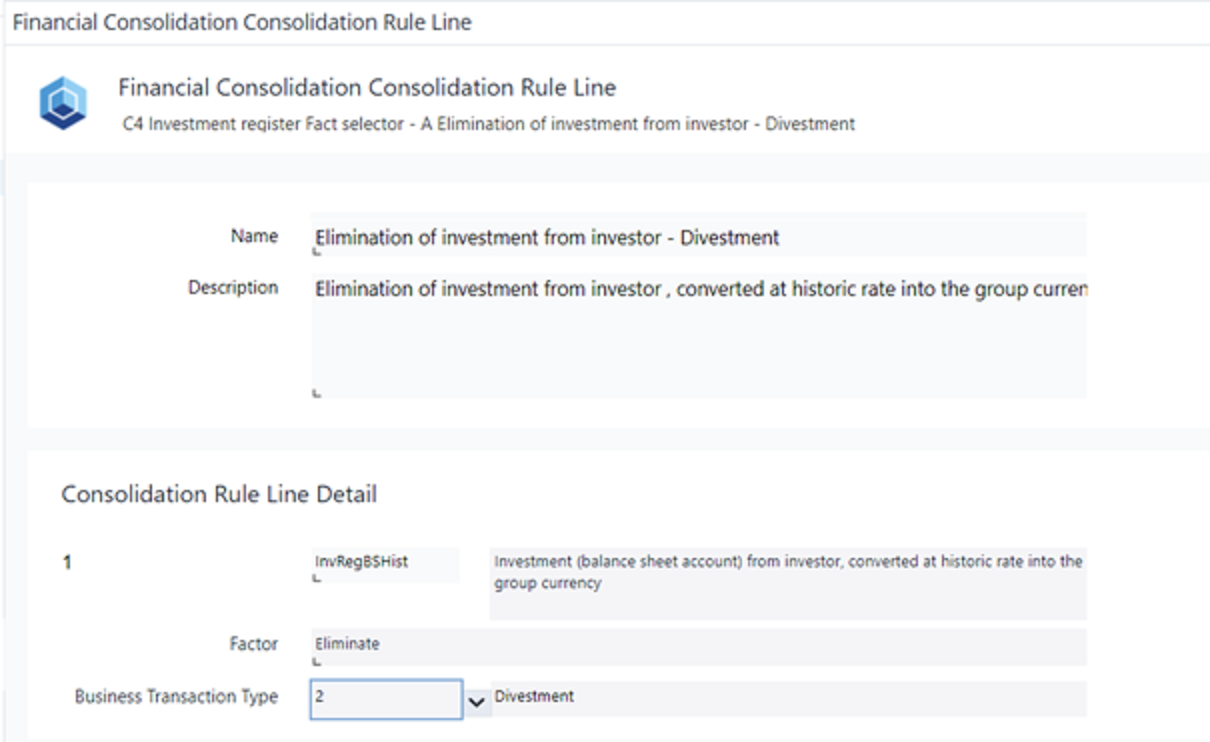

For example, InvRegHist - Investment ( balance sheet account) from the investor, converted at historic rate into group currency

| Field | Description |

| Name | The consolidation Rule line name can be given and edited in the Financial Consolidation Consolidation rule line report. E.g., Elimination of investment from investor - Divestment. |

| Description | The Description for the consolidation rule line is provided here |

| Consolidation Function | Selecting the relevant consolidation function as a part of the consolidation rule line. E.g., InvRegHist - Investment ( balance sheet account) from the investor, converted at historic rate into group currency |

| Factor | Chose to Eliminate or Recognize from the picklist |

| Business Transaction Type | Which type of Business transaction type should be eliminated or recognized. E.g., Divestment |

Consolidation Functions are part of the Consolidation Rule line, and consolidation rule lines are an important part of the financial consolidation model (Consolidation Engine) to retrieve the amounts stored in the Profit and Loss or the Balance Sheet cube. And to create expected automated journal entries with Posting Journal Instructions.

Subreport Posting Journal Instruction to create expected automated journal entries is discussed in the next article.

Updated August 13, 2025